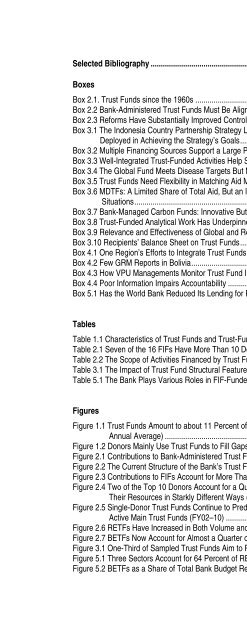

SummaryAs development challenges expand and expectations intensify for accelerated aid results, trustfunds have emerged as a significant pillar <strong>of</strong> <strong>the</strong> global aid architecture, used alongside bilateraland multilateral aid. In 2007–08, trust funds accounted for about 11 percent <strong>of</strong> total OfficialDevelopment Assistance (ODA), and <strong>the</strong>y now finance a substantial part <strong>of</strong> <strong>the</strong> <strong>World</strong> Bank’sbusiness.<strong>Trust</strong> funds do not demonstrably provide additional resources at <strong>the</strong> global level. Donorcountries generally allocate money to trust funds from within a fixed aid budget in order toearmark and pool aid for particular countries or issues, or to foster innovations in aid financingand approaches. But trust funds add value as a distinct aid vehicle by providing coordinatedfinancing and grant resources for individual countries, targeted development issues, and globalpublic goods. The value added <strong>of</strong> trust funds is more evident when <strong>the</strong>y support global publicgoods than when <strong>the</strong>y are used merely to supplement national development efforts.<strong>Trust</strong> funds have not been a consistently effective way <strong>of</strong> providing financing. They do notnecessarily integrate well with countries’ own programs, nor do <strong>the</strong>y foster coordination on <strong>the</strong>ground with o<strong>the</strong>r sources <strong>of</strong> aid. The way <strong>the</strong>y are designed and managed influences <strong>the</strong>ireffectiveness. Notably, many trust funds <strong>of</strong> global scope involve insufficient recipient participationin <strong>the</strong> design <strong>of</strong> <strong>the</strong>ir objectives and modalities, and lack clear outcome objectives. Also, singledonortrust funds generally work less well than multidonor funds in improving aid efficiency andcoordination (except in <strong>the</strong> case <strong>of</strong> trust funds that finance activities in a single country).Substantial management changes will be needed to increase <strong>the</strong> effectiveness and efficiency <strong>of</strong>trust funds as a channel <strong>of</strong> development assistance. Improved accountability for <strong>the</strong> results <strong>of</strong>trust-funded activities can be achieved only with full integration <strong>of</strong> Bank-managed trust fundresources into <strong>the</strong> Bank’s mainstream management processes.While continuing to accept trust funds that fill critical gaps in <strong>the</strong> provision <strong>of</strong> aid, <strong>the</strong> Bankshould develop a more strategic approach to accepting and managing <strong>the</strong>se funds. Theevaluation recommends that <strong>the</strong> Bank create a three-pillar structure for trust funds to fostermore effectiveness, efficiency, and accountability for results in <strong>the</strong> use <strong>of</strong> <strong>the</strong>ir resources. Itshould also initiate a discussion with its shareholders to explore <strong>the</strong> comparative advantages <strong>of</strong>multilateral and trust fund aid modalitiesWhat Are <strong>Trust</strong> <strong>Fund</strong>s?<strong>Trust</strong> funds are vehicles for channeling aidresources from governmental andnongovernmental donors to be administered by atrustee organization such as <strong>the</strong> <strong>World</strong> Bank oro<strong>the</strong>r development organization. <strong>Trust</strong> funds arenot programs in <strong>the</strong>mselves; ra<strong>the</strong>r, <strong>the</strong>y arededicated sources <strong>of</strong> funding for programs andactivities agreed between <strong>the</strong> donor(s) and <strong>the</strong>trustee organization.<strong>Trust</strong> funds administered by <strong>the</strong> <strong>World</strong> Bank arehighly varied. They comprise single-donor andmultidonor funds, and may provide financing tosingle or multiple recipient countries in support <strong>of</strong>a specific issue. They include FinancialIntermediary <strong>Fund</strong>s (FIFs)—for which <strong>the</strong> Bankholds, invests, and disburses funds wheninstructed by ano<strong>the</strong>r body without Banksupervision or oversight <strong>of</strong> <strong>the</strong> use <strong>of</strong> <strong>the</strong>resources—as well as trust funds whose programsand activities are managed by <strong>the</strong> Bank.vi

SUMMARYThe activities that trust funds finance are alsohighly varied, ranging from huge global programswith <strong>the</strong>ir own governance structures toconventional development projects; debt reliefoperations; and studies, technical assistance, andproject preparation carried out by <strong>the</strong> <strong>World</strong> Bankor recipients. For example, trust funds are nowsupporting a global program to accelerateachievement <strong>of</strong> universal primary education,coordinated support to Afghanistan and <strong>the</strong> WestBank and Gaza, climate adaptation pilots inmiddle- and low-income countries, and technicalassistance to improve disaster preparedness.This evaluation assesses what is known about howeffectively and efficiently trust funds are beingused and recommends future directions. Inmaking this assessment, <strong>the</strong> evaluation teamundertook 8 country case studies and in-depthreviews <strong>of</strong> 36 trust–funded programs. Itinterviewed numerous <strong>of</strong>ficials <strong>of</strong> donor andrecipient country governments, o<strong>the</strong>rstakeholders, and Bank management and staff. Italso reviewed <strong>the</strong> growing literature on trustfunds, including reports from o<strong>the</strong>r multilateralagencies.Scale, Rationale, and IssuesWhile <strong>the</strong> channeling <strong>of</strong> aid resources throughtrust funds has grown in response to perceivedlimitations <strong>of</strong> bilateral and multilateral aidmechanisms in meeting changing developmentchallenges, <strong>the</strong> use <strong>of</strong> <strong>the</strong> trust fund vehicle hasraised strategic issues for <strong>the</strong> effectiveness,efficiency, and coherence <strong>of</strong> <strong>the</strong> international aidsystem.SIZE. The most recent data available indicate thatin 2007–08 trust funds accounted for about 11percent <strong>of</strong> total ODA. The <strong>World</strong> Bankadministers <strong>the</strong> largest amount <strong>of</strong> donor trustfund resources <strong>of</strong> any development organization.Donors contributed $57.5 billion to trust fundsadministered by <strong>the</strong> <strong>World</strong> Bank over <strong>the</strong> fiscal2002–10 period. Their total trust fundcontributions exceeded <strong>the</strong>ir InternationalDevelopment Association (IDA) contributions ineach <strong>of</strong> <strong>the</strong> last three IDA replenishment periods(covering fiscal 2003–05, 2006–08, and 2009–11).More than half <strong>the</strong> donor contributions went toFIFs. Contributions to <strong>the</strong> largest FIF—<strong>the</strong>Global <strong>Fund</strong> to Fight AIDS, Tuberculosis, andMalaria (<strong>the</strong> Global <strong>Fund</strong>)—alone amounted to$15.8 billion over <strong>the</strong> period. The o<strong>the</strong>r half <strong>of</strong> <strong>the</strong>donors’ trust fund contributions went to fundsthat support Bank-managed programs andactivities. These Bank-managed funds provideabout 8 percent <strong>of</strong> <strong>the</strong> Bank’s total disbursementsto recipient countries. They also provide almost aquarter <strong>of</strong> <strong>the</strong> total <strong>of</strong> trust funds and net Bankbudget used for project appraisal and supervision,analytical work and technical assistance, and o<strong>the</strong>rBank work.RATIONALE. Donors use trust funds to do thingsthat would not be possible through traditionalmultilateral aid channels, such as earmarking <strong>the</strong>irtrust fund contributions for particular countriesand development issues and engaging in <strong>the</strong>Bank’s implementation <strong>of</strong> programs and activities.<strong>An</strong>d, to address limitations in bilateral aid, donorsuse trust funds to pool funds for particularprograms, tap into <strong>the</strong> capacities and systems <strong>of</strong><strong>the</strong> trustee organization, and distance <strong>the</strong>mselvesfrom politically controversial activities. The choiceis made primarily for political reasons to direct aidto particular countries or issues, and large globalfunds are created typically at <strong>the</strong> initiative <strong>of</strong> highlevelgovernment <strong>of</strong>ficials.For individual recipient countries, trust funds canbe an additional source <strong>of</strong> aid for countryprograms and can facilitate donor coordinationand harmonization, thus reducing <strong>the</strong> transactioncosts <strong>of</strong> working with multiple donors. <strong>An</strong>d for<strong>the</strong> Bank as a trustee institution, trust funds addresources to its country operations and workprogram and to its engagement in global activitiesoutside <strong>the</strong> country-based model, notably activitiesaimed at <strong>the</strong> provision <strong>of</strong> global or regional publicgoods in areas such as environmental preservationand control <strong>of</strong> communicable diseases.ISSUES. Assessing <strong>the</strong> added value and effectiveness<strong>of</strong> trust funds as a distinct aid vehicle presentschallenging questions. Notably, to what extent do<strong>the</strong>ir donor-defined objectives reflect recipients’priority development needs? How well do <strong>the</strong>yintegrate with countries’ own programs and withaid from o<strong>the</strong>r sources, whe<strong>the</strong>r provided to meetnational, regional, or global public goods needs?To what extent do <strong>the</strong>y complement or competewith assistance from traditional multilateralvii