NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

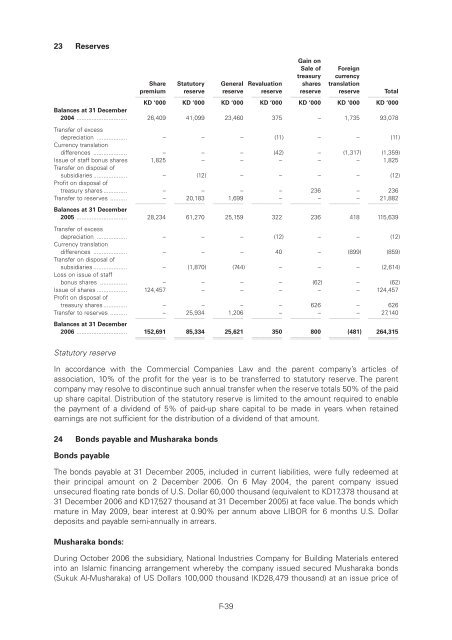

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10b23 ReservesGain onSale of Foreigntreasury currencyShare Statutory General Revaluation shares translationpremium11111reserve11111reserve11111reserve11111reserve11111reserve11111Total11111KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000Balances at 31 December2004 .............................. 26,409 41,099 23,460 375 – 1,735 93,078Transfer of excessdepreciation .................. – – – (11) – – (11)Currency translationdifferences .................... – – – (42) – (1,317) (1,359)Issue of staff bonus shares 1,825 – – – – – 1,825Transfer on disposal ofsubsidiaries .................... – (12) – – – – (12)Profit on disposal oftreasury shares .............. – – – – 236 – 236Transfer to reserves .......... –1111120,183111111,69911111–11111–11111–1111121,88211111Balances at 31 December2005 .............................. 28,234 61,270 25,159 322 236 418 115,639Transfer of excessdepreciation .................. – – – (12) – – (12)Currency translationdifferences .................... – – – 40 – (899) (859)Transfer on disposal ofsubsidiaries .................... – (1,870) (744) – – – (2,614)Loss on issue of staffbonus shares ................ – – – – (62) – (62)Issue of shares .................. 124,457 – – – – – 124,457Profit on disposal oftreasury shares .............. – – – – 626 – 626Transfer to reserves .......... –1111125,934111111,20611111–11111–11111–1111127,14011111Balances at 31 December2006 .............................. 152,691 1111185,334 1111125,621 11111350 11111800 11111(481) 11111264,31511111Statutory reserveIn accordance with the Commercial Companies Law and the parent company’s articles ofassociation, 10% of the profit for the year is to be transferred to statutory reserve. The parentcompany may resolve to discontinue such annual transfer when the reserve totals 50% of the paidup share capital. Distribution of the statutory reserve is limited to the amount required to enablethe payment of a dividend of 5% of paid-up share capital to be made in years when retainedearnings are not sufficient for the distribution of a dividend of that amount.24 Bonds payable and Musharaka bondsBonds payableThe bonds payable at 31 December 2005, included in current liabilities, were fully redeemed attheir principal amount on 2 December 2006. On 6 May 2004, the parent company issuedunsecured floating rate bonds of U.S. Dollar 60,000 thousand (equivalent to KD17,378 thousand at31 December 2006 and KD17,527 thousand at 31 December 2005) at face value. The bonds whichmature in May 2009, bear interest at 0.90% per annum above LIBOR for 6 months U.S. Dollardeposits and payable semi-annually in arrears.Musharaka bonds:During October 2006 the subsidiary, National Industries Company for Building Materials enteredinto an Islamic financing arrangement whereby the company issued secured Musharaka bonds(Sukuk Al-Musharaka) of US Dollars 100,000 thousand (KD28,479 thousand) at an issue price ofF-39