Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

As a result <strong>of</strong> weak revenue growth, the cost/income ratio in CEE<br />

rose by 1 percentage point to 46.5% while remaining significantly<br />

lower than the average <strong>of</strong> 55.9% for the bank as a whole.<br />

At CEE Division level, the number <strong>of</strong> branches and employees<br />

remained more or less unchanged in <strong>2011</strong> (–0.5% and –0.2%,<br />

respectively) but there were underlying changes and movements:<br />

staff numbers in several countries were expanded in line with strategy,<br />

in Turkey they rose by 496 FTEs (from year-end 2010 to yearend<br />

<strong>2011</strong>), in Russia by 217 FTEs, and in the Czech Republic by<br />

179 FTEs. This compares with reductions in regions with a multiple<br />

presence. Moreover, the restructuring <strong>of</strong> administrative centres in<br />

Kazakhstan and Ukraine involved a decline <strong>of</strong> 317 FTEs and<br />

666 FTEs, respectively. The branch network expansion plan has<br />

been suspended, except for key countries. A significant number <strong>of</strong><br />

new branches were added to the networks in Turkey and in the<br />

Czech Republic, but this effect was <strong>of</strong>fset by network streamlining<br />

in Kazakhstan and Ukraine. On balance, the number <strong>of</strong> branches in<br />

CEE rose by 15 to 2,750. This means that cost growth, adjusted for<br />

exchange rate movements, was mainly due to inflation-induced<br />

wage increases in the growth countries Turkey (business trends<br />

and monetary overheating), Czech Republic (market initiative) and<br />

Russia (capital market-intensive business).<br />

� In the past two years, net write-downs <strong>of</strong> loans and provisions<br />

for guarantees and commitments declined from the exceptionally<br />

high level recorded in 2009. This trend relieved the burden on<br />

results. Since 2009, a year marked by the combined impact <strong>of</strong> financial<br />

market crisis and recession, the provisioning charge has fallen<br />

significantly. This means that the favourable trend in operating performance,<br />

though comparatively moderate, feeds through to pr<strong>of</strong>its<br />

to a greater extent.<br />

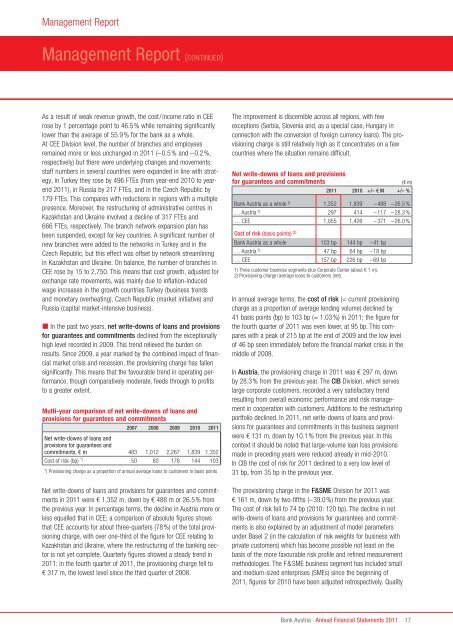

Multi-year comparison <strong>of</strong> net write-downs <strong>of</strong> loans and<br />

provisions for guarantees and commitments<br />

2007 2008 2009 2010 <strong>2011</strong><br />

Net write-downs <strong>of</strong> loans and<br />

provisions for guarantees and<br />

commitments, € m 483 1,012 2,267 1,839 1,352<br />

Cost <strong>of</strong> risk (bp) *) 50 80 178 144 103<br />

*) Provisioning charge as a proportion <strong>of</strong> annual average loans to customers in basis points<br />

Net write-downs <strong>of</strong> loans and provisions for guarantees and commitments<br />

in <strong>2011</strong> were € 1,352 m, down by € 488 m or 26.5% from<br />

the previous year. In percentage terms, the decline in <strong>Austria</strong> more or<br />

less equalled that in CEE; a comparison <strong>of</strong> absolute figures shows<br />

that CEE accounts for about three-quarters (78%) <strong>of</strong> the total provisioning<br />

charge, with over one-third <strong>of</strong> the figure for CEE relating to<br />

Kazakhstan and Ukraine, where the restructuring <strong>of</strong> the banking sector<br />

is not yet complete. Quarterly figures showed a steady trend in<br />

<strong>2011</strong>: in the fourth quarter <strong>of</strong> <strong>2011</strong>, the provisioning charge fell to<br />

€ 317 m, the lowest level since the third quarter <strong>of</strong> 2008.<br />

The improvement is discernible across all regions, with few<br />

exceptions (Serbia, Slovenia and, as a special case, Hungary in<br />

connection with the conversion <strong>of</strong> foreign currency loans). The provisioning<br />

charge is still relatively high as it concentrates on a few<br />

countries where the situation remains difficult.<br />

Net write-downs <strong>of</strong> loans and provisions<br />

for guarantees and commitments (€ m)<br />

<strong>2011</strong> 2010 +/– € m +/– %<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 1) 1,352 1,839 –488 –26.5%<br />

… <strong>Austria</strong> 1) 297 414 –117 –28.3%<br />

… CEE 1,055 1,426 –371 –26.0%<br />

Cost <strong>of</strong> risk (basis points) 2)<br />

<strong>Bank</strong> <strong>Austria</strong> as a whole 103 bp 144 bp –41 bp<br />

… <strong>Austria</strong> 1) 47 bp 64 bp –18 bp<br />

… CEE 157 bp 226 bp –69 bp<br />

1) Three customer business segments plus Corporate Center (about € 1 m).<br />

2) Provisioning charge/average loans to customers (net).<br />

In annual average terms, the cost <strong>of</strong> risk (= current provisioning<br />

charge as a proportion <strong>of</strong> average lending volume) declined by<br />

41 basis points (bp) to 103 bp (= 1.03%) in <strong>2011</strong>; the figure for<br />

the fourth quarter <strong>of</strong> <strong>2011</strong> was even lower, at 95 bp. This compares<br />

with a peak <strong>of</strong> 215 bp at the end <strong>of</strong> 2009 and the low level<br />

<strong>of</strong> 46 bp seen immediately before the financial market crisis in the<br />

middle <strong>of</strong> 2008.<br />

In <strong>Austria</strong>, the provisioning charge in <strong>2011</strong> was € 297 m, down<br />

by 28.3% from the previous year. The CIB Division, which serves<br />

large corporate customers, recorded a very satisfactory trend<br />

resulting from overall economic performance and risk management<br />

in cooperation with customers. Additions to the restructuring<br />

portfolio declined. In <strong>2011</strong>, net write-downs <strong>of</strong> loans and provisions<br />

for guarantees and commitments in this business segment<br />

were € 131 m, down by 10.1% from the previous year. In this<br />

context it should be noted that large-volume loan loss provisions<br />

made in preceding years were reduced already in mid-2010.<br />

In CIB the cost <strong>of</strong> risk for <strong>2011</strong> declined to a very low level <strong>of</strong><br />

31 bp, from 35 bp in the previous year.<br />

The provisioning charge in the F&SmE Division for <strong>2011</strong> was<br />

€ 161 m, down by two-fifths (–39.0%) from the previous year.<br />

The cost <strong>of</strong> risk fell to 74 bp (2010: 120 bp). The decline in net<br />

write-downs <strong>of</strong> loans and provisions for guarantees and commitments<br />

is also explained by an adjustment <strong>of</strong> model parameters<br />

under Basel 2 (in the calculation <strong>of</strong> risk weights for business with<br />

private customers) which has become possible not least on the<br />

basis <strong>of</strong> the more favourable risk pr<strong>of</strong>ile and refined measurement<br />

methodologies. The F&SME business segment has included small<br />

and medium-sized enterprises (SMEs) since the beginning <strong>of</strong><br />

<strong>2011</strong>, figures for 2010 have been adjusted retrospectively. Quality<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

17