NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

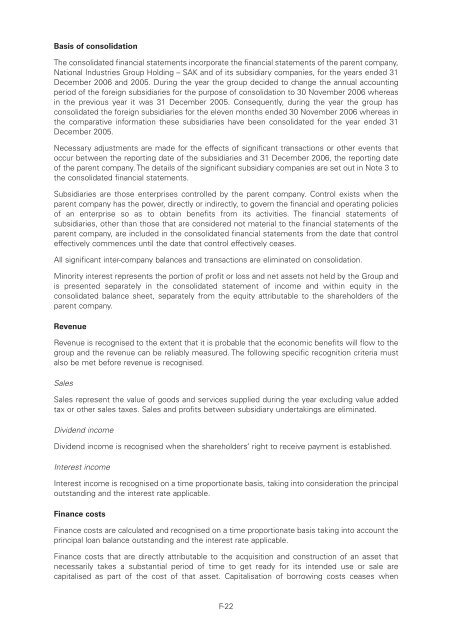

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10bBasis of consolidationThe consolidated financial statements incorporate the financial statements of the parent company,National Industries Group Holding – SAK and of its subsidiary companies, for the years ended 31December 2006 and 2005. During the year the group decided to change the annual accountingperiod of the foreign subsidiaries for the purpose of consolidation to 30 November 2006 whereasin the previous year it was 31 December 2005. Consequently, during the year the group hasconsolidated the foreign subsidiaries for the eleven months ended 30 November 2006 whereas inthe comparative information these subsidiaries have been consolidated for the year ended 31December 2005.Necessary adjustments are made for the effects of significant transactions or other events thatoccur between the reporting date of the subsidiaries and 31 December 2006, the reporting dateof the parent company. The details of the significant subsidiary companies are set out in Note 3 tothe consolidated financial statements.Subsidiaries are those enterprises controlled by the parent company. Control exists when theparent company has the power, directly or indirectly, to govern the financial and operating policiesof an enterprise so as to obtain benefits from its activities. The financial statements ofsubsidiaries, other than those that are considered not material to the financial statements of theparent company, are included in the consolidated financial statements from the date that controleffectively commences until the date that control effectively ceases.All significant inter-company balances and transactions are eliminated on consolidation.Minority interest represents the portion of profit or loss and net assets not held by the Group andis presented separately in the consolidated statement of income and within equity in theconsolidated balance sheet, separately from the equity attributable to the shareholders of theparent company.RevenueRevenue is recognised to the extent that it is probable that the economic benefits will flow to thegroup and the revenue can be reliably measured. The following specific recognition criteria mustalso be met before revenue is recognised.SalesSales represent the value of goods and services supplied during the year excluding value addedtax or other sales taxes. Sales and profits between subsidiary undertakings are eliminated.Dividend incomeDividend income is recognised when the shareholders’ right to receive payment is established.Interest incomeInterest income is recognised on a time proportionate basis, taking into consideration the principaloutstanding and the interest rate applicable.Finance costsFinance costs are calculated and recognised on a time proportionate basis taking into account theprincipal loan balance outstanding and the interest rate applicable.Finance costs that are directly attributable to the acquisition and construction of an asset thatnecessarily takes a substantial period of time to get ready for its intended use or sale arecapitalised as part of the cost of that asset. Capitalisation of borrowing costs ceases whenF-22