CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

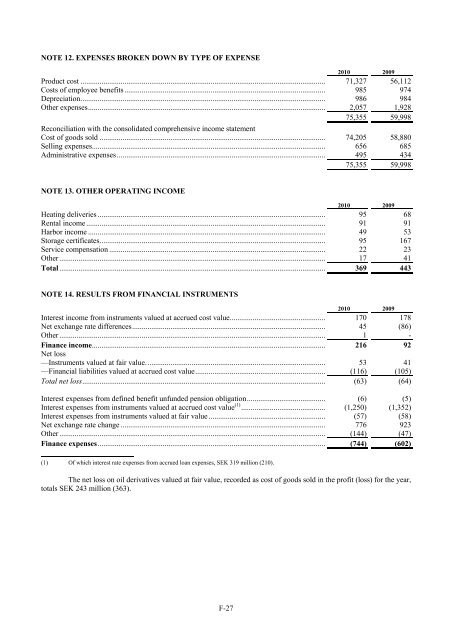

NOTE 12. EXPENSES BROKEN DOWN BY TYPE OF EXPENSE2010 2009Product cost ................................................................................................................................ 71,327 56,112Costs of employee benefits......................................................................................................... 985 974Depreciation................................................................................................................................ 986 984Other expenses............................................................................................................................ 2,057 1,92875,355 59,998Reconciliation with the consolidated comprehensive income statementCost of goods sold ...................................................................................................................... 74,205 58,880Selling expenses.......................................................................................................................... 656 685Administrative expenses............................................................................................................. 495 43475,355 59,998NOTE 13. OTHER OPERATING INCOME2010 2009Heating deliveries ....................................................................................................................... 95 68Rental income ............................................................................................................................. 91 91Harbor income ............................................................................................................................ 49 53Storage certificates...................................................................................................................... 95 167Service compensation ................................................................................................................. 22 23Other ........................................................................................................................................... 17 41Total ........................................................................................................................................... 369 443NOTE 14. RESULTS FROM FINANCIAL INSTRUMENTS2010 2009Interest income from instruments valued at accrued cost value.................................................. 170 178Net exchange rate differences..................................................................................................... 45 (86)Other ........................................................................................................................................... 1 -Finance income.......................................................................................................................... 216 92Net loss—Instruments valued at fair value.............................................................................................. 53 41—Financial liabilities valued at accrued cost value.................................................................... (116) (105)Total net loss............................................................................................................................... (63) (64)Interest expenses from defined benefit unfunded pension obligation......................................... (6) (5)Interest expenses from instruments valued at accrued cost value (1) ............................................ (1,250) (1,352)Interest expenses from instruments valued at fair value ............................................................. (57) (58)Net exchange rate change ........................................................................................................... 776 923Other ........................................................................................................................................... (144) (47)Finance expenses....................................................................................................................... (744) (602)(1) Of which interest rate expenses from accrued loan expenses, SEK 319 million (210).The net loss on oil derivatives valued at fair value, recorded as cost of goods sold in the profit (loss) for the year,totals SEK 243 million (363).F-27