NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

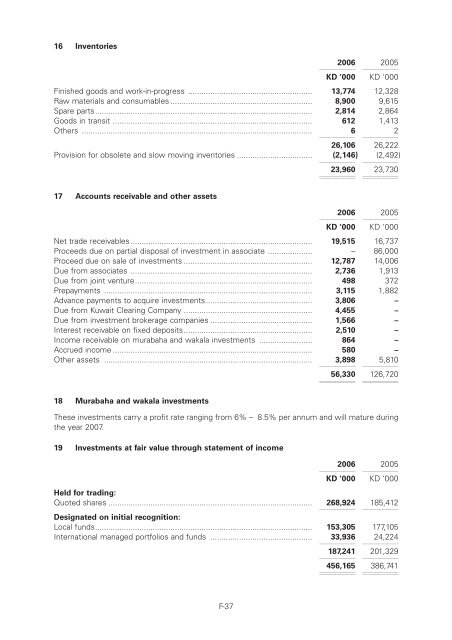

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10b16 Inventories200611112200511112KD ‘000 KD ‘000Finished goods and work-in-progress ........................................................ 13,774 12,328Raw materials and consumables ................................................................ 8,900 9,615Spare parts.................................................................................................. 2,814 2,864Goods in transit .......................................................................................... 612 1,413Others ........................................................................................................ 61111221111226,106 26,222Provision for obsolete and slow moving inventories .................................. (2,146)11112(2,492)1111223,960 1111223,7301111217 Accounts receivable and other assets200611112200511112KD ‘000 KD ‘000Net trade receivables .................................................................................. 19,515 16,737Proceeds due on partial disposal of investment in associate .................... – 86,000Proceed due on sale of investments .......................................................... 12,787 14,006Due from associates .................................................................................. 2,736 1,913Due from joint venture................................................................................ 498 372Prepayments .............................................................................................. 3,115 1,882Advance payments to acquire investments................................................ 3,806 –Due from Kuwait Clearing Company .......................................................... 4,455 –Due from investment brokerage companies .............................................. 1,566 –Interest receivable on fixed deposits.......................................................... 2,510 –Income receivable on murabaha and wakala investments ........................ 864 –Accrued income .......................................................................................... 580 –Other assets .............................................................................................. 3,898111125,8101111256,330 11112126,7201111218 Murabaha and wakala investmentsThese investments carry a profit rate ranging from 6% – 8.5% per annum and will mature duringthe year 2007.19 Investments at fair value through statement of income200611112200511112KD ‘000 KD ‘000Held for trading:Quoted shares ............................................................................................ 268,92411112185,41211112Designated on initial recognition:Local funds.................................................................................................. 153,305 177,105International managed portfolios and funds .............................................. 33,9361111224,22411112187,24111112201,32911112456,165 11112386,74111112F-37