CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

CORRAL PETROLEUM HOLDINGS AB (PUBL) - Preem

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

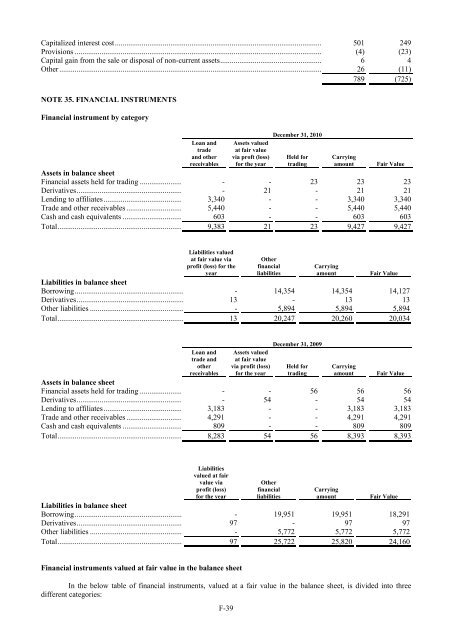

Capitalized interest cost............................................................................................................ 501 249Provisions ................................................................................................................................. (4) (23)Capital gain from the sale or disposal of non-current assets..................................................... 6 4Other ......................................................................................................................................... 26 (11)789 (725)NOTE 35. FINANCIAL INSTRUMENTSFinancial instrument by categoryLoan andtradeand otherreceivablesAssets valuedat fair valuevia proft (loss)for the yearDecember 31, 2010Held fortradingCarryingamountFair ValueAssets in balance sheetFinancial assets held for trading ...................... - - 23 23 23Derivatives....................................................... - 21 - 21 21Lending to affiliates......................................... 3,340 - - 3,340 3,340Trade and other receivables ............................. 5,440 - - 5,440 5,440Cash and cash equivalents ............................... 603 - - 603 603Total................................................................. 9,383 21 23 9,427 9,427Liabilities valuedat fair value viaprofit (loss) for theyearOtherfinancialliabilitiesCarryingamountFair ValueLiabilities in balance sheetBorrowing......................................................... - 14,354 14,354 14,127Derivatives........................................................ 13 - 13 13Other liabilities ................................................. - 5,894 5,894 5,894Total.................................................................. 13 20,247 20,260 20,034Loan andtrade andotherreceivablesAssets valuedat fair valuevia profit (loss)for the yearDecember 31, 2009Held fortradingCarryingamountFair ValueAssets in balance sheetFinancial assets held for trading ...................... - - 56 56 56Derivatives....................................................... - 54 - 54 54Lending to affiliates......................................... 3,183 - - 3,183 3,183Trade and other receivables ............................. 4,291 - - 4,291 4,291Cash and cash equivalents ............................... 809 - - 809 809Total................................................................. 8,283 54 56 8,393 8,393Liabilitiesvalued at fairvalue viaprofit (loss)for the yearOtherfinancialliabilitiesCarryingamountFair ValueLiabilities in balance sheetBorrowing......................................................... - 19,951 19,951 18,291Derivatives........................................................ 97 - 97 97Other liabilities ................................................. - 5,772 5,772 5,772Total.................................................................. 97 25,722 25,820 24,160Financial instruments valued at fair value in the balance sheetIn the below table of financial instruments, valued at a fair value in the balance sheet, is divided into threedifferent categories:F-39