NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

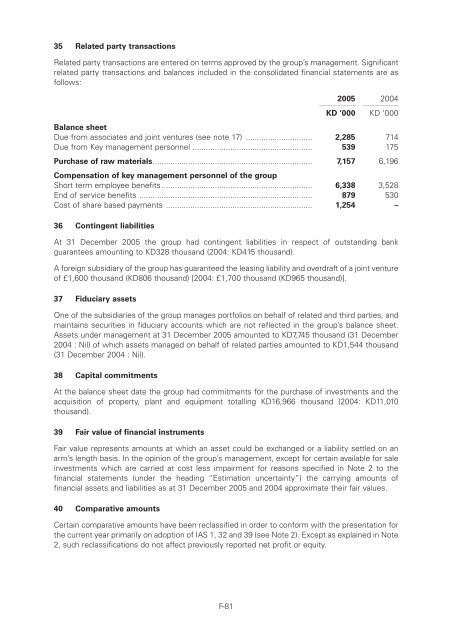

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c35 Related party transactionsRelated party transactions are entered on terms approved by the group’s management. Significantrelated party transactions and balances included in the consolidated financial statements are asfollows:200511112200411112KD ‘000 KD ‘000Balance sheetDue from associates and joint ventures (see note 17) .............................. 2,285 714Due from Key management personnel ...................................................... 539 175Purchase of raw materials........................................................................ 7,157 6,196Compensation of key management personnel of the groupShort term employee benefits .................................................................... 6,338 3,528End of service benefits .............................................................................. 879 530Cost of share based payments .................................................................. 1,254 –36 Contingent liabilitiesAt 31 December 2005 the group had contingent liabilities in respect of outstanding bankguarantees amounting to KD328 thousand (2004: KD415 thousand).A foreign subsidiary of the group has guaranteed the leasing liability and overdraft of a joint ventureof £1,600 thousand (KD806 thousand) [2004: £1,700 thousand (KD965 thousand)].37 Fiduciary assetsOne of the subsidiaries of the group manages portfolios on behalf of related and third parties, andmaintains securities in fiduciary accounts which are not reflected in the group’s balance sheet.Assets under management at 31 December 2005 amounted to KD7,745 thousand (31 December2004 : Nil) of which assets managed on behalf of related parties amounted to KD1,544 thousand(31 December 2004 : Nil).38 Capital commitmentsAt the balance sheet date the group had commitments for the purchase of investments and theacquisition of property, plant and equipment totalling KD16,966 thousand (2004: KD11,010thousand).39 Fair value of financial instrumentsFair value represents amounts at which an asset could be exchanged or a liability settled on anarm’s length basis. In the opinion of the group’s management, except for certain available for saleinvestments which are carried at cost less impairment for reasons specified in Note 2 to thefinancial statements (under the heading “Estimation uncertainty”) the carrying amounts offinancial assets and liabilities as at 31 December 2005 and 2004 approximate their fair values.40 Comparative amountsCertain comparative amounts have been reclassified in order to conform with the presentation forthe current year primarily on adoption of IAS 1, 32 and 39 (see Note 2). Except as explained in Note2, such reclassifications do not affect previously reported net profit or equity.F-81