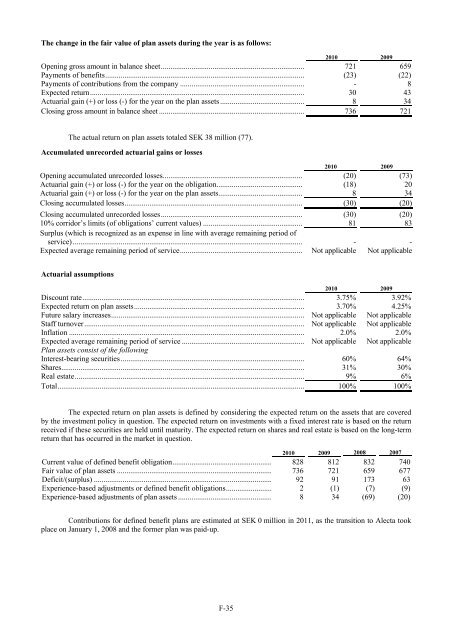

The change in the fair value of plan assets during the year is as follows:2010 2009Opening gross amount in balance sheet........................................................................... 721 659Payments of benefits........................................................................................................ (23) (22)Payments of contributions from the company ................................................................. - 8Expected return................................................................................................................ 30 43Actuarial gain (+) or loss (-) for the year on the plan assets ............................................ 8 34Closing gross amount in balance sheet ............................................................................ 736 721The actual return on plan assets totaled SEK 38 million (77).Accumulated unrecorded actuarial gains or losses2010 2009Opening accumulated unrecorded losses......................................................................... (20) (73)Actuarial gain (+) or loss (-) for the year on the obligation............................................. (18) 20Actuarial gain (+) or loss (-) for the year on the plan assets............................................ 8 34Closing accumulated losses............................................................................................. (30) (20)Closing accumulated unrecorded losses.......................................................................... (30) (20)10% corridor’s limits (of obligations’ current values) .................................................... 81 83Surplus (which is recognized as an expense in line with average remaining period ofservice) ........................................................................................................................ - -Expected average remaining period of service................................................................ Not applicable Not applicableActuarial assumptions2010 2009Discount rate.................................................................................................................... 3.75% 3.92%Expected return on plan assets......................................................................................... 3.70% 4.25%Future salary increases..................................................................................................... Not applicable Not applicableStaff turnover................................................................................................................... Not applicable Not applicableInflation ........................................................................................................................... 2.0% 2.0%Expected average remaining period of service ................................................................ Not applicable Not applicablePlan assets consist of the followingInterest-bearing securities................................................................................................ 60% 64%Shares............................................................................................................................... 31% 30%Real estate........................................................................................................................ 9% 6%Total................................................................................................................................. 100% 100%The expected return on plan assets is defined by considering the expected return on the assets that are coveredby the investment policy in question. The expected return on investments with a fixed interest rate is based on the returnreceived if these securities are held until maturity. The expected return on shares and real estate is based on the long-termreturn that has occurred in the market in question.2010 2009 2008 2007Current value of defined benefit obligation.................................................... 828 812 832 740Fair value of plan assets ................................................................................. 736 721 659 677Deficit/(surplus) ............................................................................................. 92 91 173 63Experience-based adjustments or defined benefit obligations........................ 2 (1) (7) (9)Experience-based adjustments of plan assets ................................................. 8 34 (69) (20)Contributions for defined benefit plans are estimated at SEK 0 million in 2011, as the transition to Alecta tookplace on January 1, 2008 and the former plan was paid-up.F-35

NOTE 27. OTHER PROVISIONSRestoration fortheenvironment (1) Other TotalOpening balance 2009..................................................................................... 115 1 116Provisions during the year............................................................................... - - -Amount used ................................................................................................... (13) (1) (14)Unutilized amounts that have been reversed................................................... - - -Closing balance 2009 ...................................................................................... 102 - 102Provisions during the year............................................................................... - - -Amount used ................................................................................................... (9) - (9)Unutilized amounts that have been reversed................................................... - - -Closing balance 2010 ...................................................................................... 94 - 94(1) <strong>Preem</strong> <strong>AB</strong> has paid an insurance premium via its subsidiary <strong>Preem</strong> Insurance Co Ltd of SEK 148 million for known and planneddecontamination works. In 2010 SEK 9 million (13) of the reserve have been used and SEK 94 million (102) remain. During 2011 approx.SEK 25 million of the remaining reserve will be utilized.NOTE 28. BORROWINGS2010 2009 2008Long-term loansParent companyLoans in USD .................................................................................................... 255 - 2,862Loans in EUR .................................................................................................... 757 - 4,095Total long-term loans, Parent Company ....................................................... 1,012 - 6,957Group companiesLoans in SEK..................................................................................................... - 4,937 6,943Loans in USD .................................................................................................... - 4,781 4,288Total long-term loans, Group companies ...................................................... - 9,718 11,231Total long-term loans, Group ......................................................................... 1,012 9,718 18,188Transaction costs .............................................................................................. - (277) (481)Net total long-term borrowing........................................................................ 1,012 9,441 17,707Short-term loans 2010 2009 2008Parent companyLoans in USD .................................................................................................... 1,819 2,759 -Loans in EUR .................................................................................................... 2,128 4,016 -Total short-term loans, Parent Company...................................................... 3,947 6,775 -Transaction costs .............................................................................................. (166) - -Net total short-term loans, Parent Company ................................................ 3,781 6,775 -Group companiesLoans in SEK..................................................................................................... 7,408 3,028 2,000Loans in USD .................................................................................................... 2,263 707 1,788Total short-term loans, Group companies..................................................... 9,671 3,735 3,788Transaction costs .............................................................................................. (111) - -Net total short-term loans, Group.................................................................. 9,561 3,735 3,788Total borrowing, Group.................................................................................. 14,630 20,227 21,976Net total borrowing, Group ............................................................................ 14,354 19,951 21,495Repayment plan 2011 2012 2013 2014 2015- Total13 618 - - - 1 012 14 630F-36

- Page 2:

TABLE OF CONTENTSDisclosure Regardi

- Page 5:

which was merged into Preem on Octo

- Page 8 and 9:

RISK FACTORSThe risk factors below

- Page 10 and 11:

the cost of exploring for, developi

- Page 12 and 13:

purchase a minimum of 10% to 20% of

- Page 14 and 15:

market price at the time of settlem

- Page 16 and 17:

Notes, we would try to obtain waive

- Page 18 and 19:

are reasonable grounds for believin

- Page 20 and 21:

civil liability, whether or not pre

- Page 22 and 23:

SELECTED CONSOLIDATED FINANCIAL DAT

- Page 24 and 25:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 26 and 27:

Year ended December 31,%2008 2009 C

- Page 28 and 29:

arrel in February, increased to app

- Page 30 and 31:

(1) Includes sales by our supply an

- Page 32 and 33:

SEK 5,519 million, from a loss of S

- Page 34 and 35:

Cash flow used in investment activi

- Page 36 and 37:

Restrictions on transfers of fundsW

- Page 38 and 39:

Variable rate debt—amount due .

- Page 40 and 41:

As of December 31, 2008, SEK 21,999

- Page 42 and 43:

Our StrengthsOur competitive streng

- Page 44 and 45:

Lysekil has a total storage capacit

- Page 46 and 47:

Unfinished and Blend Stocks........

- Page 48 and 49:

Heating Oil .......................

- Page 50 and 51:

Business-to-Business DivisionWe pre

- Page 52 and 53: “.nu,” “.org,” “.biz,”

- Page 54 and 55: Energy AB, Huda Trading AB, the Swe

- Page 56 and 57: was incorporated on March 22, 2007,

- Page 58 and 59: RELATED PARTY TRANSACTIONSCapital T

- Page 60 and 61: DESCRIPTION OF CERTAIN INDEBTEDNESS

- Page 62 and 63: effected by the Third Supplemental

- Page 64 and 65: first ranking mortgage certificates

- Page 66 and 67: LEGAL INFORMATIONCorral Petroleum H

- Page 68 and 69: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 70 and 71: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 72 and 73: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 74 and 75: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 76 and 77: SubsidiariesSubsidiaries are compan

- Page 78 and 79: The refinery installations consist

- Page 80 and 81: of occupational pension insurance,

- Page 82 and 83: Emission rights 2010LysekilGothenbu

- Page 84 and 85: NOTE 2. FINANCIAL RISK MANAGEMENTTh

- Page 86 and 87: In addition to price risk managemen

- Page 88 and 89: The fair value of borrowing is calc

- Page 90 and 91: Reconciliation with the Group’s t

- Page 92 and 93: The Board members including the Cha

- Page 94 and 95: NOTE 12. EXPENSES BROKEN DOWN BY TY

- Page 96 and 97: NOTE 16. EXCHANGE RATE DIFFERENCES

- Page 98 and 99: Equipment, tools, fixtures and fitt

- Page 100 and 101: NOTE 23. TRADE AND OTHER RECEIVABLE

- Page 104 and 105: Loan conditions, effective interest

- Page 106 and 107: Capitalized interest cost..........

- Page 108: SalesDecember 31, 2009AccountsPurch