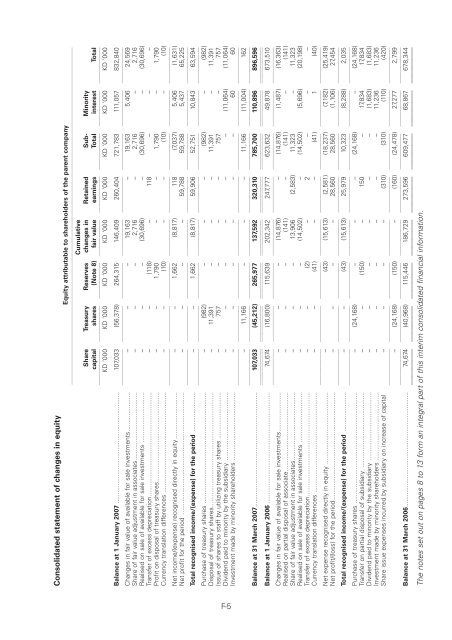

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10a : 3776 Section 10aConsolidated statement of changes in equityEquity attributable to shareholders of the parent company11112111111311112111121111211112111121111211112CumulativeShare Treasury Reserves changes in Retained Sub- Minoritycapital 11112 shares 11112 (Note 8) 11112 fair value 11112 earnings 11112 Total 11112 interest 11112 Total11112KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000Balance at 1 January 2007 .............................................................. 107,033 11112 (56,378) 11112 264,315 11112 146,409 11112 260,404 11112 721,783 11112 111,057 11112 832,84011112Changes in fair value of available for sale investments...................... – – – 19,163 – 19,163 5,406 24,569Share of fair value adjustment in associates...................................... – – – 2,716 – 2,716 – 2,716Realised on sale of available for sale investments ............................ – – – (30,696) – (30,696) – (30,696)Transfer of excess depreciation.......................................................... – – (118) – 118 – – –Profit on disposal of treasury shares.................................................. – – 1,790 – – 1,790 – 1,790Currency translation differences ........................................................ – 11112 – 11112 (10) 11112 – 11112 – 11112 (10) 11112 – 11112 (10)11112Net income/(expense) recognised directly in equity .......................... – – 1,662 (8,817) 118 (7,037) 5,406 (1,631)Net profit for the period .................................................................... – 11112 – 11112 – 11112 – 11112 59,788 11112 59,788 11112 5,437 11112 65,22511112Total recognised income/(expense) for the period ...................... – – 1,662 (8,817) 59,906 52,751 10,843 63,59411112 11112 11112 11112 11112 11112 11112 11112Purchase of treasury shares .............................................................. – (982) – – – (982) – (982)Disposal of treasury shares................................................................ – 11,391 – – – 11,391 – 11,391Issue of shares to staff by utilizing treasury shares .......................... – 757 – – – 757 – 757Dividend paid to minority by the subsidiary ...................................... – – – – – – (11,064) (11,064)Investment made by minority shareholders ...................................... – – – – – – 60 6011112 11112 11112 11112 11112 11112 11112 11112– 11,166 – – – 11,166 (11,004) 16211112 11112 11112 11112 11112 11112 11112 11112Balance at 31 March 2007................................................................ 107,033 (45,212) 265,977 137,592 320,310 785,700 110,896 896,59611112 11112 11112 11112 11112 11112 11112 11112Balance at 1 January 2006 .............................................................. 74,674 (16,800) 115,639 202,342 247,777 623,632 49,878 673,51011112 11112 11112 11112 11112 11112 11112 11112Changes in fair value of available for sale investments...................... – – – (14,876) – (14,876) (1,487) (16,363)Realised on partial disposal of associate............................................ – – – (141) – (141) – (141)Share of fair value adjustment in associates...................................... – – – 13,906 (2,583) 11,323 – 11,323Realised on sale of available for sale investments ............................ – – – (14,502) – (14,502) (5,696) (20,198)Transfer of excess depreciation.......................................................... – – (2) – 2 – – –Currency translation differences ........................................................ – – (41) – – (41) 1 (40)11112 11112 11112 11112 11112 11112 11112 11112Net expense recognised directly in equity ........................................ – (43) (15,613) (2,581) (18,237) (7,182) (25,419)Net profit/(loss) for the period ............................................................ – – – – 28,560 28,560 (1,106) 27,45411112 11112 11112 11112 11112 11112 11112 11112Total recognised income/(expense) for the period ...................... – – (43) (15,613) 25,979 10,323 (8,288) 2,03511112 11112 11112 11112 11112 11112 11112 11112Purchase of treasury shares .............................................................. – (24,168) – – – (24,168) – (24,168)Transfer on partial disposal of subsidiary .......................................... – – (150) – 150 – 17,834 17,834Dividend paid to minority by the subsidiary ...................................... – – – – – – (1,683) (1,683)Investment made by minority shareholders ...................................... – – – – – – 11,236 11,236Share issue expenses incurred by subsidiary on increase of capital – – – – (310) (310) (110) (420)11112 11112 11112 11112 11112 11112 11112 11112– (24,168) (150) – (160) (24,478) 27,277 2,79911112 11112 11112 11112 11112 11112 11112 11112Balance at 31 March 2006................................................................ 74,674 (40,968) 115,446 186,729 273,596 609,477 68,867 678,34411112 11112 11112 11112 11112 11112 11112 11112The notes set out on pages 8 to 13 form an integral part of this interim consolidated financial information.F-5

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10a : 3776 Section 10aConsolidated statement of cash flowsThree Threemonths monthsended 31 ended 31March March2007 2006(Unaudited) (Unaudited)11111 11111KD ‘000 KD ‘000OPERATING ACTIVITIESProfit for the period .................................................................................. 67,427 29,649Adjustments for:Depreciation of property, plant and equipment ...................................... 1,185 908Profit on disposal of property, plant and equipment .............................. (108) –Impairment in value of goodwill.............................................................. 1,250 –Share of profits of associates ................................................................ (3,450) (3,240)Dividend income from available for sale investments ............................ (1,377) (656)Profit on partial disposal of associate .................................................... – (559)Profit on sale of available for sale investments ...................................... (25,913) (20,402)Profit on partial disposal of subsidiaries ................................................ – (30,226)Net provisions (released)/charged .......................................................... (22) 277Finance costs .......................................................................................... 10,213 6,074Interest income ...................................................................................... (3,880) (474)11111 11111Operating profit/(loss) before changes in operating assets and liabilities .. 45,325 (18,649)Changes in operating assets and liabilities:Inventories ............................................................................................ (326) 1,189Accounts receivable and other assets .................................................... (2,764) 48,327Investments at fair value through statement of income ........................ (103,951) 7,732Accounts payable and other liabilities .................................................... 2,429 5,52811111 11111Cash (used in)/from operations .................................................................. (59,287) 44,127Taxation paid .............................................................................................. (101) (11)KFAS contribution paid................................................................................ (1,607) –National Labour Support Tax paid................................................................ (4,299) –11111 11111Net cash (used in)/from operating activities ........................................ (65,294) 44,11611111 11111F-6

- Page 1 and 2:

Level: 8 - From: 8 - Thursday, Augu

- Page 3 and 4:

Level: 8 - From: 8 - Thursday, Augu

- Page 5:

Level: 8 - From: 8 - Thursday, Augu

- Page 9 and 10:

Level: 8 - From: 8 - Thursday, Augu

- Page 11 and 12:

Level: 8 - From: 8 - Thursday, Augu

- Page 13 and 14:

Level: 8 - From: 8 - Thursday, Augu

- Page 15 and 16:

Level: 8 - From: 8 - Thursday, Augu

- Page 17 and 18:

Level: 8 - From: 8 - Thursday, Augu

- Page 19:

Level: 8 - From: 8 - Thursday, Augu

- Page 22:

Level: 8 - From: 8 - Thursday, Augu

- Page 25 and 26:

Level: 8 - From: 8 - Thursday, Augu

- Page 27 and 28:

Level: 8 - From: 8 - Thursday, Augu

- Page 29 and 30:

Level: 8 - From: 8 - Thursday, Augu

- Page 31 and 32:

Level: 8 - From: 8 - Thursday, Augu

- Page 33 and 34:

Level: 8 - From: 8 - Thursday, Augu

- Page 35 and 36:

Level: 8 - From: 8 - Thursday, Augu

- Page 37 and 38:

Level: 8 - From: 8 - Thursday, Augu

- Page 39 and 40:

Level: 8 - From: 8 - Thursday, Augu

- Page 41 and 42:

Level: 8 - From: 8 - Thursday, Augu

- Page 43 and 44:

Level: 8 - From: 8 - Thursday, Augu

- Page 45 and 46:

Level: 8 - From: 8 - Thursday, Augu

- Page 47 and 48:

Level: 8 - From: 8 - Thursday, Augu

- Page 49 and 50:

Level: 8 - From: 8 - Thursday, Augu

- Page 52 and 53:

Level: 8 - From: 8 - Thursday, Augu

- Page 54 and 55:

Level: 8 - From: 8 - Thursday, Augu

- Page 56 and 57: Level: 8 - From: 8 - Thursday, Augu

- Page 58 and 59: Level: 8 - From: 8 - Thursday, Augu

- Page 60 and 61: Level: 8 - From: 8 - Thursday, Augu

- Page 62 and 63: Level: 8 - From: 8 - Thursday, Augu

- Page 64 and 65: Level: 8 - From: 8 - Thursday, Augu

- Page 66 and 67: Level: 8 - From: 8 - Thursday, Augu

- Page 68 and 69: Level: 8 - From: 8 - Thursday, Augu

- Page 70 and 71: Level: 8 - From: 8 - Thursday, Augu

- Page 72 and 73: Level: 8 - From: 8 - Thursday, Augu

- Page 74 and 75: Level: 8 - From: 8 - Thursday, Augu

- Page 76 and 77: Level: 8 - From: 8 - Thursday, Augu

- Page 78 and 79: Level: 8 - From: 8 - Thursday, Augu

- Page 80 and 81: Level: 8 - From: 8 - Thursday, Augu

- Page 82 and 83: Level: 8 - From: 8 - Thursday, Augu

- Page 84 and 85: Level: 8 - From: 8 - Thursday, Augu

- Page 86 and 87: Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89: Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91: Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157:

Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159:

Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161:

Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163:

Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165:

Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167:

Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169:

Level: 8 - From: 8 - Thursday, Augu

- Page 170 and 171:

Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173:

Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175:

Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177:

Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179:

Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181:

Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183:

Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185:

Level: 8 - From: 8 - Thursday, Augu