Benchlearning methodology and data gathering template

Benchlearning methodology and data gathering template

Benchlearning methodology and data gathering template

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

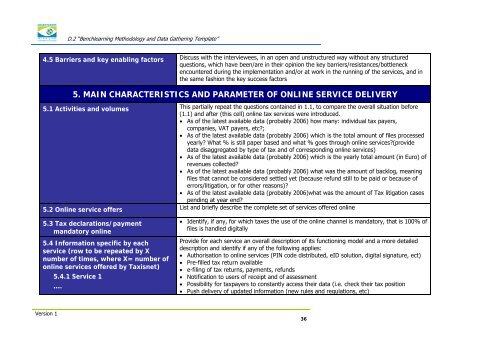

D.2 “<strong>Benchlearning</strong> Methodology <strong>and</strong> Data Gathering Template”4.5 Barriers <strong>and</strong> key enabling factors Discuss with the interviewees, in an open <strong>and</strong> unstructured way without any structuredquestions, which have been/are in their opinion the key barriers/resistances/bottleneckencountered during the implementation <strong>and</strong>/or at work in the running of the services, <strong>and</strong> inthe same fashion the key success factors5. MAIN CHARACTERISTICS AND PARAMETER OF ONLINE SERVICE DELIVERY5.1 Activities <strong>and</strong> volumes This partially repeat the questions contained in 1.1, to compare the overall situation before(1.1) <strong>and</strong> after (this cell) online tax services were introduced.• As of the latest available <strong>data</strong> (probably 2006) how many: individual tax payers,companies, VAT payers, etc?;• As of the latest available <strong>data</strong> (probably 2006) which is the total amount of files processedyearly? What % is still paper based <strong>and</strong> what % goes through online services?(provide<strong>data</strong> disaggregated by type of tax <strong>and</strong> of corresponding online services)• As of the latest available <strong>data</strong> (probably 2006) which is the yearly total amount (in Euro) ofrevenues collected?• As of the latest available <strong>data</strong> (probably 2006) what was the amount of backlog, meaningfiles that cannot be considered settled yet (because refund still to be paid or because oferrors/litigation, or for other reasons)?• As of the latest available <strong>data</strong> (probably 2006)what was the amount of Tax litigation casespending at year end?5.2 Online service offers List <strong>and</strong> briefly describe the complete set of services offered online5.3 Tax declarations/paymentm<strong>and</strong>atory online5.4 Information specific by eachservice (row to be repeated by Xnumber of times, where X= number ofonline services offered by Taxisnet)5.4.1 Service 1….• Identify, if any, for which taxes the use of the online channel is m<strong>and</strong>atory, that is 100% offiles is h<strong>and</strong>led digitallyProvide for each service an overall description of its functioning model <strong>and</strong> a more detaileddescription <strong>and</strong> identify if any of the following applies:• Authorisation to online services (PIN code distributed, eID solution, digital signature, ect)• Pre-filled tax return available• e-filing of tax returns, payments, refunds• Notification to users of receipt <strong>and</strong> of assessment• Possibility for taxpayers to constantly access their <strong>data</strong> (i.e. check their tax position• Push delivery of updated information (new rules <strong>and</strong> regulations, etc)Version 136