The Final Report - Malcolm Shabazz City High School, Madison WI

The Final Report - Malcolm Shabazz City High School, Madison WI

The Final Report - Malcolm Shabazz City High School, Madison WI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

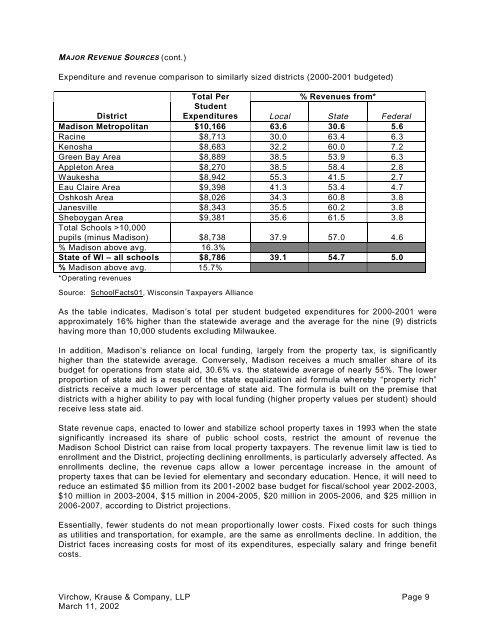

MAJOR REVENUE SOURCES (cont.)Expenditure and revenue comparison to similarly sized districts (2000-2001 budgeted)Total Per% Revenues from*DistrictStudentExpenditures Local State Federal<strong>Madison</strong> Metropolitan $10,166 63.6 30.6 5.6Racine $8,713 30.0 63.4 6.3Kenosha $8,683 32.2 60.0 7.2Green Bay Area $8,889 38.5 53.9 6.3Appleton Area $8,270 38.5 58.4 2.8Waukesha $8,942 55.3 41.5 2.7Eau Claire Area $9,398 41.3 53.4 4.7Oshkosh Area $8,026 34.3 60.8 3.8Janesville $8,343 35.5 60.2 3.8Sheboygan Area $9,381 35.6 61.5 3.8Total <strong>School</strong>s >10,000pupils (minus <strong>Madison</strong>) $8,738 37.9 57.0 4.6% <strong>Madison</strong> above avg. 16.3%State of <strong>WI</strong> – all schools $8,786 39.1 54.7 5.0% <strong>Madison</strong> above avg. 15.7%*Operating revenuesSource: <strong>School</strong>Facts01, Wisconsin Taxpayers AllianceAs the table indicates, <strong>Madison</strong>’s total per student budgeted expenditures for 2000-2001 wereapproximately 16% higher than the statewide average and the average for the nine (9) districtshaving more than 10,000 students excluding Milwaukee.In addition, <strong>Madison</strong>’s reliance on local funding, largely from the property tax, is significantlyhigher than the statewide average. Conversely, <strong>Madison</strong> receives a much smaller share of itsbudget for operations from state aid, 30.6% vs. the statewide average of nearly 55%. <strong>The</strong> lowerproportion of state aid is a result of the state equalization aid formula whereby “property rich”districts receive a much lower percentage of state aid. <strong>The</strong> formula is built on the premise thatdistricts with a higher ability to pay with local funding (higher property values per student) shouldreceive less state aid.State revenue caps, enacted to lower and stabilize school property taxes in 1993 when the statesignificantly increased its share of public school costs, restrict the amount of revenue the<strong>Madison</strong> <strong>School</strong> District can raise from local property taxpayers. <strong>The</strong> revenue limit law is tied toenrollment and the District, projecting declining enrollments, is particularly adversely affected. Asenrollments decline, the revenue caps allow a lower percentage increase in the amount ofproperty taxes that can be levied for elementary and secondary education. Hence, it will need toreduce an estimated $5 million from its 2001-2002 base budget for fiscal/school year 2002-2003,$10 million in 2003-2004, $15 million in 2004-2005, $20 million in 2005-2006, and $25 million in2006-2007, according to District projections.Essentially, fewer students do not mean proportionally lower costs. Fixed costs for such thingsas utilities and transportation, for example, are the same as enrollments decline. In addition, theDistrict faces increasing costs for most of its expenditures, especially salary and fringe benefitcosts.Virchow, Krause & Company, LLP Page 9March 11, 2002