Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

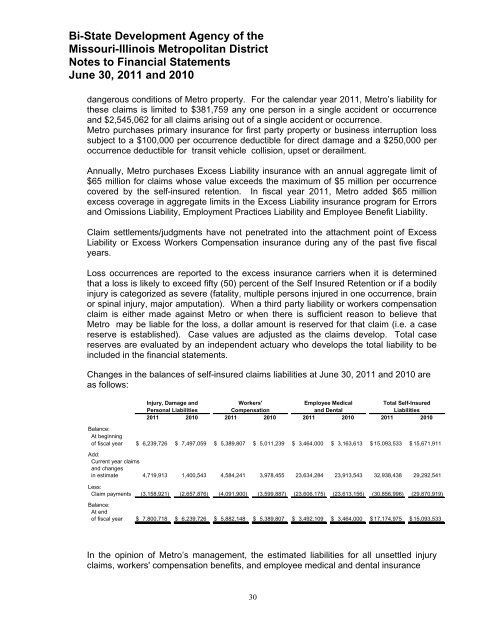

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictNotes to <strong>Financial</strong> StatementsJune 30, 2011 and 2010dangerous conditions of <strong>Metro</strong> property. For the calendar year 2011, <strong>Metro</strong>’s liability forthese claims is limited to $381,759 any one person in a single accident or occurrenceand $2,545,062 for all claims arising out of a single accident or occurrence.<strong>Metro</strong> purchases primary insurance for first party property or business interruption losssubject to a $100,000 per occurrence deductible for direct damage and a $250,000 peroccurrence deductible for transit vehicle collision, upset or derailment.<strong>Annual</strong>ly, <strong>Metro</strong> purchases Excess Liability insurance with an annual aggregate limit of$65 million for claims whose value exceeds the maximum of $5 million per occurrencecovered by the self-insured retention. In fiscal year 2011, <strong>Metro</strong> added $65 millionexcess coverage in aggregate limits in the Excess Liability insurance program for Errorsand Omissions Liability, Employment Practices Liability and Employee Benefit Liability.Claim settlements/judgments have not penetrated into the attachment point of ExcessLiability or Excess Workers Compensation insurance during any of the past five fiscalyears.Loss occurrences are reported to the excess insurance carriers when it is determinedthat a loss is likely to exceed fifty (50) percent of the Self Insured Retention or if a bodilyinjury is categorized as severe (fatality, multiple persons injured in one occurrence, brainor spinal injury, major amputation). When a third party liability or workers compensationclaim is either made against <strong>Metro</strong> or when there is sufficient reason to believe that<strong>Metro</strong> may be liable for the loss, a dollar amount is reserved for that claim (i.e. a casereserve is established). Case values are adjusted as the claims develop. Total casereserves are evaluated by an independent actuary who develops the total liability to beincluded in the financial statements.Changes in the balances of self-insured claims liabilities at June 30, 2011 and 2010 areas follows:Injury, Damage and Workers' Employee Medical Total Self-InsuredPersonal Liabilities Compensation and Dental Liabilities2011 2010 2011 2010 2011 2010 2011 2010Balance:At beginningof fiscal year $ 6,239,726 $ 7,497,059 $ 5,389,807 $ 5,011,239 $ 3,464,000 $ 3,163,613 $ 15,093,533 $ 15,671,911Add:Current year claimsand changesin estimate 4,719,913 1,400,543 4,584,241 3,978,455 23,634,284 23,913,543 32,938,438 29,292,541Less:Claim payments (3,158,921) (2,657,876) (4,091,900) (3,599,887) (23,606,175) (23,613,156) (30,856,996) (29,870,919)Balance:At endof fiscal year $ 7,800,718 $ 6,239,726 $ 5,882,148 $ 5,389,807 $ 3,492,109 $ 3,464,000 $ 17,174,975 $ 15,093,533In the opinion of <strong>Metro</strong>’s management, the estimated liabilities for all unsettled injuryclaims, workers' compensation benefits, and employee medical and dental insurance30