Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

� The long-term outlook for the CEE region is now, after the fundamental<br />

reappraisal <strong>of</strong> banking business in <strong>2011</strong>, perceived differently.<br />

The convergence process has made substantial progress in<br />

the 22 years after the opening <strong>of</strong> the East, and entails weaker<br />

growth rates after the boom years – even if these are still double<br />

the growth rates <strong>of</strong> Western Europe. This has increased sensitivity to<br />

cyclical influences and disruptions in capital movements. But in most<br />

CEE countries, especially in the large economies, the upturn <strong>of</strong> the<br />

banking sector remains assured, even if it may be more moderate<br />

than in the past.<br />

But there are some countries with a promising economic environment<br />

where the restructuring <strong>of</strong> the banking sector is not yet complete,<br />

or where there is strong dependence on external capital<br />

inflows. In Kazakhstan NPL ratios (non-performing loans as a percentage<br />

<strong>of</strong> gross lending volume) will remain disproportionately high<br />

for some time, which is partly due to local legislation. Ukraine is suffering<br />

from a large external funding gap, and the domestic circular<br />

flow <strong>of</strong> money is only slowly gaining momentum, not least on account<br />

<strong>of</strong> political uncertainty. When, in <strong>2011</strong>, international banks reevaluated<br />

risks and were confronted with the new regulatory requirements<br />

and more difficult funding conditions, they also adjusted their plans<br />

for exposed countries to the new scenarios, a process which involved<br />

impairment losses on goodwill.<br />

In Hungary, a number <strong>of</strong> amendments to the Constitution and to the<br />

legal framework were not entirely acceptable to the EU and the IMF,<br />

the country’s most important lender. Hungary’s credit rating was<br />

moreover downgraded to speculative investment, which made the<br />

rollover <strong>of</strong> its large foreign debt much more expensive and triggered<br />

a sharp depreciation <strong>of</strong> the forint. This led to the adoption <strong>of</strong> countermeasures<br />

which aggravated the crisis. Finally, the levy on banks<br />

introduced in 2010 was compounded by efforts to ease the solvency<br />

problems <strong>of</strong> private households through administrative procedures,<br />

placing a larger burden on banks which acted as lenders. The Home<br />

Protection Act passed in May <strong>2011</strong> among other things gave mortgage<br />

debtors the option <strong>of</strong> rescheduling their debt at fixed exchange<br />

rates. In September the government went even further with the<br />

option <strong>of</strong> early repayment <strong>of</strong> loans denominated in euro or foreign<br />

currency at a fixed mandatory conversion rate. In December <strong>2011</strong>,<br />

the government and the Hungarian <strong>Bank</strong>ing Association reached<br />

agreement on easing the burden on banks, permitting the latter to<br />

<strong>of</strong>fset 30% <strong>of</strong> the losses thereby incurred against the levy on banks<br />

in 2012.<br />

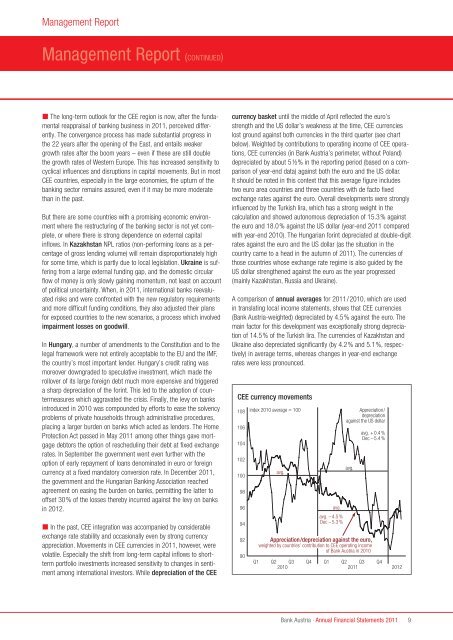

� In the past, CEE integration was accompanied by considerable<br />

exchange rate stability and occasionally even by strong currency<br />

appreciation. Movements in CEE currencies in <strong>2011</strong>, however, were<br />

volatile. Especially the shift from long-term capital inflows to shortterm<br />

portfolio investments increased sensitivity to changes in sentiment<br />

among international investors. While depreciation <strong>of</strong> the CEE<br />

currency basket until the middle <strong>of</strong> April reflected the euro’s<br />

strength and the US dollar’s weakness at the time, CEE currencies<br />

lost ground against both currencies in the third quarter (see chart<br />

below). Weighted by contributions to operating income <strong>of</strong> CEE operations,<br />

CEE currencies (in <strong>Bank</strong> <strong>Austria</strong>’s perimeter, without Poland)<br />

depreciated by about 5 ½% in the reporting period (based on a comparison<br />

<strong>of</strong> year-end data) against both the euro and the US dollar.<br />

It should be noted in this context that this average figure includes<br />

two euro area countries and three countries with de facto fixed<br />

exchange rates against the euro. Overall developments were strongly<br />

influenced by the Turkish lira, which has a strong weight in the<br />

calculation and showed autonomous depreciation <strong>of</strong> 15.3% against<br />

the euro and 18.0% against the US dollar (year-end <strong>2011</strong> compared<br />

with year-end 2010). The Hungarian forint depreciated at double-digit<br />

rates against the euro and the US dollar (as the situation in the<br />

country came to a head in the autumn <strong>of</strong> <strong>2011</strong>). The currencies <strong>of</strong><br />

those countries whose exchange rate regime is also guided by the<br />

US dollar strengthened against the euro as the year progressed<br />

(mainly Kazakhstan, Russia and Ukraine).<br />

A comparison <strong>of</strong> annual averages for <strong>2011</strong>/2010, which are used<br />

in translating local income statements, shows that CEE currencies<br />

(<strong>Bank</strong> <strong>Austria</strong>-weighted) depreciated by 4.5% against the euro. The<br />

main factor for this development was exceptionally strong depreciation<br />

<strong>of</strong> 14.5% <strong>of</strong> the Turkish lira. The currencies <strong>of</strong> Kazakhstan and<br />

Ukraine also depreciated significantly (by 4.2% and 5.1%, respectively)<br />

in average terms, whereas changes in year-end exchange<br />

rates were less pronounced.<br />

CEE currency movements<br />

108<br />

106<br />

104<br />

102<br />

100<br />

98<br />

96<br />

94<br />

92<br />

90<br />

index 2010 average = 100<br />

avg.<br />

avg.<br />

avg. –4.5 %<br />

Dec –5.3 %<br />

Appreciation/<br />

depreciation<br />

against the US dollar<br />

avg.<br />

Appreciation/depreciation against the euro,<br />

weighted by countries’ contribution to CEE operating income<br />

<strong>of</strong> <strong>Bank</strong> <strong>Austria</strong> in 2010<br />

avg. +0.4 %<br />

Dec –5.4 %<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

2010 <strong>2011</strong> 2012<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

9