NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

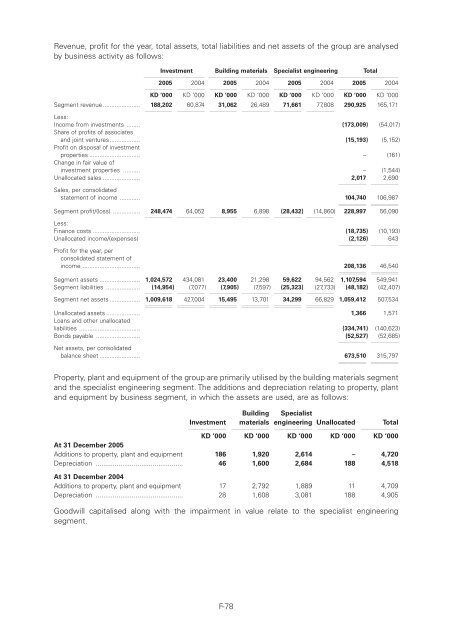

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cRevenue, profit for the year, total assets, total liabilities and net assets of the group are analysedby business activity as follows:Investment Building materials Specialist engineering Total11112111112 11112111112 11112111112 11112111112200511112200411112200511112200411112200511112200411112200511112200411112KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000Segment revenue ...................... 188,2021111260,8741111231,0621111226,4891111271,6611111277,80811112290,925 165,171Less:Income from investments ........ (173,009) (54,017)Share of profits of associatesand joint ventures.................. (15,193) (5,152)Profit on disposal of investmentproperties .............................. – (161)Change in fair value ofinvestment properties .......... – (1,544)Unallocated sales ...................... 2,017111122,69011112Sales, per consolidatedstatement of income ............ 104,740 11112106,98711112Segment profit/(loss) ................ 248,4741111264,052111128,955111126,89811112(28,432) (14,860)11112 11112228,997 56,090Less:Finance costs ............................ (18,735) (10,193)Unallocated income/(expenses) (2,126) 64311112 11112Profit for the year, perconsolidated statement ofincome .................................. 208,136 1111246,54011112Segment assets ........................ 1,024,572 434,081 23,400 21,298 59,622 94,562 1,107,594 549,941Segment liabilities .................... (14,954) (7,077)11112 11112(7,905) (7,597)11112 11112(25,323) (27,733)11112 11112(48,182) (42,407)Segment net assets .................. 1,009,618 427,004 15,495 13,701 34,299 66,829 11112 11112 11112 11112 11112 111121,059,412 507,534Unallocated assets .................... 1,366 1,571Loans and other unallocatedliabilities .................................... (334,741) (140,623)Bonds payable .......................... (52,527) (52,685)11112 11112Net assets, per consolidatedbalance sheet ........................ 673,510 11112315,79711112Property, plant and equipment of the group are primarily utilised by the building materials segmentand the specialist engineering segment. The additions and depreciation relating to property, plantand equipment by business segment, in which the assets are used, are as follows:Building SpecialistInvestment111112materials engineering Unallocated111112 111112 111112Total111112KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000At 31 December 2005Additions to property, plant and equipment 186 1,920 2,614 – 4,720Depreciation .............................................. 46 1,600 2,684 188 4,518At 31 December 2004Additions to property, plant and equipment 17 2,792 1,889 11 4,709Depreciation .............................................. 28 1,608 3,081 188 4,905Goodwill capitalised along with the impairment in value relate to the specialist engineeringsegment.F-78