Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

exchange-rate management in business with customers. In Hungary,<br />

which also experienced significant exchange rate movements, net<br />

trading income also improved from nil to € 14 m.<br />

operating costs were € 2,195 m, up by 3.2% (adjusted for<br />

exchange rate movements, 7.5%) on the previous year. The total<br />

amount includes the bank levies in Slovenia and Hungary, which<br />

were lower than in the previous year (€ 22.4 m after € 28.5 m in<br />

2010) as losses from foreign currency conversion in Hungary are<br />

permitted to be <strong>of</strong>fset against the bank levy. Cost growth at constant<br />

exchange rates was strongest in the countries where our banking<br />

operations achieved the strongest performance: in Turkey (<strong>of</strong>fset by<br />

depreciation against the euro) and in Russia, operating expenses<br />

were driven by higher inflation rates and wage/salary increases,<br />

especially in trading-related areas; in the Czech Republic the bank’s<br />

relocation to a new head <strong>of</strong>fice building was a significant factor. The<br />

number <strong>of</strong> branches rose by a net 15 to 2,750, reflecting a larger<br />

number <strong>of</strong> new <strong>of</strong>fices opened and branches closed in <strong>2011</strong>. The<br />

large-scale network expansion programme was suspended for the<br />

time being and replaced by a more targeted approach. At the end <strong>of</strong><br />

<strong>2011</strong>, the number <strong>of</strong> branches was significantly higher in Turkey<br />

(+37), in the Czech Republic (+26) and in Slovenia (+8) and Serbia<br />

(+5) compared with a year earlier. In several countries the opening <strong>of</strong><br />

new branches was accompanied by closures <strong>of</strong> branches in regions<br />

where the bank maintained a multiple presence. The adjustment <strong>of</strong><br />

the branch network and the closure <strong>of</strong> regional administrative centres<br />

in Ukraine and Kazakhstan led to a combined decline <strong>of</strong> 62 <strong>of</strong>fices.<br />

Investment in mobile sales channels continued (see the country<br />

reports on the following pages). This was one <strong>of</strong> the reasons why<br />

staff numbers at the end <strong>of</strong> <strong>2011</strong> were down by 80 FTEs from a year<br />

earlier. As revenue growth was moderate, the cost/income ratio<br />

increased by 1.1 percentage point to 46.5%. At this level, the cost/<br />

income ratio in the CEE business segment is still almost 10 percentage<br />

points lower than for <strong>Bank</strong> <strong>Austria</strong> as a whole (55.9%).<br />

operating pr<strong>of</strong>it for <strong>2011</strong> amounted to € 2,527 m, more or less<br />

matching the previous year’s level; at current exchange rates, operating<br />

pr<strong>of</strong>it was down by 1.4%; adjusted for exchange rate movements,<br />

it was 3.2% higher than in the previous year.<br />

net write-downs <strong>of</strong> loans and provisions for guarantees and<br />

commitments in the CEE business segment fell by € 371 m or<br />

26.0% to € 1,055 m. The cost <strong>of</strong> risk declined from 226 basis points<br />

(bp) in 2010 to 157 bp in <strong>2011</strong>. The banking subsidiaries in Kazakhstan<br />

(€ 282 m) 1), in Ukraine (€ 100 m) and in the Baltic countries<br />

(€ 9 m), which accounted for most <strong>of</strong> the increase in net write-downs<br />

<strong>of</strong> loans and provisions for guarantees and commitments in the past<br />

1) Including a provisioning charge <strong>of</strong> € 172 m arising from guarantees assumed by UniCredit<br />

<strong>Bank</strong> <strong>Austria</strong> AG. The provisioning charge at the Vienna-based CEE headquarters, which is<br />

part <strong>of</strong> the CEE Division for segment reporting purposes, in <strong>2011</strong> totalled € 232 m (down by<br />

18% from the previous year), which also includes cross-regional portfolios in commercial real<br />

estate business and structured financings.<br />

years, still accounted for about 37% <strong>of</strong> the provisioning charge.<br />

But they also made the largest contribution to the decline compared<br />

with the previous year, with a combined decrease <strong>of</strong> € 253 m out <strong>of</strong><br />

€ 371 m (68%). While South-East Europe (SEE) was still lagging<br />

behind in the credit cycle, the situation in SEE has improved in the<br />

meantime (provisioning charge down by 14.5%). In Romania, net<br />

write-downs <strong>of</strong> loans and provisions for guarantees and commitments<br />

were considerably lower (–20.4%) than in the previous year,<br />

but the cost <strong>of</strong> risk in <strong>2011</strong> was still relatively high (338 bp). The<br />

situation in Bulgaria also improved (provisioning charge down by<br />

26.8%, cost <strong>of</strong> risk: 179 bp). In Croatia and Bosnia, the cost <strong>of</strong> risk<br />

also declined after a strong temporary increase; at 107 bp in both<br />

countries, the levels were lower than in the previous year. In Russia<br />

the situation improved significantly in line with general economic<br />

trends (provisioning charge down by 55.6%, cost <strong>of</strong> risk at 61 bp).<br />

Turkey, which is far ahead <strong>of</strong> other countries in the cycle, is a special<br />

case: asset quality in Turkey improved substantially in 2010 as debt<br />

collection efforts were successful. Net write-downs <strong>of</strong> loans and provisions<br />

for guarantees and commitments continued to decline, in<br />

euro terms even more significantly than in local currency. At 42 bp,<br />

the cost <strong>of</strong> risk in Turkey is even below the <strong>Austria</strong>n level (46 bp),<br />

which was particularly low in <strong>2011</strong>. In the Central Europe (CE) country<br />

group, Hungary stands out as a special case, with the cost <strong>of</strong> risk<br />

reaching 239 bp in <strong>2011</strong>. The increase <strong>of</strong> € 15 m or 18.2% in the<br />

provisioning charge was caused by provisions for the settlement <strong>of</strong><br />

debt restructuring and mandatory conversion <strong>of</strong> foreign currency<br />

loans pursuant to rules defined by the government.<br />

When analysing the overall picture, one should note that the reduction<br />

<strong>of</strong> the provisioning charge – resulting from economic trends,<br />

local restructuring measures and the gradual improvement, or at<br />

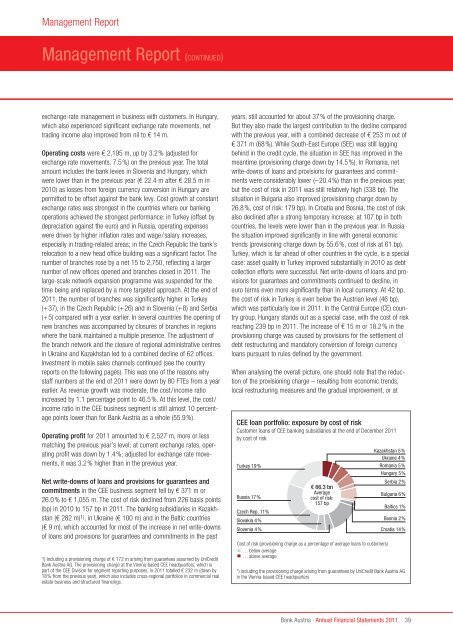

CEE loan portfolio: exposure by cost <strong>of</strong> risk<br />

Customer loans <strong>of</strong> CEE banking subsidiaries at the end <strong>of</strong> December <strong>2011</strong><br />

by cost <strong>of</strong> risk<br />

Turkey 19%<br />

Russia 17%<br />

Czech Rep. 11%<br />

Slovakia 4%<br />

Slovenia 4%<br />

€ 66.3 bn<br />

Average<br />

cost <strong>of</strong> risk:<br />

157 bp<br />

Cost <strong>of</strong> risk (provisioning charge as a percentage <strong>of</strong> average loans to customers)<br />

… below average<br />

… above average<br />

Kazakhstan 5%<br />

Ukraine 4%<br />

Romania 5%<br />

Hungary 5%<br />

Serbia 2%<br />

Bulgaria 6%<br />

Baltics 1%<br />

Bosnia 2%<br />

Croatia 14%<br />

*) including the provisioning charge arising from guarantees by UniCredit <strong>Bank</strong> <strong>Austria</strong> AG<br />

in the Vienna-based CEE headquarters<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

39