NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

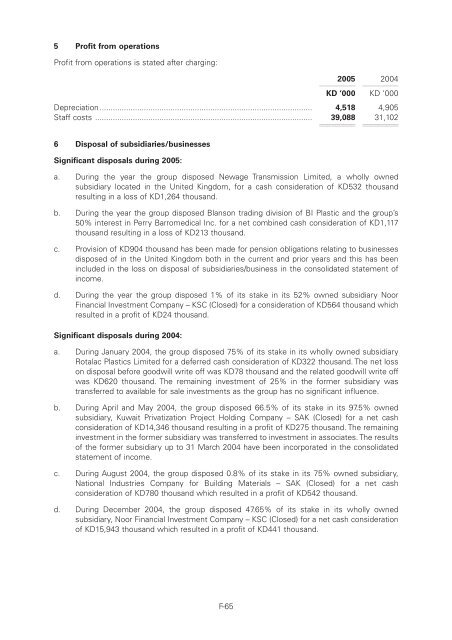

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c5 Profit from operationsProfit from operations is stated after charging:200511112200411112KD ‘000 KD ‘000Depreciation................................................................................................ 4,518 4,905Staff costs .................................................................................................. 39,088 1111231,102111126 Disposal of subsidiaries/businessesSignificant disposals during 2005:a. During the year the group disposed Newage Transmission Limited, a wholly ownedsubsidiary located in the United Kingdom, for a cash consideration of KD532 thousandresulting in a loss of KD1,264 thousand.b. During the year the group disposed Blanson trading division of BI Plastic and the group’s50% interest in Perry Barromedical Inc. for a net combined cash consideration of KD1,117thousand resulting in a loss of KD213 thousand.c. Provision of KD904 thousand has been made for pension obligations relating to businessesdisposed of in the United Kingdom both in the current and prior years and this has beenincluded in the loss on disposal of subsidiaries/business in the consolidated statement ofincome.d. During the year the group disposed 1% of its stake in its 52% owned subsidiary NoorFinancial Investment Company – KSC (Closed) for a consideration of KD564 thousand whichresulted in a profit of KD24 thousand.Significant disposals during 2004:a. During January 2004, the group disposed 75% of its stake in its wholly owned subsidiaryRotalac Plastics Limited for a deferred cash consideration of KD322 thousand. The net losson disposal before goodwill write off was KD78 thousand and the related goodwill write offwas KD620 thousand. The remaining investment of 25% in the former subsidiary wastransferred to available for sale investments as the group has no significant influence.b. During April and May 2004, the group disposed 66.5% of its stake in its 97.5% ownedsubsidiary, Kuwait Privatization Project Holding Company – SAK (Closed) for a net cashconsideration of KD14,346 thousand resulting in a profit of KD275 thousand. The remaininginvestment in the former subsidiary was transferred to investment in associates. The resultsof the former subsidiary up to 31 March 2004 have been incorporated in the consolidatedstatement of income.c. During August 2004, the group disposed 0.8% of its stake in its 75% owned subsidiary,National Industries Company for Building Materials – SAK (Closed) for a net cashconsideration of KD780 thousand which resulted in a profit of KD542 thousand.d. During December 2004, the group disposed 47.65% of its stake in its wholly ownedsubsidiary, Noor Financial Investment Company – KSC (Closed) for a net cash considerationof KD15,943 thousand which resulted in a profit of KD441 thousand.F-65