NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

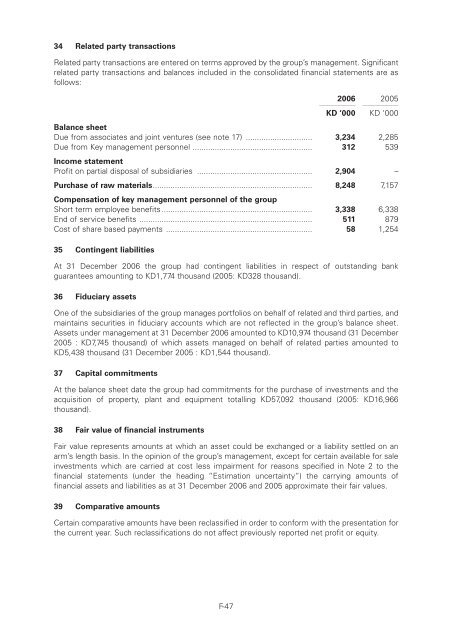

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10b34 Related party transactionsRelated party transactions are entered on terms approved by the group’s management. Significantrelated party transactions and balances included in the consolidated financial statements are asfollows:200611112200511112KD ‘000 KD ‘000Balance sheetDue from associates and joint ventures (see note 17) .............................. 3,234 2,285Due from Key management personnel ...................................................... 312 539Income statementProfit on partial disposal of subsidiaries .................................................... 2,904 –Purchase of raw materials........................................................................ 8,248 7,157Compensation of key management personnel of the groupShort term employee benefits .................................................................... 3,338 6,338End of service benefits .............................................................................. 511 879Cost of share based payments .................................................................. 58 1,25435 Contingent liabilitiesAt 31 December 2006 the group had contingent liabilities in respect of outstanding bankguarantees amounting to KD1,774 thousand (2005: KD328 thousand).36 Fiduciary assetsOne of the subsidiaries of the group manages portfolios on behalf of related and third parties, andmaintains securities in fiduciary accounts which are not reflected in the group’s balance sheet.Assets under management at 31 December 2006 amounted to KD10,974 thousand (31 December2005 : KD7,745 thousand) of which assets managed on behalf of related parties amounted toKD5,438 thousand (31 December 2005 : KD1,544 thousand).37 Capital commitmentsAt the balance sheet date the group had commitments for the purchase of investments and theacquisition of property, plant and equipment totalling KD57,092 thousand (2005: KD16,966thousand).38 Fair value of financial instrumentsFair value represents amounts at which an asset could be exchanged or a liability settled on anarm’s length basis. In the opinion of the group’s management, except for certain available for saleinvestments which are carried at cost less impairment for reasons specified in Note 2 to thefinancial statements (under the heading “Estimation uncertainty”) the carrying amounts offinancial assets and liabilities as at 31 December 2006 and 2005 approximate their fair values.39 Comparative amountsCertain comparative amounts have been reclassified in order to conform with the presentation forthe current year. Such reclassifications do not affect previously reported net profit or equity.F-47