Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

Development <strong>of</strong> business segments<br />

Family & SME <strong>Bank</strong>ing (F&SME)<br />

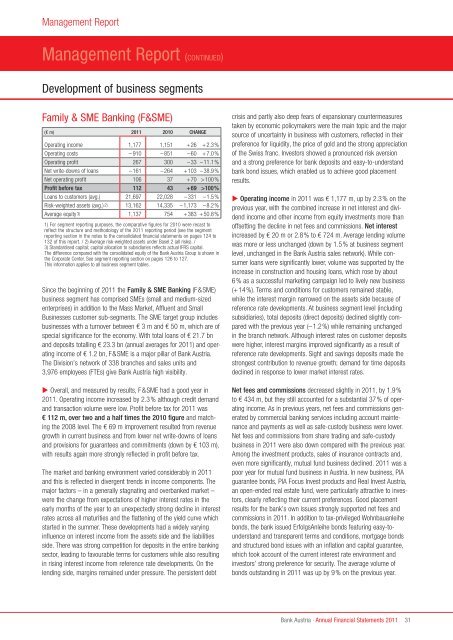

(€ m) <strong>2011</strong> 2010 CHAngE<br />

Operating income 1,177 1,151 +26 +2.3%<br />

Operating costs – 910 –851 –60 +7.0%<br />

Operating pr<strong>of</strong>it 267 300 –33 –11.1%<br />

Net write-downs <strong>of</strong> loans –161 –264 +103 –38.9%<br />

Net operating pr<strong>of</strong>it 106 37 +70 >100%<br />

Pr<strong>of</strong>it before tax 112 43 +69 >100%<br />

Loans to customers (avg.) 21,697 22,028 –331 –1.5%<br />

Risk-weighted assets (avg.) 2) 13,162 14,335 –1,173 –8.2%<br />

Average equity 3) 1,137 754 +383 +50.8%<br />

1) For segment reporting purposes, the comparative figures for 2010 were recast to<br />

reflect the structure and methodology <strong>of</strong> the <strong>2011</strong> reporting period (see the segment<br />

reporting section in the notes to the consolidated financial statements on pages 124 to<br />

132 <strong>of</strong> this report. / 2) Average risk-weighted assets under Basel 2 (all risks). /<br />

3) Standardised capital; capital allocation to subsidiaries reflects actual IFRS capital.<br />

The difference compared with the consolidated equity <strong>of</strong> the <strong>Bank</strong> <strong>Austria</strong> Group is shown in<br />

the Corporate Center. See segment reporting section on pages 126 to 127.<br />

This information applies to all business segment tables.<br />

Since the beginning <strong>of</strong> <strong>2011</strong> the Family & SmE <strong>Bank</strong>ing (F&SME)<br />

business segment has comprised SMEs (small and medium-sized<br />

enterprises) in addition to the Mass Market, Affluent and Small<br />

Businesses customer sub-segments. The SME target group includes<br />

businesses with a turnover between € 3 m and € 50 m, which are <strong>of</strong><br />

special significance for the economy. With total loans <strong>of</strong> € 21.7 bn<br />

and deposits totalling € 23.3 bn (annual averages for <strong>2011</strong>) and operating<br />

income <strong>of</strong> € 1.2 bn, F&SME is a major pillar <strong>of</strong> <strong>Bank</strong> <strong>Austria</strong>.<br />

The Division’s network <strong>of</strong> 338 branches and sales units and<br />

3,976 employees (FTEs) give <strong>Bank</strong> <strong>Austria</strong> high visibility.<br />

� Overall, and measured by results, F&SME had a good year in<br />

<strong>2011</strong>. Operating income increased by 2.3% although credit demand<br />

and transaction volume were low. Pr<strong>of</strong>it before tax for <strong>2011</strong> was<br />

€ 112 m, over two and a half times the 2010 figure and matching<br />

the 2008 level. The € 69 m improvement resulted from revenue<br />

growth in current business and from lower net write-downs <strong>of</strong> loans<br />

and provisions for guarantees and commitments (down by € 103 m),<br />

with results again more strongly reflected in pr<strong>of</strong>it before tax.<br />

The market and banking environment varied considerably in <strong>2011</strong><br />

and this is reflected in divergent trends in income components. The<br />

major factors – in a generally stagnating and overbanked market –<br />

were the change from expectations <strong>of</strong> higher interest rates in the<br />

early months <strong>of</strong> the year to an unexpectedly strong decline in interest<br />

rates across all maturities and the flattening <strong>of</strong> the yield curve which<br />

started in the summer. These developments had a widely varying<br />

influence on interest income from the assets side and the liabilities<br />

side. There was strong competition for deposits in the entire banking<br />

sector, leading to favourable terms for customers while also resulting<br />

in rising interest income from reference rate developments. On the<br />

lending side, margins remained under pressure. The persistent debt<br />

crisis and partly also deep fears <strong>of</strong> expansionary countermeasures<br />

taken by economic policymakers were the main topic and the major<br />

source <strong>of</strong> uncertainty in business with customers, reflected in their<br />

preference for liquidity, the price <strong>of</strong> gold and the strong appreciation<br />

<strong>of</strong> the Swiss franc. Investors showed a pronounced risk aversion<br />

and a strong preference for bank deposits and easy-to-understand<br />

bank bond issues, which enabled us to achieve good placement<br />

results.<br />

� operating income in <strong>2011</strong> was € 1,177 m, up by 2.3% on the<br />

previous year, with the combined increase in net interest and dividend<br />

income and other income from equity investments more than<br />

<strong>of</strong>fsetting the decline in net fees and commissions. net interest<br />

increased by € 20 m or 2.8% to € 724 m. Average lending volume<br />

was more or less unchanged (down by 1.5% at business segment<br />

level, unchanged in the <strong>Bank</strong> <strong>Austria</strong> sales network). While consumer<br />

loans were significantly lower, volume was supported by the<br />

increase in construction and housing loans, which rose by about<br />

6% as a successful marketing campaign led to lively new business<br />

(+14%). Terms and conditions for customers remained stable,<br />

while the interest margin narrowed on the assets side because <strong>of</strong><br />

reference rate developments. At business segment level (including<br />

subsidiaries), total deposits (direct deposits) declined slightly compared<br />

with the previous year (–1.2%) while remaining unchanged<br />

in the branch network. Although interest rates on customer deposits<br />

were higher, interest margins improved significantly as a result <strong>of</strong><br />

reference rate developments. Sight and savings deposits made the<br />

strongest contribution to revenue growth; demand for time deposits<br />

declined in response to lower market interest rates.<br />

net fees and commissions decreased slightly in <strong>2011</strong>, by 1.9%<br />

to € 434 m, but they still accounted for a substantial 37% <strong>of</strong> operating<br />

income. As in previous years, net fees and commissions generated<br />

by commercial banking services including account maintenance<br />

and payments as well as safe-custody business were lower.<br />

Net fees and commissions from share trading and safe-custody<br />

business in <strong>2011</strong> were also down compared with the previous year.<br />

Among the investment products, sales <strong>of</strong> insurance contracts and,<br />

even more significantly, mutual fund business declined. <strong>2011</strong> was a<br />

poor year for mutual fund business in <strong>Austria</strong>. In new business, PIA<br />

guarantee bonds, PIA Focus Invest products and Real Invest <strong>Austria</strong>,<br />

an open-ended real estate fund, were particularly attractive to investors,<br />

clearly reflecting their current preferences. Good placement<br />

results for the bank’s own issues strongly supported net fees and<br />

commissions in <strong>2011</strong>. In addition to tax-privileged Wohnbauanleihe<br />

bonds, the bank issued ErfolgsAnleihe bonds featuring easy-tounderstand<br />

and transparent terms and conditions, mortgage bonds<br />

and structured bond issues with an inflation and capital guarantee,<br />

which took account <strong>of</strong> the current interest rate environment and<br />

investors’ strong preference for security. The average volume <strong>of</strong><br />

bonds outstanding in <strong>2011</strong> was up by 9% on the previous year.<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

31