Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

Annual Financial Statements 2011 of Bank Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Report<br />

Management Report (CONTINUED)<br />

� The following non-operating items were deducted from the net<br />

operating pr<strong>of</strong>it in <strong>2011</strong> to obtain the pr<strong>of</strong>it before tax:<br />

Allocations to provisions for risks and charges in <strong>2011</strong> were<br />

€ 136 m, unchanged over the previous year. This amount was<br />

mainly set aside for pending legal risks, most <strong>of</strong> it for the legal<br />

proceedings in Switzerland which are still under way (formerly<br />

AKB Privatbank AG/alleged claims by Bundesanstalt für vereinigungsbedingte<br />

Sonderaufgaben, BvS); further details are provided<br />

in Section E.10 <strong>of</strong> the risk report on pages 155 to 156.<br />

The item net income from investments moved into negative<br />

territory in <strong>2011</strong> (– € 277 m) from net income <strong>of</strong> € 61 m (recast)<br />

in the previous year. In addition to a generally good performance<br />

<strong>of</strong> financial and real estate investments, positive factors included<br />

a one-<strong>of</strong>f effect from a revaluation gain resulting from the restructuring<br />

<strong>of</strong> the Moscow Interbank Currency Exchange (MICEX)<br />

Group, in which our Russian banking subsidiary holds an equity<br />

interest, and realised gains in connection with an addition to our<br />

shareholding in CA Immo, a real estate investment company, as<br />

well as income from the sale <strong>of</strong> industrial shareholdings held by<br />

B&C Holding based on the terms and conditions <strong>of</strong> sale (Lenzing<br />

AG earn-out); these factors totalled € 154 m.<br />

The most important factor which had a negative impact were the<br />

write-downs on holdings <strong>of</strong> greek government bonds. The European<br />

Council decisions made on 21 July <strong>2011</strong> to support Greece<br />

were for the first time accompanied by an <strong>of</strong>fer for the participation<br />

<strong>of</strong> private investors, made in the middle <strong>of</strong> <strong>2011</strong>, suggesting an<br />

impairment <strong>of</strong> the exposure to Greek government bonds. In the<br />

consolidated financial statements for the first six months <strong>of</strong> <strong>2011</strong>,<br />

<strong>Bank</strong> <strong>Austria</strong> therefore made a write-down on its holdings <strong>of</strong><br />

Greek government bonds, which the parent company UniCredit<br />

<strong>Bank</strong> <strong>Austria</strong> AG and CEE banking subsidiaries have held in the<br />

banking book for a long time. The European Council’s statements <strong>of</strong><br />

intent <strong>of</strong> 26 October <strong>2011</strong> made a more extensive debt restructuring<br />

appear more likely. Therefore a write-down on the holdings <strong>of</strong><br />

Greek government bonds to the mid-market prices prevailing as<br />

at 30 September <strong>2011</strong> (fair value level 1) was made in the consolidated<br />

financial statements for the first nine months <strong>of</strong> <strong>2011</strong>.<br />

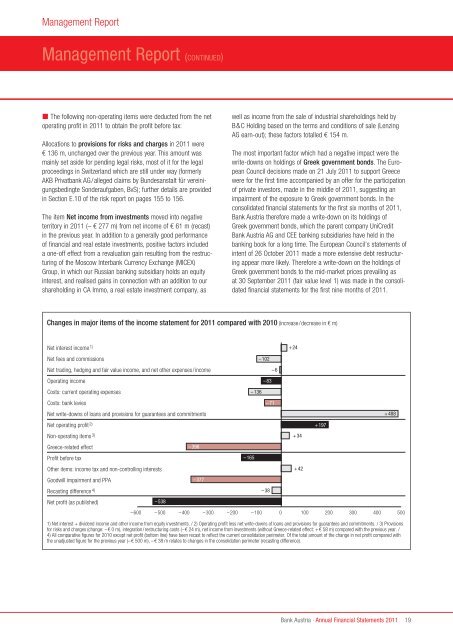

Changes in major items <strong>of</strong> the income statement for <strong>2011</strong> compared with 2010 (increase/decrease in € m)<br />

Net interest income 1)<br />

Net fees and commissions<br />

Net trading, hedging and fair value income, and net other expenses/income<br />

Operating income<br />

Costs: current operating expenses<br />

Costs: bank levies<br />

Net write-downs <strong>of</strong> loans and provisions for guarantees and commitments<br />

Net operating pr<strong>of</strong>it 2)<br />

Non-operating items 3)<br />

Greece-related effect<br />

Pr<strong>of</strong>it before tax<br />

Other items: income tax and non-controlling interests<br />

Goodwill impairment and PPA<br />

Recasting difference 4)<br />

–396<br />

–377<br />

Net pr<strong>of</strong>it (as published)<br />

–538<br />

1) Net interest + dividend income and other income from equity investments. / 2) Operating pr<strong>of</strong>it less net write-downs <strong>of</strong> loans and provisions for guarantees and commitments. / 3) Provisions<br />

for risks and charges (change: –€ 0 m), integration/restructuring costs (–€ 24 m), net income from investments (without Greece-related effect: +€ 58 m) compared with the previous year. /<br />

4) All comparative figures for 2010 except net pr<strong>of</strong>it (bottom line) have been recast to reflect the current consolidation perimeter. Of the total amount <strong>of</strong> the change in net pr<strong>of</strong>it compared with<br />

the unadjusted figure for the previous year (–€ 500 m), –€ 38 m relates to changes in the consolidation perimeter (recasting difference).<br />

–165<br />

–136<br />

–102<br />

–83<br />

–38<br />

–71<br />

–600 –500 –400 –300 –200 –100 0 100 200 300<br />

400 500<br />

–6<br />

+24<br />

+34<br />

+42<br />

+197<br />

+488<br />

<strong>Bank</strong> <strong>Austria</strong> · <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

19