NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

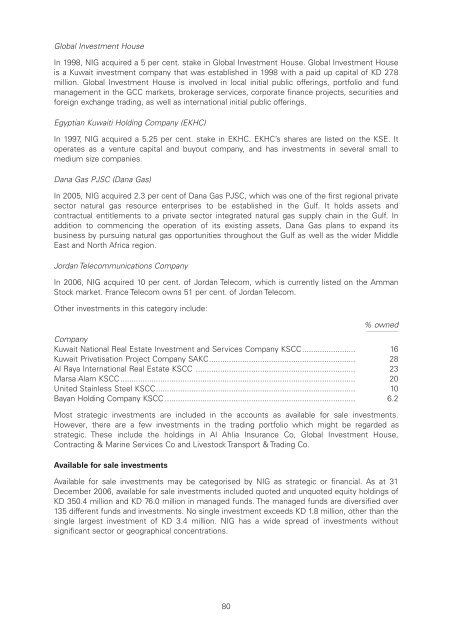

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07Global Investment HouseIn 1998, <strong>NIG</strong> acquired a 5 per cent. stake in Global Investment House. Global Investment Houseis a Kuwait investment company that was established in 1998 with a paid up capital of KD 27.8million. Global Investment House is involved in local initial public offerings, portfolio and fundmanagement in the GCC markets, brokerage services, corporate finance projects, securities andforeign exchange trading, as well as international initial public offerings.Egyptian Kuwaiti Holding Company (EKHC)In 1997, <strong>NIG</strong> acquired a 5.25 per cent. stake in EKHC. EKHC’s shares are listed on the KSE. Itoperates as a venture capital and buyout company, and has investments in several small tomedium size companies.Dana Gas PJSC (Dana Gas)In 2005, <strong>NIG</strong> acquired 2.3 per cent of Dana Gas PJSC, which was one of the first regional privatesector natural gas resource enterprises to be established in the Gulf. It holds assets andcontractual entitlements to a private sector integrated natural gas supply chain in the Gulf. Inaddition to commencing the operation of its existing assets, Dana Gas plans to expand itsbusiness by pursuing natural gas opportunities throughout the Gulf as well as the wider MiddleEast and North Africa region.Jordan Telecommunications CompanyIn 2006, <strong>NIG</strong> acquired 10 per cent. of Jordan Telecom, which is currently listed on the Amman<strong>Stock</strong> market. France Telecom owns 51 per cent. of Jordan Telecom.Other investments in this category include:% owned1111CompanyKuwait National Real Estate Investment and Services Company KSCC........................ 16Kuwait Privatisation Project Company SAKC.................................................................. 28Al Raya International Real Estate KSCC ........................................................................ 23Marsa Alam KSCC .......................................................................................................... 20United Stainless Steel KSCC.......................................................................................... 10Bayan Holding Company KSCC ...................................................................................... 6.2Most strategic investments are included in the accounts as available for sale investments.However, there are a few investments in the trading portfolio which might be regarded asstrategic. These include the holdings in Al Ahlia Insurance Co, Global Investment House,Contracting & Marine Services Co and Livestock Transport & Trading Co.Available for sale investmentsAvailable for sale investments may be categorised by <strong>NIG</strong> as strategic or financial. As at 31December 2006, available for sale investments included quoted and unquoted equity holdings ofKD 350.4 million and KD 76.0 million in managed funds. The managed funds are diversified over135 different funds and investments. No single investment exceeds KD 1.8 million, other than thesingle largest investment of KD 3.4 million. <strong>NIG</strong> has a wide spread of investments withoutsignificant sector or geographical concentrations.80