NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

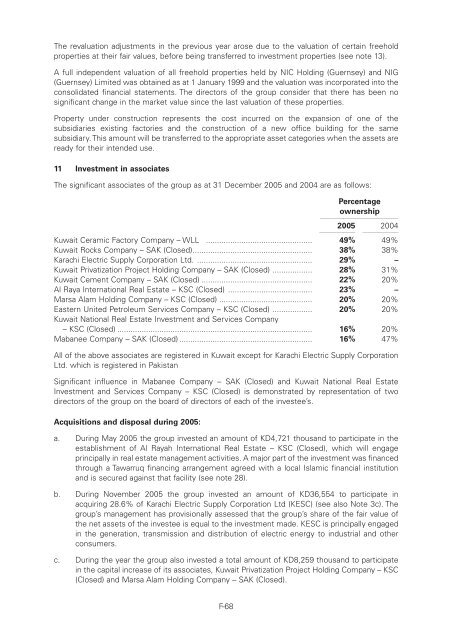

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cThe revaluation adjustments in the previous year arose due to the valuation of certain freeholdproperties at their fair values, before being transferred to investment properties (see note 13).A full independent valuation of all freehold properties held by NIC Holding (Guernsey) and <strong>NIG</strong>(Guernsey) Limited was obtained as at 1 January 1999 and the valuation was incorporated into theconsolidated financial statements. The directors of the group consider that there has been nosignificant change in the market value since the last valuation of these properties.Property under construction represents the cost incurred on the expansion of one of thesubsidiaries existing factories and the construction of a new office building for the samesubsidiary. This amount will be transferred to the appropriate asset categories when the assets areready for their intended use.11 Investment in associatesThe significant associates of the group as at 31 December 2005 and 2004 are as follows:Percentageownership1111223411112200511112200411112Kuwait Ceramic Factory Company – WLL ................................................ 49% 49%Kuwait Rocks Company – SAK (Closed)...................................................... 38% 38%Karachi Electric Supply Corporation Ltd. .................................................... 29% –Kuwait Privatization Project Holding Company – SAK (Closed) .................. 28% 31%Kuwait Cement Company – SAK (Closed) .................................................. 22% 20%Al Raya International Real Estate – KSC (Closed) ...................................... 23% –Marsa Alam Holding Company – KSC (Closed) .......................................... 20% 20%Eastern United Petroleum Services Company – KSC (Closed) .................. 20% 20%Kuwait National Real Estate Investment and Services Company– KSC (Closed) ........................................................................................ 16% 20%Mabanee Company – SAK (Closed) ............................................................ 16% 47%All of the above associates are registered in Kuwait except for Karachi Electric Supply CorporationLtd. which is registered in PakistanSignificant influence in Mabanee Company – SAK (Closed) and Kuwait National Real EstateInvestment and Services Company – KSC (Closed) is demonstrated by representation of twodirectors of the group on the board of directors of each of the investee’s.Acquisitions and disposal during 2005:a. During May 2005 the group invested an amount of KD4,721 thousand to participate in theestablishment of Al Rayah International Real Estate – KSC (Closed), which will engageprincipally in real estate management activities. A major part of the investment was financedthrough a Tawarruq financing arrangement agreed with a local Islamic financial institutionand is secured against that facility (see note 28).b. During November 2005 the group invested an amount of KD36,554 to participate inacquiring 28.6% of Karachi Electric Supply Corporation Ltd (KESC) (see also Note 3c). Thegroup’s management has provisionally assessed that the group’s share of the fair value ofthe net assets of the investee is equal to the investment made. KESC is principally engagedin the generation, transmission and distribution of electric energy to industrial and otherconsumers.c. During the year the group also invested a total amount of KD8,259 thousand to participatein the capital increase of its associates, Kuwait Privatization Project Holding Company – KSC(Closed) and Marsa Alam Holding Company – SAK (Closed).F-68