CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

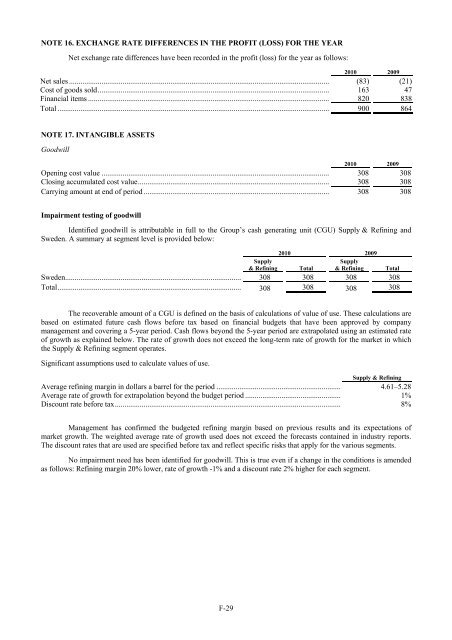

NOTE 16. EXCHANGE RATE DIFFERENCES IN THE PROFIT (LOSS) FOR THE YEARNet exchange rate differences have been recorded in the profit (loss) for the year as follows:2010 2009Net sales ........................................................................................................................................ (83) (21)Cost of goods sold......................................................................................................................... 163 47Financial items .............................................................................................................................. 820 838Total .............................................................................................................................................. 900 864NOTE 17. INTANGIBLE ASSETSGoodwill2010 2009Opening cost value ....................................................................................................................... 308 308Closing accumulated cost value.................................................................................................... 308 308Carrying amount at end of period ................................................................................................. 308 308Impairment testing of goodwillIdentified goodwill is attributable in full to the Group’s cash generating unit (CGU) Supply & Refining andSweden. A summary at segment level is provided below:2010 2009Supply& Refining TotalSupply& RefiningSweden............................................................................................ 308 308 308 308Total................................................................................................ 308 308 308 308TotalThe recoverable amount of a CGU is defined on the basis of calculations of value of use. These calculations arebased on estimated future cash flows before tax based on financial budgets that have been approved by companymanagement and covering a 5-year period. Cash flows beyond the 5-year period are extrapolated using an estimated rateof growth as explained below. The rate of growth does not exceed the long-term rate of growth for the market in whichthe Supply & Refining segment operates.Significant assumptions used to calculate values of use.Supply & RefiningAverage refining margin in dollars a barrel for the period ................................................................. 4.61–5.28Average rate of growth for extrapolation beyond the budget period .................................................. 1%Discount rate before tax...................................................................................................................... 8%Management has confirmed the budgeted refining margin based on previous results and its expectations ofmarket growth. The weighted average rate of growth used does not exceed the forecasts contained in industry reports.The discount rates that are used are specified before tax and reflect specific risks that apply for the various segments.No impairment need has been identified for goodwill. This is true even if a change in the conditions is amendedas follows: Refining margin 20% lower, rate of growth -1% and a discount rate 2% higher for each segment.F-29