Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

Management Report (CONTINUED)<br />

Private <strong>Bank</strong>ing<br />

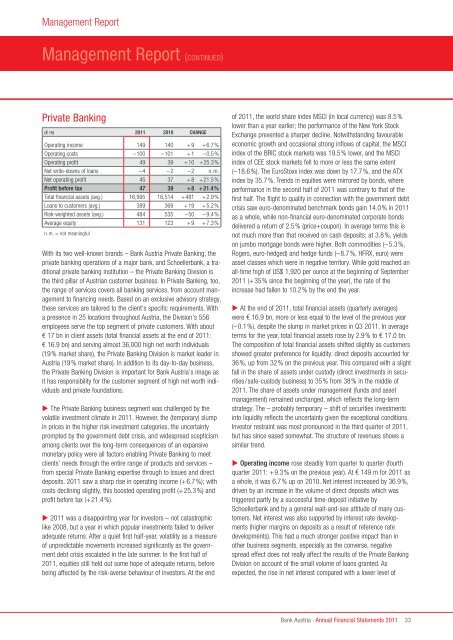

(€ m) <strong>2011</strong> 2010 CHAngE<br />

Operating income 149 140 +9 +6.7%<br />

Operating costs –100 –101 +1 –0.5%<br />

Operating pr<strong>of</strong>it 49 39 +10 +25.3%<br />

Net write-downs <strong>of</strong> loans –4 –2 –2 n.m.<br />

Net operating pr<strong>of</strong>it 45 37 +8 +21.5%<br />

Pr<strong>of</strong>it before tax 47 39 +8 +21.4%<br />

Total financial assets (avg.) 16,995 16,514 +481 +2.9%<br />

Loans to customers (avg.) 389 369 +19 +5.2%<br />

Risk-weighted assets (avg.) 484 535 –50 – 9.4%<br />

Average equity 131 123 +9 +7.3%<br />

n.m. = not meaningful<br />

With its two well-known brands – <strong>Bank</strong> <strong>Austria</strong> Private <strong>Bank</strong>ing, the<br />

private banking operations <strong>of</strong> a major bank, and Schoellerbank, a traditional<br />

private banking institution – the Private <strong>Bank</strong>ing Division is<br />

the third pillar <strong>of</strong> <strong>Austria</strong>n customer business. In Private <strong>Bank</strong>ing, too,<br />

the range <strong>of</strong> services covers all banking services, from account management<br />

to financing needs. Based on an exclusive advisory strategy,<br />

these services are tailored to the client’s specific requirements. With<br />

a presence in 25 locations throughout <strong>Austria</strong>, the Division’s 556<br />

employees serve the top segment <strong>of</strong> private customers. With about<br />

€ 17 bn in client assets (total financial assets at the end <strong>of</strong> <strong>2011</strong>:<br />

€ 16.9 bn) and serving almost 36,000 high net worth individuals<br />

(19% market share), the Private <strong>Bank</strong>ing Division is market leader in<br />

<strong>Austria</strong> (19% market share). In addition to its day-to-day business,<br />

the Private <strong>Bank</strong>ing Division is important for <strong>Bank</strong> <strong>Austria</strong>’s image as<br />

it has responsibility for the customer segment <strong>of</strong> high net worth individuals<br />

and private foundations.<br />

� The Private <strong>Bank</strong>ing business segment was challenged by the<br />

volatile investment climate in <strong>2011</strong>. However, the (temporary) slump<br />

in prices in the higher risk investment categories, the uncertainty<br />

prompted by the government debt crisis, and widespread scepticism<br />

among clients over the long-term consequences <strong>of</strong> an expansive<br />

monetary policy were all factors enabling Private <strong>Bank</strong>ing to meet<br />

clients’ needs through the entire range <strong>of</strong> products and services –<br />

from special Private <strong>Bank</strong>ing expertise through to issues and direct<br />

deposits. <strong>2011</strong> saw a sharp rise in operating income (+6.7%); with<br />

costs declining slightly, this boosted operating pr<strong>of</strong>it (+25.3%) and<br />

pr<strong>of</strong>it before tax (+21.4%).<br />

� <strong>2011</strong> was a disappointing year for investors – not catastrophic<br />

like 2008, but a year in which popular investments failed to deliver<br />

adequate returns. After a quiet first half-year, volatility as a measure<br />

<strong>of</strong> unpredictable movements increased significantly as the government<br />

debt crisis escalated in the late summer. In the first half <strong>of</strong><br />

<strong>2011</strong>, equities still held out some hope <strong>of</strong> adequate returns, before<br />

being affected by the risk-averse behaviour <strong>of</strong> investors. At the end<br />

<strong>of</strong> <strong>2011</strong>, the world share index MSCI (in local currency) was 8.5%<br />

lower than a year earlier; the performance <strong>of</strong> the New York Stock<br />

Exchange prevented a sharper decline. Notwithstanding favourable<br />

economic growth and occasional strong inflows <strong>of</strong> capital, the MSCI<br />

index <strong>of</strong> the BRIC stock markets was 19.5% lower, and the MSCI<br />

index <strong>of</strong> CEE stock markets fell to more or less the same extent<br />

(–18.6%). The EuroStoxx index was down by 17.7%, and the ATX<br />

index by 35.7%. Trends in equities were mirrored by bonds, where<br />

performance in the second half <strong>of</strong> <strong>2011</strong> was contrary to that <strong>of</strong> the<br />

first half. The flight to quality in connection with the government debt<br />

crisis saw euro-denominated benchmark bonds gain 14.0% in <strong>2011</strong><br />

as a whole, while non-financial euro-denominated corporate bonds<br />

delivered a return <strong>of</strong> 2.5% (price+coupon). In average terms this is<br />

not much more than that received on cash deposits; at 3.8%, yields<br />

on jumbo mortgage bonds were higher. Both commodities (–5.3%,<br />

Rogers, euro-hedged) and hedge funds (–8.7%, HFRX, euro) were<br />

asset classes which were in negative territory. While gold reached an<br />

all-time high <strong>of</strong> US$ 1,920 per ounce at the beginning <strong>of</strong> September<br />

<strong>2011</strong> (+35% since the beginning <strong>of</strong> the year), the rate <strong>of</strong> the<br />

increase had fallen to 10.2% by the end the year.<br />

� At the end <strong>of</strong> <strong>2011</strong>, total financial assets (quarterly averages)<br />

were € 16.9 bn, more or less equal to the level <strong>of</strong> the previous year<br />

(–0.1%), despite the slump in market prices in Q3 <strong>2011</strong>. In average<br />

terms for the year, total financial assets rose by 2.9% to € 17.0 bn.<br />

The composition <strong>of</strong> total financial assets shifted slightly as customers<br />

showed greater preference for liquidity: direct deposits accounted for<br />

36%, up from 32% on the previous year. This compared with a slight<br />

fall in the share <strong>of</strong> assets under custody (direct investments in securities/safe-custody<br />

business) to 35% from 38% in the middle <strong>of</strong><br />

<strong>2011</strong>. The share <strong>of</strong> assets under management (funds and asset<br />

management) remained unchanged, which reflects the long-term<br />

strategy. The – probably temporary – shift <strong>of</strong> securities investments<br />

into liquidity reflects the uncertainty given the exceptional conditions.<br />

Investor restraint was most pronounced in the third quarter <strong>of</strong> <strong>2011</strong>,<br />

but has since eased somewhat. The structure <strong>of</strong> revenues shows a<br />

similar trend.<br />

� operating income rose steadily from quarter to quarter (fourth<br />

quarter <strong>2011</strong>: +9.3% on the previous year). At € 149 m for <strong>2011</strong> as<br />

a whole, it was 6.7% up on 2010. Net interest increased by 36.9%,<br />

driven by an increase in the volume <strong>of</strong> direct deposits which was<br />

triggered partly by a successful time-deposit initiative by<br />

Schoellerbank and by a general wait-and-see attitude <strong>of</strong> many customers.<br />

Net interest was also supported by interest rate developments<br />

(higher margins on deposits as a result <strong>of</strong> reference rate<br />

developments). This had a much stronger positive impact than in<br />

other business segments, especially as the converse, negative<br />

spread effect does not really affect the results <strong>of</strong> the Private <strong>Bank</strong>ing<br />

Division on account <strong>of</strong> the small volume <strong>of</strong> loans granted. As<br />

expected, the rise in net interest compared with a lower level <strong>of</strong><br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

33