Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

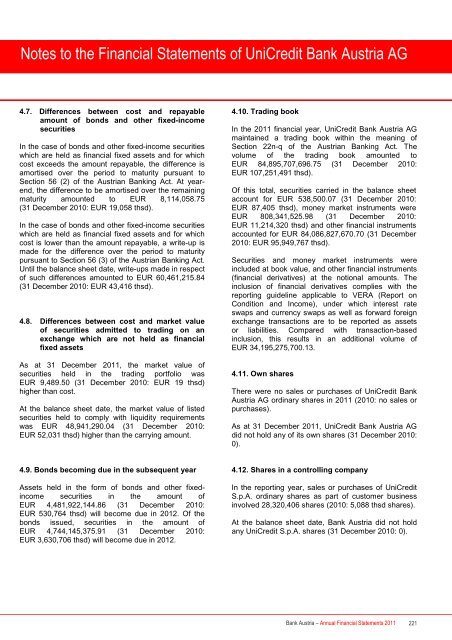

Notes to the <strong>Financial</strong> <strong>Statements</strong> <strong>of</strong> UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

4.7. Differences between cost and repayable<br />

amount <strong>of</strong> bonds and other fixed-income<br />

securities<br />

In the case <strong>of</strong> bonds and other fixed-income securities<br />

which are held as financial fixed assets and for which<br />

cost exceeds the amount repayable, the difference is<br />

amortised over the period to maturity pursuant to<br />

Section 56 (2) <strong>of</strong> the <strong>Austria</strong>n <strong>Bank</strong>ing Act. At yearend,<br />

the difference to be amortised over the remaining<br />

maturity amounted to EUR 8,114,058.75<br />

(31 December 2010: EUR 19,058 thsd).<br />

In the case <strong>of</strong> bonds and other fixed-income securities<br />

which are held as financial fixed assets and for which<br />

cost is lower than the amount repayable, a write-up is<br />

made for the difference over the period to maturity<br />

pursuant to Section 56 (3) <strong>of</strong> the <strong>Austria</strong>n <strong>Bank</strong>ing Act.<br />

Until the balance sheet date, write-ups made in respect<br />

<strong>of</strong> such differences amounted to EUR 60,461,215.84<br />

(31 December 2010: EUR 43,416 thsd).<br />

4.8. Differences between cost and market value<br />

<strong>of</strong> securities admitted to trading on an<br />

exchange which are not held as financial<br />

fixed assets<br />

As at 31 December <strong>2011</strong>, the market value <strong>of</strong><br />

securities held in the trading portfolio was<br />

EUR 9,489.50 (31 December 2010: EUR 19 thsd)<br />

higher than cost.<br />

At the balance sheet date, the market value <strong>of</strong> listed<br />

securities held to comply with liquidity requirements<br />

was EUR 48,941,290.04 (31 December 2010:<br />

EUR 52,031 thsd) higher than the carrying amount.<br />

4.9. Bonds becoming due in the subsequent year<br />

Assets held in the form <strong>of</strong> bonds and other fixedincome<br />

securities in the amount <strong>of</strong><br />

EUR 4,481,922,144.86 (31 December 2010:<br />

EUR 530,764 thsd) will become due in 2012. Of the<br />

bonds issued, securities in the amount <strong>of</strong><br />

EUR 4,744,145,375.91 (31 December 2010:<br />

EUR 3,630,706 thsd) will become due in 2012.<br />

4.10. Trading book<br />

In the <strong>2011</strong> financial year, UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

maintained a trading book within the meaning <strong>of</strong><br />

Section 22n-q <strong>of</strong> the <strong>Austria</strong>n <strong>Bank</strong>ing Act. The<br />

volume <strong>of</strong> the trading book amounted to<br />

EUR 84,895,707,696.75 (31 December 2010:<br />

EUR 107,251,491 thsd).<br />

Of this total, securities carried in the balance sheet<br />

account for EUR 538,500.07 (31 December 2010:<br />

EUR 87,405 thsd), money market instruments were<br />

EUR 808,341,525.98 (31 December 2010:<br />

EUR 11,214,320 thsd) and other financial instruments<br />

accounted for EUR 84,086,827,670.70 (31 December<br />

2010: EUR 95,949,767 thsd).<br />

Securities and money market instruments were<br />

included at book value, and other financial instruments<br />

(financial derivatives) at the notional amounts. The<br />

inclusion <strong>of</strong> financial derivatives complies with the<br />

reporting guideline applicable to VERA (Report on<br />

Condition and Income), under which interest rate<br />

swaps and currency swaps as well as forward foreign<br />

exchange transactions are to be reported as assets<br />

or liabilities. Compared with transaction-based<br />

inclusion, this results in an additional volume <strong>of</strong><br />

EUR 34,195,275,700.13.<br />

4.11. Own shares<br />

There were no sales or purchases <strong>of</strong> UniCredit <strong>Bank</strong><br />

<strong>Austria</strong> AG ordinary shares in <strong>2011</strong> (2010: no sales or<br />

purchases).<br />

As at 31 December <strong>2011</strong>, UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

did not hold any <strong>of</strong> its own shares (31 December 2010:<br />

0).<br />

4.12. Shares in a controlling company<br />

In the reporting year, sales or purchases <strong>of</strong> UniCredit<br />

S.p.A. ordinary shares as part <strong>of</strong> customer business<br />

involved 28,320,406 shares (2010: 5,088 thsd shares).<br />

At the balance sheet date, <strong>Bank</strong> <strong>Austria</strong> did not hold<br />

any UniCredit S.p.A. shares (31 December 2010: 0).<br />

<strong>Bank</strong> <strong>Austria</strong> – <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 221