NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

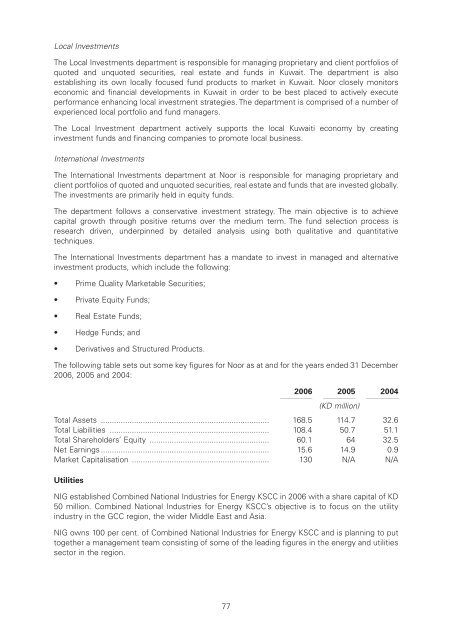

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07Local InvestmentsThe Local Investments department is responsible for managing proprietary and client portfolios ofquoted and unquoted securities, real estate and funds in Kuwait. The department is alsoestablishing its own locally focused fund products to market in Kuwait. Noor closely monitorseconomic and financial developments in Kuwait in order to be best placed to actively executeperformance enhancing local investment strategies. The department is comprised of a number ofexperienced local portfolio and fund managers.The Local Investment department actively supports the local Kuwaiti economy by creatinginvestment funds and financing companies to promote local business.International InvestmentsThe International Investments department at Noor is responsible for managing proprietary andclient portfolios of quoted and unquoted securities, real estate and funds that are invested globally.The investments are primarily held in equity funds.The department follows a conservative investment strategy. The main objective is to achievecapital growth through positive returns over the medium term. The fund selection process isresearch driven, underpinned by detailed analysis using both qualitative and quantitativetechniques.The International Investments department has a mandate to invest in managed and alternativeinvestment products, which include the following:• Prime Quality Marketable Securities;• Private Equity Funds;• Real Estate Funds;• Hedge Funds; and• Derivatives and Structured Products.The following table sets out some key figures for Noor as at and for the years ended 31 December2006, 2005 and 2004:200611112005111120041111(KD million)Total Assets ............................................................................ 168.5 114.7 32.6Total Liabilities ........................................................................ 108.4 50.7 51.1Total Shareholders’ Equity ...................................................... 60.1 64 32.5Net Earnings ............................................................................ 15.6 14.9 0.9Market Capitalisation .............................................................. 130 N/A N/AUtilities<strong>NIG</strong> established Combined National Industries for Energy KSCC in 2006 with a share capital of KD50 million. Combined National Industries for Energy KSCC’s objective is to focus on the utilityindustry in the GCC region, the wider Middle East and Asia.<strong>NIG</strong> owns 100 per cent. of Combined National Industries for Energy KSCC and is planning to puttogether a management team consisting of some of the leading figures in the energy and utilitiessector in the region.77