notes to the consolidated financial statements - Sacombank

notes to the consolidated financial statements - Sacombank

notes to the consolidated financial statements - Sacombank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

For <strong>the</strong> year ended 31 December 2011<br />

Group 3: Sub-standard<br />

n Undue commitments which, according <strong>to</strong> <strong>the</strong> Group’s assessment, could not be fully settled when <strong>the</strong>y fall due;<br />

n Due commitments which are overdue for less than 30 days<br />

Group 4: Doubtful<br />

n Undue commitments which, according <strong>to</strong> <strong>the</strong> Group’s assessment, could not be fully settled when <strong>the</strong>y fall due;<br />

n Due commitments and contingencies which are overdue from 30 days <strong>to</strong> 90 days<br />

Group 5: Bad<br />

n Undue commitments which, according <strong>to</strong> <strong>the</strong> Group’s assessment, could not be fully settled when <strong>the</strong>y fall due;<br />

n Due commitments which are overdue for more than 90 days<br />

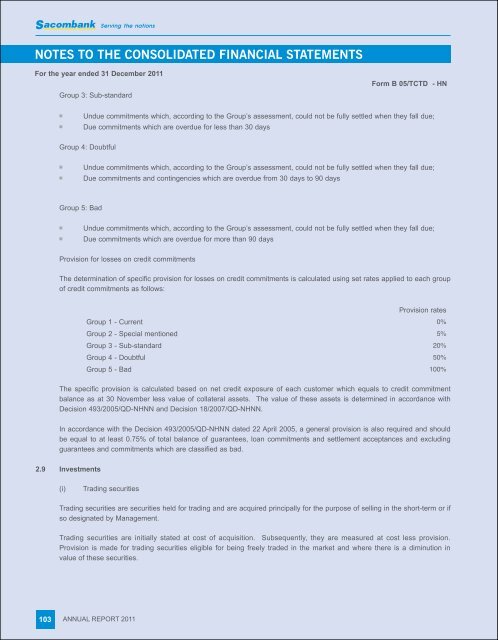

Provision for losses on credit commitments<br />

The determination of specific provision for losses on credit commitments is calculated using set rates applied <strong>to</strong> each group<br />

of credit commitments as follows:<br />

Group 1 - Current<br />

Provision rates<br />

0%<br />

Group 2 - Special mentioned 5%<br />

Group 3 - Sub-standard 20%<br />

Group 4 - Doubtful 50%<br />

Group 5 - Bad 100%<br />

The specific provision is calculated based on net credit exposure of each cus<strong>to</strong>mer which equals <strong>to</strong> credit commitment<br />

balance as at 30 November less value of collateral assets. The value of <strong>the</strong>se assets is determined in accordance with<br />

Decision 493/2005/QD-NHNN and Decision 18/2007/QD-NHNN.<br />

In accordance with <strong>the</strong> Decision 493/2005/QD-NHNN dated 22 April 2005, a general provision is also required and should<br />

be equal <strong>to</strong> at least 0.75% of <strong>to</strong>tal balance of guarantees, loan commitments and settlement acceptances and excluding<br />

guarantees and commitments which are classified as bad.<br />

2.9 Investments<br />

(i) Trading securities<br />

Trading securities are securities held for trading and are acquired principally for <strong>the</strong> purpose of selling in <strong>the</strong> short-term or if<br />

so designated by Management.<br />

Trading securities are initially stated at cost of acquisition. Subsequently, <strong>the</strong>y are measured at cost less provision.<br />

Provision is made for trading securities eligible for being freely traded in <strong>the</strong> market and where <strong>the</strong>re is a diminution in<br />

value of <strong>the</strong>se securities.<br />

103 ANNUAL REPORT 2011<br />

Form B 05/TCTD - HN