Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

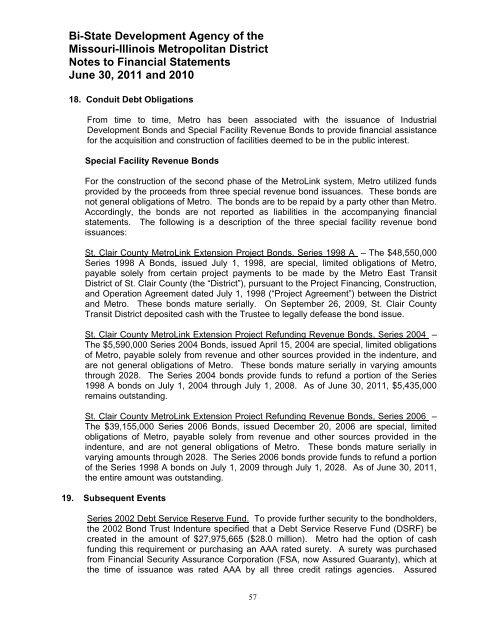

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictNotes to <strong>Financial</strong> StatementsJune 30, 2011 and 201018. Conduit Debt ObligationsFrom time to time, <strong>Metro</strong> has been associated with the issuance of IndustrialDevelopment Bonds and Special Facility Revenue Bonds to provide financial assistancefor the acquisition and construction of facilities deemed to be in the public interest.Special Facility Revenue BondsFor the construction of the second phase of the <strong>Metro</strong>Link system, <strong>Metro</strong> utilized fundsprovided by the proceeds from three special revenue bond issuances. These bonds arenot general obligations of <strong>Metro</strong>. The bonds are to be repaid by a party other than <strong>Metro</strong>.Accordingly, the bonds are not reported as liabilities in the accompanying financialstatements. The following is a description of the three special facility revenue bondissuances:St. Clair County <strong>Metro</strong>Link Extension Project Bonds, Series 1998 A – The $48,550,000Series 1998 A Bonds, issued July 1, 1998, are special, limited obligations of <strong>Metro</strong>,payable solely from certain project payments to be made by the <strong>Metro</strong> East <strong>Transit</strong>District of St. Clair County (the “District”), pursuant to the Project Financing, Construction,and Operation Agreement dated July 1, 1998 (“Project Agreement”) between the Districtand <strong>Metro</strong>. These bonds mature serially. On September 26, 2009, St. Clair County<strong>Transit</strong> District deposited cash with the Trustee to legally defease the bond issue.St. Clair County <strong>Metro</strong>Link Extension Project Refunding Revenue Bonds, Series 2004 –The $5,590,000 Series 2004 Bonds, issued April 15, 2004 are special, limited obligationsof <strong>Metro</strong>, payable solely from revenue and other sources provided in the indenture, andare not general obligations of <strong>Metro</strong>. These bonds mature serially in varying amountsthrough 2028. The Series 2004 bonds provide funds to refund a portion of the Series1998 A bonds on July 1, 2004 through July 1, 2008. As of June 30, 2011, $5,435,000remains outstanding.St. Clair County <strong>Metro</strong>Link Extension Project Refunding Revenue Bonds, Series 2006 –The $39,155,000 Series 2006 Bonds, issued December 20, 2006 are special, limitedobligations of <strong>Metro</strong>, payable solely from revenue and other sources provided in theindenture, and are not general obligations of <strong>Metro</strong>. These bonds mature serially invarying amounts through 2028. The Series 2006 bonds provide funds to refund a portionof the Series 1998 A bonds on July 1, 2009 through July 1, 2028. As of June 30, 2011,the entire amount was outstanding.19.Subsequent EventsSeries 2002 Debt Service Reserve Fund. To provide further security to the bondholders,the 2002 Bond Trust Indenture specified that a Debt Service Reserve Fund (DSRF) becreated in the amount of $27,975,665 ($28.0 million). <strong>Metro</strong> had the option of cashfunding this requirement or purchasing an AAA rated surety. A surety was purchasedfrom <strong>Financial</strong> Security Assurance Corporation (FSA, now Assured Guaranty), which atthe time of issuance was rated AAA by all three credit ratings agencies. Assured57