NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

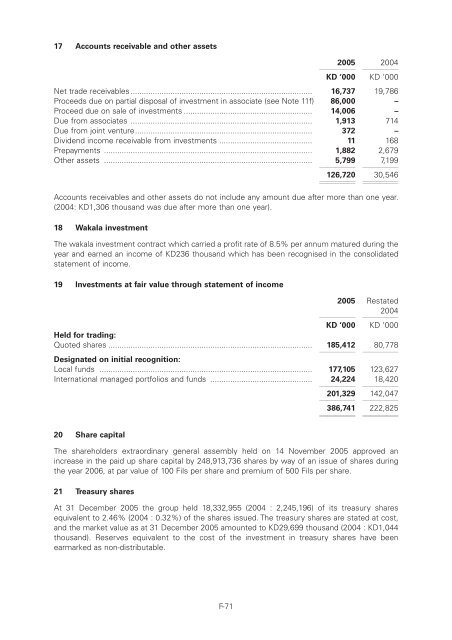

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c17 Accounts receivable and other assets200511112200411112KD ‘000 KD ‘000Net trade receivables .................................................................................. 16,737 19,786Proceeds due on partial disposal of investment in associate (see Note 11f) 86,000 –Proceed due on sale of investments .......................................................... 14,006 –Due from associates .................................................................................. 1,913 714Due from joint venture................................................................................ 372 –Dividend income receivable from investments .......................................... 11 168Prepayments .............................................................................................. 1,882 2,679Other assets .............................................................................................. 5,799111127,19911112126,720 1111230,54611112Accounts receivables and other assets do not include any amount due after more than one year.(2004: KD1,306 thousand was due after more than one year).18 Wakala investmentThe wakala investment contract which carried a profit rate of 8.5% per annum matured during theyear and earned an income of KD236 thousand which has been recognised in the consolidatedstatement of income.19 Investments at fair value through statement of income2005 Restated11112200411112KD ‘000 KD ‘000Held for trading:Quoted shares ............................................................................................ 185,4121111280,77811112Designated on initial recognition:Local funds ................................................................................................ 177,105 123,627International managed portfolios and funds .............................................. 24,2241111218,42011112201,32911112142,0471111220 Share capital386,741 222,82511112 1111211112 11112The shareholders extraordinary general assembly held on 14 November 2005 approved anincrease in the paid up share capital by 248,913,736 shares by way of an issue of shares duringthe year 2006, at par value of 100 Fils per share and premium of 500 Fils per share.21 Treasury sharesAt 31 December 2005 the group held 18,332,955 (2004 : 2,245,196) of its treasury sharesequivalent to 2.46% (2004 : 0.32%) of the shares issued. The treasury shares are stated at cost,and the market value as at 31 December 2005 amounted to KD29,699 thousand (2004 : KD1,044thousand). Reserves equivalent to the cost of the investment in treasury shares have beenearmarked as non-distributable.F-71