Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

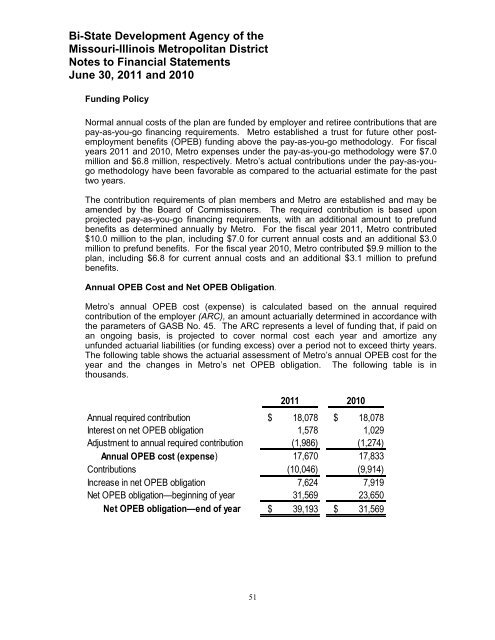

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictNotes to <strong>Financial</strong> StatementsJune 30, 2011 and 2010Funding PolicyNormal annual costs of the plan are funded by employer and retiree contributions that arepay-as-you-go financing requirements. <strong>Metro</strong> established a trust for future other postemploymentbenefits (OPEB) funding above the pay-as-you-go methodology. For fiscalyears 2011 and 2010, <strong>Metro</strong> expenses under the pay-as-you-go methodology were $7.0million and $6.8 million, respectively. <strong>Metro</strong>’s actual contributions under the pay-as-yougomethodology have been favorable as compared to the actuarial estimate for the pasttwo years.The contribution requirements of plan members and <strong>Metro</strong> are established and may beamended by the Board of Commissioners. The required contribution is based uponprojected pay-as-you-go financing requirements, with an additional amount to prefundbenefits as determined annually by <strong>Metro</strong>. For the fiscal year 2011, <strong>Metro</strong> contributed$10.0 million to the plan, including $7.0 for current annual costs and an additional $3.0million to prefund benefits. For the fiscal year 2010, <strong>Metro</strong> contributed $9.9 million to theplan, including $6.8 for current annual costs and an additional $3.1 million to prefundbenefits.<strong>Annual</strong> OPEB Cost and Net OPEB Obligation.<strong>Metro</strong>’s annual OPEB cost (expense) is calculated based on the annual requiredcontribution of the employer (ARC), an amount actuarially determined in accordance withthe parameters of GASB No. 45. The ARC represents a level of funding that, if paid onan ongoing basis, is projected to cover normal cost each year and amortize anyunfunded actuarial liabilities (or funding excess) over a period not to exceed thirty years.The following table shows the actuarial assessment of <strong>Metro</strong>’s annual OPEB cost for theyear and the changes in <strong>Metro</strong>’s net OPEB obligation. The following table is inthousands.20112010<strong>Annual</strong> required contribution $ 18,078 $ 18,078Interest on net OPEB obligation 1,578 1,029Adjustment to annual required contribution (1,986) (1,274)<strong>Annual</strong> OPEB cost (expense) 17,670 17,833Contributions (10,046) (9,914)Increase in net OPEB obligation 7,624 7,919Net OPEB obligation—beginning of year 31,569 23,650Net OPEB obligation—end of year $ 39,193 $ 31,56951