NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

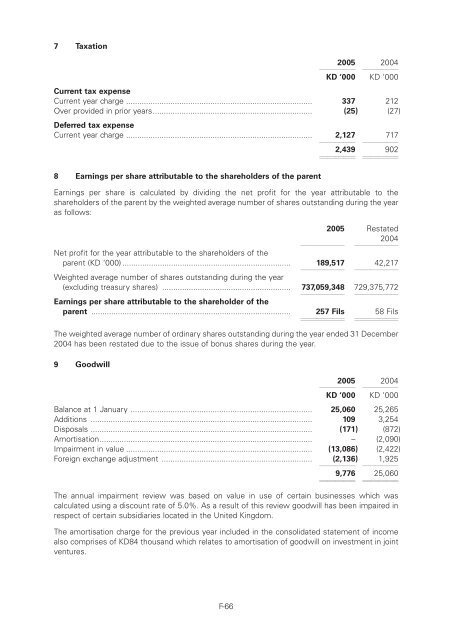

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c7 Taxation200511112200411112KD ‘000 KD ‘000Current tax expenseCurrent year charge .................................................................................... 337 212Over provided in prior years........................................................................ (25) (27)Deferred tax expenseCurrent year charge .................................................................................... 2,12711112717111122,439 11112902111128 Earnings per share attributable to the shareholders of the parentEarnings per share is calculated by dividing the net profit for the year attributable to theshareholders of the parent by the weighted average number of shares outstanding during the yearas follows:2005 Restated1111122004111112Net profit for the year attributable to the shareholders of theparent (KD ‘000) ............................................................................ 189,51711111242,217111112Weighted average number of shares outstanding during the year(excluding treasury shares) .......................................................... 737,059,348111112729,375,772111112Earnings per share attributable to the shareholder of theparent .......................................................................................... 257 Fils 58 Fils111112 111112111112 111112The weighted average number of ordinary shares outstanding during the year ended 31 December2004 has been restated due to the issue of bonus shares during the year.9 Goodwill200511112200411112KD ‘000 KD ‘000Balance at 1 January .................................................................................. 25,060 25,265Additions .................................................................................................... 109 3,254Disposals .................................................................................................... (171) (872)Amortisation................................................................................................ – (2,090)Impairment in value .................................................................................... (13,086) (2,422)Foreign exchange adjustment .................................................................... (2,136)111121,925111129,776 1111225,06011112The annual impairment review was based on value in use of certain businesses which wascalculated using a discount rate of 5.0%. As a result of this review goodwill has been impaired inrespect of certain subsidiaries located in the United Kingdom.The amortisation charge for the previous year included in the consolidated statement of incomealso comprises of KD84 thousand which relates to amortisation of goodwill on investment in jointventures.F-66