NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

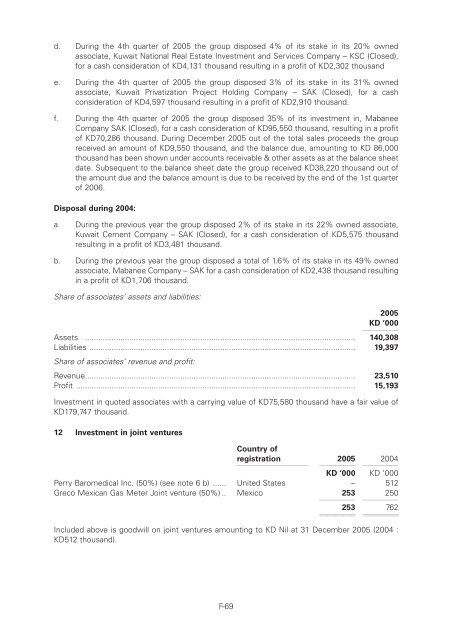

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cd. During the 4th quarter of 2005 the group disposed 4% of its stake in its 20% ownedassociate, Kuwait National Real Estate Investment and Services Company – KSC (Closed),for a cash consideration of KD4,131 thousand resulting in a profit of KD2,302 thousande. During the 4th quarter of 2005 the group disposed 3% of its stake in its 31% ownedassociate, Kuwait Privatization Project Holding Company – SAK (Closed), for a cashconsideration of KD4,597 thousand resulting in a profit of KD2,910 thousand.f. During the 4th quarter of 2005 the group disposed 35% of its investment in, MabaneeCompany SAK (Closed), for a cash consideration of KD95,550 thousand, resulting in a profitof KD70,286 thousand. During December 2005 out of the total sales proceeds the groupreceived an amount of KD9,550 thousand, and the balance due, amounting to KD 86,000thousand has been shown under accounts receivable & other assets as at the balance sheetdate. Subsequent to the balance sheet date the group received KD38,220 thousand out ofthe amount due and the balance amount is due to be received by the end of the 1st quarterof 2006.Disposal during 2004:a. During the previous year the group disposed 2% of its stake in its 22% owned associate,Kuwait Cement Company – SAK (Closed), for a cash consideration of KD5,575 thousandresulting in a profit of KD3,481 thousand.b. During the previous year the group disposed a total of 1.6% of its stake in its 49% ownedassociate, Mabanee Company – SAK for a cash consideration of KD2,438 thousand resultingin a profit of KD1,706 thousand.Share of associates’ assets and liabilities:2005KD ‘00011112Assets .......................................................................................................................... 140,308Liabilities ........................................................................................................................ 19,397Share of associates’ revenue and profit:Revenue.......................................................................................................................... 23,510Profit .............................................................................................................................. 15,193Investment in quoted associates with a carrying value of KD75,580 thousand have a fair value ofKD179,747 thousand.12 Investment in joint venturesCountry ofregistration1111211112200511112200411112KD ‘000 KD ‘000Perry Baromedical Inc. (50%) (see note 6 b) ...... United States – 512Greco Mexican Gas Meter Joint venture (50%) .. Mexico 2531111225011112253 1111276211112Included above is goodwill on joint ventures amounting to KD Nil at 31 December 2005 (2004 :KD512 thousand).F-69