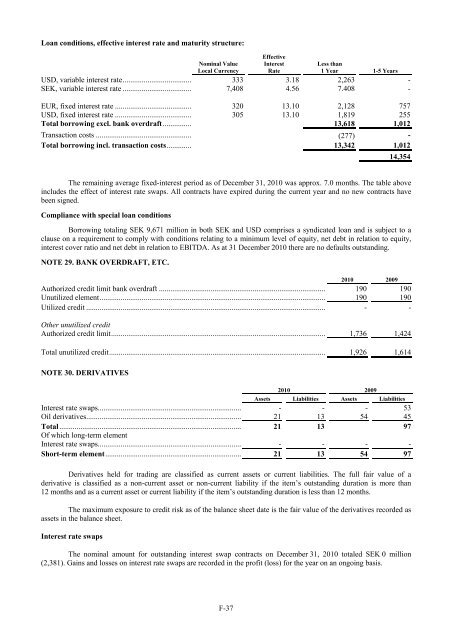

Loan conditions, effective interest rate and maturity structure:Nominal ValueLocal CurrencyEffectiveInterestRateLess than1 Year 1-5 YearsUSD, variable interest rate.................................... 333 3.18 2,263 -SEK, variable interest rate .................................... 7,408 4.56 7.408 -EUR, fixed interest rate ........................................ 320 13.10 2,128 757USD, fixed interest rate ........................................ 305 13.10 1,819 255Total borrowing excl. bank overdraft............... 13,618 1,012Transaction costs .................................................. (277) -Total borrowing incl. transaction costs............. 13,342 1,01214,354The remaining average fixed-interest period as of December 31, 2010 was approx. 7.0 months. The table aboveincludes the effect of interest rate swaps. All contracts have expired during the current year and no new contracts havebeen signed.Compliance with special loan conditionsBorrowing totaling SEK 9,671 million in both SEK and USD comprises a syndicated loan and is subject to aclause on a requirement to comply with conditions relating to a minimum level of equity, net debt in relation to equity,interest cover ratio and net debt in relation to EBITDA. As at 31 December 2010 there are no defaults outstanding.NOTE 29. BANK OVERDRAFT, ETC.2010 2009Authorized credit limit bank overdraft ....................................................................................... 190 190Unutilized element...................................................................................................................... 190 190Utilized credit ............................................................................................................................. - -Other unutilized creditAuthorized credit limit................................................................................................................ 1,736 1,424Total unutilized credit................................................................................................................. 1,926 1,614NOTE 30. DERIVATIVES2010 2009Assets Liabilities Assets LiabilitiesInterest rate swaps........................................................................... - - - 53Oil derivatives................................................................................. 21 13 54 45Total............................................................................................... 21 13 97Of which long-term elementInterest rate swaps........................................................................... - - - -Short-term element....................................................................... 21 13 54 97Derivatives held for trading are classified as current assets or current liabilities. The full fair value of aderivative is classified as a non-current asset or non-current liability if the item’s outstanding duration is more than12 months and as a current asset or current liability if the item’s outstanding duration is less than 12 months.The maximum exposure to credit risk as of the balance sheet date is the fair value of the derivatives recorded asassets in the balance sheet.Interest rate swapsThe nominal amount for outstanding interest swap contracts on December 31, 2010 totaled SEK 0 million(2,381). Gains and losses on interest rate swaps are recorded in the profit (loss) for the year on an ongoing basis.F-37

Oil derivativesThe oil derivatives contracts are held primarily to economically hedge price changes in petroleum products. Thenominal amount for oil derivative contracts bought net was SEK 615 million (sold net 656). The total nominal amountfor these outstanding oil derivative contracts is SEK 5,282 million (6,971) as of December 31, 2010.NOTE 31. OTHER LI<strong>AB</strong>ILITIES2010 2009Value Added Tax..................................................................................................................... 624 467Excise Duties (1) ........................................................................................................................ 1,025 862Other Liabilities....................................................................................................................... 254 1401,904 1,469(1) Excise duties refer to energy tax, gasoline tax, carbon dioxide tax, sulfur tax and alcohol tax.NOTE 32. ACCRUED EXPENSES AND PREPAID INCOME2010 2009Purchases of crude oil and products.......................................................................................... 3,122 1,075Personnel .................................................................................................................................. 215 214Interest ...................................................................................................................................... 3 91Other ......................................................................................................................................... 144 1263,484 1,506NOTE 33. PLEDGED ASSETS AND CONTINGENT LI<strong>AB</strong>ILITIES2010 2009Pledged assetsReal estate mortgages ............................................................................................................... 4,000 -Floating charges........................................................................................................................ 6,000 -Inventories ................................................................................................................................ 4,198 4,087Account receivables.................................................................................................................. 2,740 2,916Deposits .................................................................................................................................... 33 5216,971 7,055Contingent LiabilitiesSureties in favour of associates................................................................................................. 53 53Guarantees FPG/PRI................................................................................................................. 2 255 55The real estate mortgages, floating charges, inventories and account receivables refer to pledges in regards tofulfillment of obligations the Group’s syndicated bank loans.The deposits relate primarily to guarantees issued in connection with trade in oil derivatives. These amounts falldue for payment if the Group does not meet its commitments.A future close-down of operations within <strong>Preem</strong> may involve a requirement for decontamination and restorationworks. This is, however, considered to be well into the future and the future expenses cannot be calculated reliably.NOTE 34. SUPPLEMENTARY INFORMATION FOR THE CASH FLOW STATEMENTF-382010 2009Interest received/paidInterest received........................................................................................................................ 13 21Interest paid .............................................................................................................................. (1,085) (1,020)Adjustment for items not included in cash flow, etc.Depreciation and impairment of non-current assets.................................................................. 986 984Impairment of inventories/Reversed impairment of inventories............................................... - (1,098)Unrealized exchange rate losses+/exchange rate gain .............................................................. (788) (727)Unrealized loss+/gain- on oil and interest rate swaps............................................................... (100) (156)Element of capitalized borrowing costs recognized as expenses.............................................. 319 210Cash interest not received......................................................................................................... (157) (157)

- Page 2:

TABLE OF CONTENTSDisclosure Regardi

- Page 5:

which was merged into Preem on Octo

- Page 8 and 9:

RISK FACTORSThe risk factors below

- Page 10 and 11:

the cost of exploring for, developi

- Page 12 and 13:

purchase a minimum of 10% to 20% of

- Page 14 and 15:

market price at the time of settlem

- Page 16 and 17:

Notes, we would try to obtain waive

- Page 18 and 19:

are reasonable grounds for believin

- Page 20 and 21:

civil liability, whether or not pre

- Page 22 and 23:

SELECTED CONSOLIDATED FINANCIAL DAT

- Page 24 and 25:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 26 and 27:

Year ended December 31,%2008 2009 C

- Page 28 and 29:

arrel in February, increased to app

- Page 30 and 31:

(1) Includes sales by our supply an

- Page 32 and 33:

SEK 5,519 million, from a loss of S

- Page 34 and 35:

Cash flow used in investment activi

- Page 36 and 37:

Restrictions on transfers of fundsW

- Page 38 and 39:

Variable rate debt—amount due .

- Page 40 and 41:

As of December 31, 2008, SEK 21,999

- Page 42 and 43:

Our StrengthsOur competitive streng

- Page 44 and 45:

Lysekil has a total storage capacit

- Page 46 and 47:

Unfinished and Blend Stocks........

- Page 48 and 49:

Heating Oil .......................

- Page 50 and 51:

Business-to-Business DivisionWe pre

- Page 52 and 53:

“.nu,” “.org,” “.biz,”

- Page 54 and 55: Energy AB, Huda Trading AB, the Swe

- Page 56 and 57: was incorporated on March 22, 2007,

- Page 58 and 59: RELATED PARTY TRANSACTIONSCapital T

- Page 60 and 61: DESCRIPTION OF CERTAIN INDEBTEDNESS

- Page 62 and 63: effected by the Third Supplemental

- Page 64 and 65: first ranking mortgage certificates

- Page 66 and 67: LEGAL INFORMATIONCorral Petroleum H

- Page 68 and 69: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 70 and 71: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 72 and 73: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 74 and 75: CORRAL PETROLEUM HOLDINGS AB (publ)

- Page 76 and 77: SubsidiariesSubsidiaries are compan

- Page 78 and 79: The refinery installations consist

- Page 80 and 81: of occupational pension insurance,

- Page 82 and 83: Emission rights 2010LysekilGothenbu

- Page 84 and 85: NOTE 2. FINANCIAL RISK MANAGEMENTTh

- Page 86 and 87: In addition to price risk managemen

- Page 88 and 89: The fair value of borrowing is calc

- Page 90 and 91: Reconciliation with the Group’s t

- Page 92 and 93: The Board members including the Cha

- Page 94 and 95: NOTE 12. EXPENSES BROKEN DOWN BY TY

- Page 96 and 97: NOTE 16. EXCHANGE RATE DIFFERENCES

- Page 98 and 99: Equipment, tools, fixtures and fitt

- Page 100 and 101: NOTE 23. TRADE AND OTHER RECEIVABLE

- Page 102 and 103: The change in the fair value of pla

- Page 106 and 107: Capitalized interest cost..........

- Page 108: SalesDecember 31, 2009AccountsPurch