NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

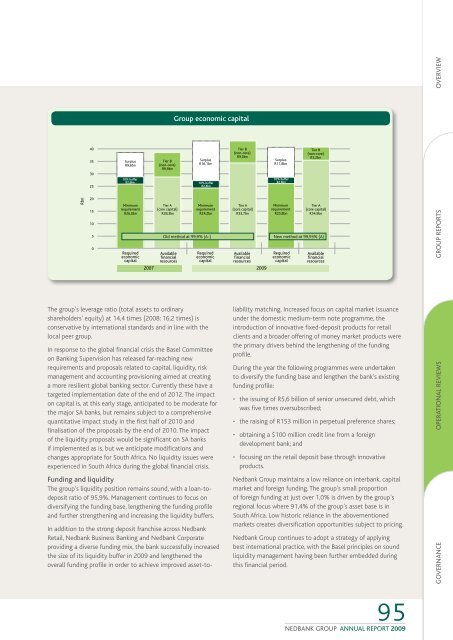

OVERVIEWGROUP ECONOMIC CAPITAL<strong>Group</strong> economic capital40353025SurplusR9,6bn10% bufferR2,6bnTier B(non-core)R9,9bnSurplusR16,1bn10% bufferR2,4bnTier B(non-core)R9,0bnSurplusR11,8bn10% bufferR2,6bnTier B(non-core)R5,2bnRbn20151050MinimumrequirementR26,0bnRequiredeconomiccapital2007Tier A(core capital)R28,3bnMinimumrequirementR24,2bnOld method at 99,9% (A-)AvailablefinancialresourcesRequiredeconomiccapitalTier A(core capital)R33,7bnAvailablefinancialresources2009MinimumrequirementR25,8bnTier A(core capital)R34,9bnNew method at 99,93% (A)RequiredeconomiccapitalAvailablefinancialresourcesGROUP REPORTSThe group’s leverage ratio (total assets to ordinaryshareholders’ equity) at 14,4 times (2008: 16,2 times) isconservative by international standards and in line with thelocal peer group.In response to the global financial crisis the Basel Committeeon Banking Supervision has released far-reaching newrequirements and proposals related to capital, liquidity, riskmanagement and accounting provisioning aimed at creatinga more resilient global banking sector. Currently these have atargeted implementation date of the end of 2012. The impacton capital is, at this early stage, anticipated to be moderate forthe major SA banks, but remains subject to a comprehensivequantitative impact study in the first half of 2010 andfinalisation of the proposals by the end of 2010. The impactof the liquidity proposals would be significant on SA banksif implemented as is, but we anticipate modifications andchanges appropriate for South Africa. No liquidity issues wereexperienced in South Africa during the global financial crisis.Funding and liquidityThe group’s liquidity position remains sound, with a loan-todepositratio of 95,9%. Management continues to focus ondiversifying the funding base, lengthening the funding profileand further strengthening and increasing the liquidity buffers.In addition to the strong deposit franchise across <strong>Nedbank</strong>Retail, <strong>Nedbank</strong> Business Banking and <strong>Nedbank</strong> Corporateproviding a diverse funding mix, the bank successfully increasedthe size of its liquidity buffer in 2009 and lengthened theoverall funding profile in order to achieve improved asset-toliabilitymatching. Increased focus on capital market issuanceunder the domestic medium-term note programme, theintroduction of innovative fixed-deposit products for retailclients and a broader offering of money market products werethe primary drivers behind the lengthening of the fundingprofile.During the year the following programmes were undertakento diversify the funding base and lengthen the bank’s existingfunding profile:• the issuing of R5,6 billion of senior unsecured debt, whichwas five times oversubscribed;• the raising of R153 million in perpetual preference shares;• obtaining a $100 million credit line from a foreigndevelopment bank; and• focusing on the retail deposit base through innovativeproducts.<strong>Nedbank</strong> <strong>Group</strong> maintains a low reliance on interbank, capitalmarket and foreign funding. The group’s small proportionof foreign funding at just over 1,0% is driven by the group’sregional focus where 91,4% of the group’s asset base is inSouth Africa. Low historic reliance in the abovementionedmarkets creates diversification opportunities subject to pricing.<strong>Nedbank</strong> <strong>Group</strong> continues to adopt a strategy of applyingbest international practice, with the Basel principles on soundliquidity management having been further embedded duringthis financial period.95<strong>NEDBANK</strong> GROUP ANNUAL REPORT 2009OPERATIONAL REVIEWSGOVERNANCE