NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

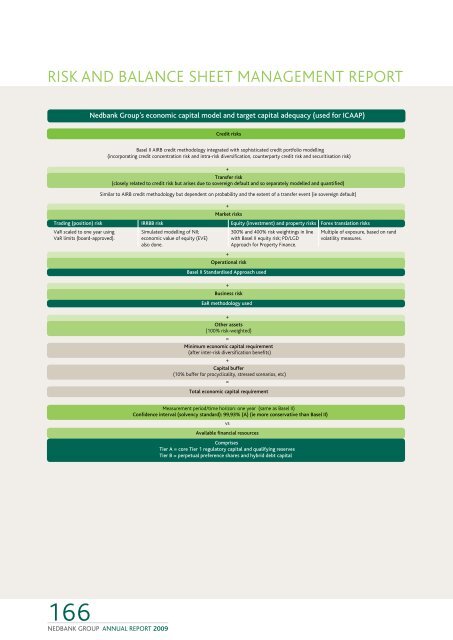

isk and BALANCE SHEET management report<strong>Nedbank</strong> <strong>Group</strong>’s economic capital model and target capital adequacy (used for ICAAP)Credit risksBasel II AIRB credit methodology integrated with sophisticated credit portfolio modelling(incorporating credit concentration risk and intra-risk diversification, counterparty credit risk and securitisation risk)+Transfer risk(closely related to credit risk but arises due to sovereign default and so separately modelled and quantified)Similar to AIRB credit methodology but dependent on probability and the extent of a transfer event (ie sovereign default)+Market risksTrading (position) riskIRRBB riskEquity (investment) and property risksForex translation risksVaR scaled to one year usingVaR limits (board-approved).Simulated modelling of NII;economic value of equity (EVE)also done.300% and 400% risk weightings in linewith Basel II equity risk; PD/LGDApproach for Property Finance.Multiple of exposure, based on randvolatility measures.+Operational riskBasel II Standardised Approach used+Business riskEaR methodology used+Other assets(100% risk-weighted)=Minimum economic capital requirement(after inter-risk diversification benefits)+Capital buffer(10% buffer for procyclicality, stressed scenarios, etc)=Total economic capital requirementMeasurement period/time horizon: one year (same as Basel II)Confidence interval (solvency standard): 99,93% (A) (ie more conservative than Basel II)vsAvailable financial resourcesComprisesTier A = core Tier 1 regulatory capital and qualifying reservesTier B = perpetual preference shares and hybrid debt capital166<strong>NEDBANK</strong> GROUP ANNUAL REPORT 2009