CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

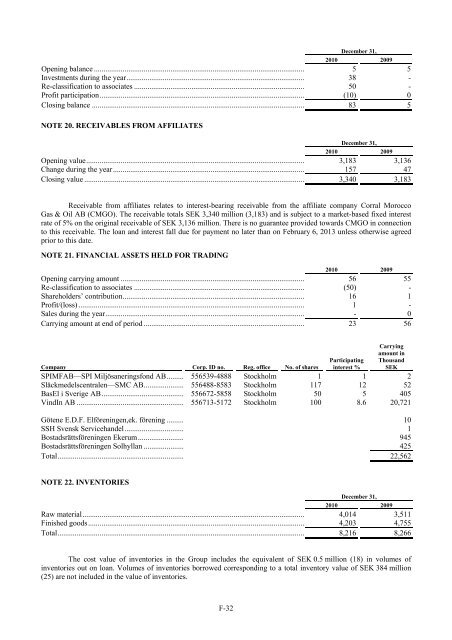

December 31,2010 2009Opening balance .............................................................................................................. 5 5Investments during the year............................................................................................. 38 -Re-classification to associates ......................................................................................... 50 -Profit participation........................................................................................................... (10) 0Closing balance ............................................................................................................... 83 5NOTE 20. RECEIV<strong>AB</strong>LES FROM AFFILIATESDecember 31,2010 2009Opening value.................................................................................................................. 3,183 3,136Change during the year.................................................................................................... 157 47Closing value ................................................................................................................... 3,340 3,183Receivable from affiliates relates to interest-bearing receivable from the affiliate company Corral MoroccoGas & Oil <strong>AB</strong> (CMGO). The receivable totals SEK 3,340 million (3,183) and is subject to a market-based fixed interestrate of 5% on the original receivable of SEK 3,136 million. There is no guarantee provided towards CMGO in connectionto this receivable. The loan and interest fall due for payment no later than on February 6, 2013 unless otherwise agreedprior to this date.NOTE 21. FINANCIAL ASSETS HELD FOR TRADING2010 2009Opening carrying amount ................................................................................................ 56 55Re-classification to associates ......................................................................................... (50) -Shareholders’ contribution............................................................................................... 16 1Profit/(loss) ...................................................................................................................... 1 -Sales during the year........................................................................................................ - 0Carrying amount at end of period .................................................................................... 23 56Company Corp. ID no. Reg. office No. of sharesParticipatinginterest %Carryingamount inThousandSEKSPIMF<strong>AB</strong>—SPI Miljösaneringsfond <strong>AB</strong>......... 556539-4888 Stockholm 1 1 2Släckmedelscentralen—SMC <strong>AB</strong>..................... 556488-8583 Stockholm 117 12 52BasEl i Sverige <strong>AB</strong>........................................... 556672-5858 Stockholm 50 5 405VindIn <strong>AB</strong> ........................................................ 556713-5172 Stockholm 100 8.6 20,721Götene E.D.F. Elföreningen,ek. förening ......... 10SSH Svensk Servicehandel............................... 1Bostadsrättsföreningen Ekerum........................ 945Bostadsrättsföreningen Solhyllan ..................... 425Total.................................................................. 22,562NOTE 22. INVENTORIESDecember 31,2010 2009Raw material.................................................................................................................... 4,014 3,511Finished goods................................................................................................................. 4,203 4,755Total................................................................................................................................. 8,216 8,266The cost value of inventories in the Group includes the equivalent of SEK 0.5 million (18) in volumes ofinventories out on loan. Volumes of inventories borrowed corresponding to a total inventory value of SEK 384 million(25) are not included in the value of inventories.F-32