NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

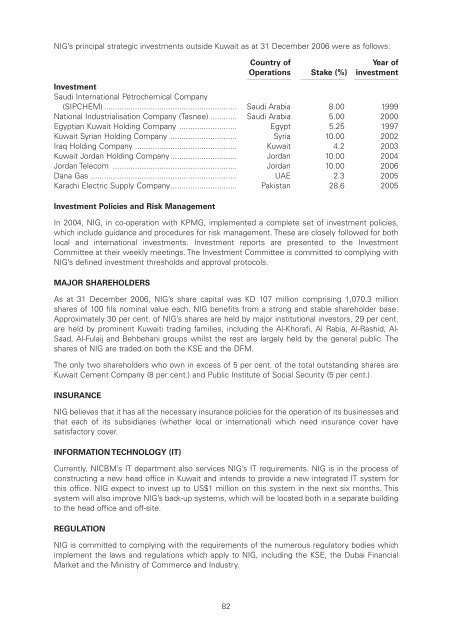

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07<strong>NIG</strong>’s principal strategic investments outside Kuwait as at 31 December 2006 were as follows:Country ofYear ofOperations111112Stake (%)111112investment111112InvestmentSaudi International Petrochemical Company(SIPCHEM) ............................................................ Saudi Arabia 8.00 1999National Industrialisation Company (Tasnee) ............ Saudi Arabia 5.00 2000Egyptian Kuwait Holding Company .......................... Egypt 5.25 1997Kuwait Syrian Holding Company .............................. Syria 10.00 2002Iraq Holding Company .............................................. Kuwait 4.2 2003Kuwait Jordan Holding Company .............................. Jordan 10.00 2004Jordan Telecom ........................................................ Jordan 10.00 2006Dana Gas .................................................................. UAE 2.3 2005Karachi Electric Supply Company.............................. Pakistan 28.6 2005Investment Policies and Risk ManagementIn 2004, <strong>NIG</strong>, in co-operation with KPMG, implemented a complete set of investment policies,which include guidance and procedures for risk management. These are closely followed for bothlocal and international investments. Investment reports are presented to the InvestmentCommittee at their weekly meetings. The Investment Committee is committed to complying with<strong>NIG</strong>’s defined investment thresholds and approval protocols.MAJOR SHAREHOLDERSAs at 31 December 2006, <strong>NIG</strong>’s share capital was KD 107 million comprising 1,070.3 millionshares of 100 fils nominal value each. <strong>NIG</strong> benefits from a strong and stable shareholder base.Approximately 30 per cent. of <strong>NIG</strong>’s shares are held by major institutional investors, 29 per cent.are held by prominent Kuwaiti trading families, including the Al-Khorafi, Al Rabia, Al-Rashid, Al-Saad, Al-Fulaij and Behbehani groups whilst the rest are largely held by the general public. Theshares of <strong>NIG</strong> are traded on both the KSE and the DFM.The only two shareholders who own in excess of 5 per cent. of the total outstanding shares areKuwait Cement Company (8 per cent.) and Public Institute of Social Security (5 per cent.).INSURANCE<strong>NIG</strong> believes that it has all the necessary insurance policies for the operation of its businesses andthat each of its subsidiaries (whether local or international) which need insurance cover havesatisfactory cover.INFORMATION TECHNOLOGY (IT)Currently, NICBM’s IT department also services <strong>NIG</strong>’s IT requirements. <strong>NIG</strong> is in the process ofconstructing a new head office in Kuwait and intends to provide a new integrated IT system forthis office. <strong>NIG</strong> expect to invest up to US$1 million on this system in the next six months. Thissystem will also improve <strong>NIG</strong>’s back-up systems, which will be located both in a separate buildingto the head office and off-site.REGULATION<strong>NIG</strong> is committed to complying with the requirements of the numerous regulatory bodies whichimplement the laws and regulations which apply to <strong>NIG</strong>, including the KSE, the Dubai FinancialMarket and the Ministry of Commerce and Industry.82