Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10b27 Accounts payable and other liabilities200611112200511112KD ‘000 KD ‘000Trade payables ............................................................................................ 13,033 11,499Accrued interest.......................................................................................... 2,257 2,891Dividend payable ........................................................................................ 1,088 939Leasing creditors – amount due in less than one year .............................. 124 665Provision for rental property – amount due in less than one year.............. 1,335 1,423National labour support tax ........................................................................ 7,365 4,581Kuwait Foundation for the Advancement of Sciences ................................ 3,946 2,362Corporation tax of foreign subsidiaries ...................................................... 183 –Other accruals ............................................................................................ 8,754 13,476Donations payable ...................................................................................... 6,365 –Due to investment brokerage companies .................................................. 1,060 –Other liabilities ............................................................................................ 6,693111124,4131111252,203 1111242,2491111228 Short-term borrowingsCurrency Interest rate Security 200611112200511112KD ‘000 KD ‘000Conventional loansKuwaiti Dinars ................................ 7% – 8% Unsecured 146,525 102,450Kuwaiti Dinars ................................ 8.25% Secured 20,000 –US Dollars ...................................... 5.87% – 7.62% Unsecured 214,648 77,706Sterling .......................................... 5.55% – 6.8% Unsecured 20,945 20,503Sterling – current portion .............. 4.00% – 7.50% Secured 510 504Euro – current portion.................... 5.00% – 5.55% Unsecured 231 172Euro .............................................. 4.3% Unsecured 32611112–11112403,18511112201,33511112Islamic financing arrangementsTawarruq facilities .......................... – 10,919Less: deferred cost........................ –11112(170)11112–1111210,74911112Total .............................................. 403,185 11112212,08411112Kuwaiti Dinars loans amounting to KD20,000 thousand are secured by investments at fair valuethrough statement of income (see note 19).29 Cash and cash equivalents200611112200511112KD ‘000 KD ‘000Murabaha and wakala investments – maturing within three months ........ 22,608 –Short term deposits .................................................................................... 248,758 34,993Bank balance and cash .............................................................................. 16,258 8,712Due to banks .............................................................................................. (31,652)11112(17,127)11112255,972 1111226,57811112F-41

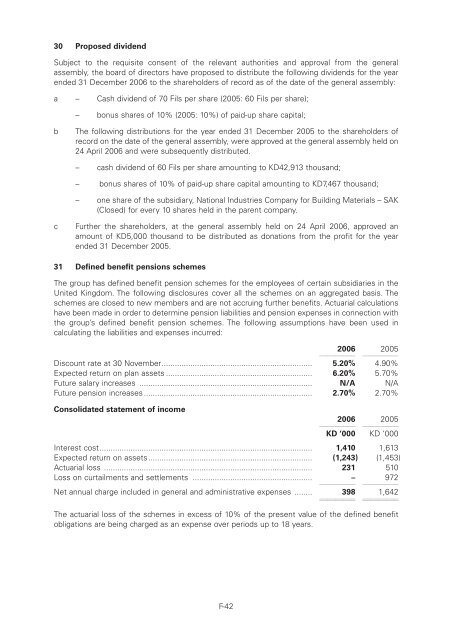

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10b30 Proposed dividendSubject to the requisite consent of the relevant authorities and approval from the generalassembly, the board of directors have proposed to distribute the following dividends for the yearended 31 December 2006 to the shareholders of record as of the date of the general assembly:a – Cash dividend of 70 Fils per share (2005: 60 Fils per share);– bonus shares of 10% (2005: 10%) of paid-up share capital;bThe following distributions for the year ended 31 December 2005 to the shareholders ofrecord on the date of the general assembly, were approved at the general assembly held on24 April 2006 and were subsequently distributed.– cash dividend of 60 Fils per share amounting to KD42,913 thousand;– bonus shares of 10% of paid-up share capital amounting to KD7,467 thousand;– one share of the subsidiary, National Industries Company for Building Materials – SAK(Closed) for every 10 shares held in the parent company.cFurther the shareholders, at the general assembly held on 24 April 2006, approved anamount of KD5,000 thousand to be distributed as donations from the profit for the yearended 31 December 2005.31 Defined benefit pensions schemesThe group has defined benefit pension schemes for the employees of certain subsidiaries in theUnited Kingdom. The following disclosures cover all the schemes on an aggregated basis. Theschemes are closed to new members and are not accruing further benefits. Actuarial calculationshave been made in order to determine pension liabilities and pension expenses in connection withthe group’s defined benefit pension schemes. The following assumptions have been used incalculating the liabilities and expenses incurred:200611112200511112Discount rate at 30 November.................................................................... 5.20% 4.90%Expected return on plan assets .................................................................. 6.20% 5.70%Future salary increases .............................................................................. N/A N/AFuture pension increases ............................................................................ 2.70% 2.70%Consolidated statement of income200611112200511112KD ‘000 KD ‘000Interest cost................................................................................................ 1,410 1,613Expected return on assets.......................................................................... (1,243) (1,453)Actuarial loss .............................................................................................. 231 510Loss on curtailments and settlements ...................................................... –1111297211112Net annual charge included in general and administrative expenses ........ 398 111121,64211112The actuarial loss of the schemes in excess of 10% of the present value of the defined benefitobligations are being charged as an expense over periods up to 18 years.F-42

- Page 1 and 2:

Level: 8 - From: 8 - Thursday, Augu

- Page 3 and 4:

Level: 8 - From: 8 - Thursday, Augu

- Page 5:

Level: 8 - From: 8 - Thursday, Augu

- Page 9 and 10:

Level: 8 - From: 8 - Thursday, Augu

- Page 11 and 12:

Level: 8 - From: 8 - Thursday, Augu

- Page 13 and 14:

Level: 8 - From: 8 - Thursday, Augu

- Page 15 and 16:

Level: 8 - From: 8 - Thursday, Augu

- Page 17 and 18:

Level: 8 - From: 8 - Thursday, Augu

- Page 19:

Level: 8 - From: 8 - Thursday, Augu

- Page 22:

Level: 8 - From: 8 - Thursday, Augu

- Page 25 and 26:

Level: 8 - From: 8 - Thursday, Augu

- Page 27 and 28:

Level: 8 - From: 8 - Thursday, Augu

- Page 29 and 30:

Level: 8 - From: 8 - Thursday, Augu

- Page 31 and 32:

Level: 8 - From: 8 - Thursday, Augu

- Page 33 and 34:

Level: 8 - From: 8 - Thursday, Augu

- Page 35 and 36:

Level: 8 - From: 8 - Thursday, Augu

- Page 37 and 38:

Level: 8 - From: 8 - Thursday, Augu

- Page 39 and 40:

Level: 8 - From: 8 - Thursday, Augu

- Page 41 and 42:

Level: 8 - From: 8 - Thursday, Augu

- Page 43 and 44:

Level: 8 - From: 8 - Thursday, Augu

- Page 45 and 46:

Level: 8 - From: 8 - Thursday, Augu

- Page 47 and 48:

Level: 8 - From: 8 - Thursday, Augu

- Page 49 and 50:

Level: 8 - From: 8 - Thursday, Augu

- Page 52 and 53:

Level: 8 - From: 8 - Thursday, Augu

- Page 54 and 55:

Level: 8 - From: 8 - Thursday, Augu

- Page 56 and 57:

Level: 8 - From: 8 - Thursday, Augu

- Page 58 and 59:

Level: 8 - From: 8 - Thursday, Augu

- Page 60 and 61:

Level: 8 - From: 8 - Thursday, Augu

- Page 62 and 63:

Level: 8 - From: 8 - Thursday, Augu

- Page 64 and 65:

Level: 8 - From: 8 - Thursday, Augu

- Page 66 and 67:

Level: 8 - From: 8 - Thursday, Augu

- Page 68 and 69:

Level: 8 - From: 8 - Thursday, Augu

- Page 70 and 71:

Level: 8 - From: 8 - Thursday, Augu

- Page 72 and 73:

Level: 8 - From: 8 - Thursday, Augu

- Page 74 and 75:

Level: 8 - From: 8 - Thursday, Augu

- Page 76 and 77:

Level: 8 - From: 8 - Thursday, Augu

- Page 78 and 79:

Level: 8 - From: 8 - Thursday, Augu

- Page 80 and 81:

Level: 8 - From: 8 - Thursday, Augu

- Page 82 and 83:

Level: 8 - From: 8 - Thursday, Augu

- Page 84 and 85:

Level: 8 - From: 8 - Thursday, Augu

- Page 86 and 87:

Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89:

Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91:

Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163: Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165: Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167: Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169: Level: 8 - From: 8 - Thursday, Augu

- Page 170 and 171: Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173: Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175: Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177: Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179: Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181: Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183: Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185: Level: 8 - From: 8 - Thursday, Augu