NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

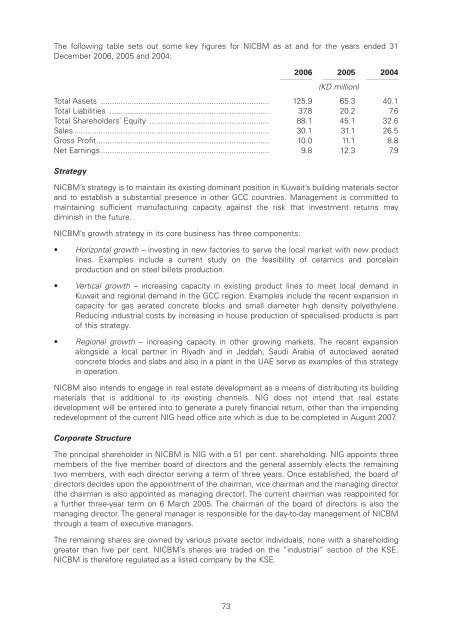

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07The following table sets out some key figures for NICBM as at and for the years ended 31December 2006, 2005 and 2004:200611112005111120041111(KD million)Total Assets ............................................................................ 125.9 65.3 40.1Total Liabilities ........................................................................ 37.8 20.2 7.6Total Shareholders’ Equity ...................................................... 88.1 45.1 32.6Sales ........................................................................................ 30.1 31.1 26.5Gross Profit.............................................................................. 10.0 11.1 8.8Net Earnings ............................................................................ 9.8 12.3 7.9StrategyNICBM’s strategy is to maintain its existing dominant position in Kuwait’s building materials sectorand to establish a substantial presence in other GCC countries. Management is committed tomaintaining sufficient manufacturing capacity against the risk that investment returns maydiminish in the future.NICBM’s growth strategy in its core business has three components:• Horizontal growth – investing in new factories to serve the local market with new productlines. Examples include a current study on the feasibility of ceramics and porcelainproduction and on steel billets production.• Vertical growth – increasing capacity in existing product lines to meet local demand inKuwait and regional demand in the GCC region. Examples include the recent expansion incapacity for gas aerated concrete blocks and small diameter high density polyethylene.Reducing industrial costs by increasing in house production of specialised products is partof this strategy.• Regional growth – increasing capacity in other growing markets. The recent expansionalongside a local partner in Riyadh and in Jeddah, Saudi Arabia of autoclaved aeratedconcrete blocks and slabs and also in a plant in the UAE serve as examples of this strategyin operation.NICBM also intends to engage in real estate development as a means of distributing its buildingmaterials that is additional to its existing channels. <strong>NIG</strong> does not intend that real estatedevelopment will be entered into to generate a purely financial return, other than the impendingredevelopment of the current <strong>NIG</strong> head office site which is due to be completed in August 2007.Corporate StructureThe principal shareholder in NICBM is <strong>NIG</strong> with a 51 per cent. shareholding. <strong>NIG</strong> appoints threemembers of the five member board of directors and the general assembly elects the remainingtwo members, with each director serving a term of three years. Once established, the board ofdirectors decides upon the appointment of the chairman, vice chairman and the managing director(the chairman is also appointed as managing director). The current chairman was reappointed fora further three-year term on 6 March 2005. The chairman of the board of directors is also themanaging director. The general manager is responsible for the day-to-day management of NICBMthrough a team of executive managers.The remaining shares are owned by various private sector individuals, none with a shareholdinggreater than five per cent. NICBM’s shares are traded on the “industrial” section of the KSE.NICBM is therefore regulated as a listed company by the KSE.73