NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

NEDBANK CAPITAl - Nedbank Group Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

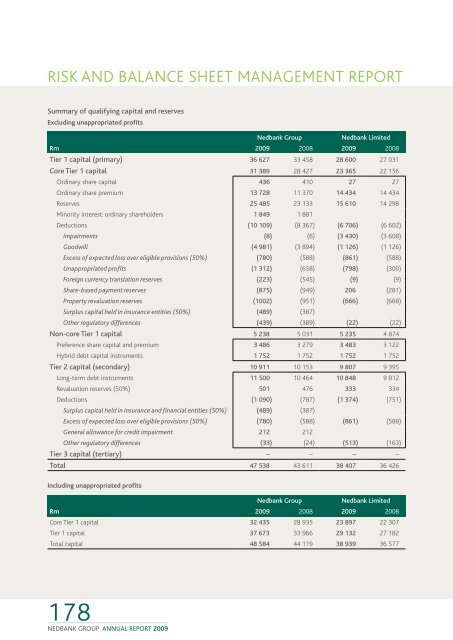

isk and BALANCE SHEET management reportSummary of qualifying capital and reservesExcluding unappropriated profits<strong>Nedbank</strong> <strong>Group</strong> <strong>Nedbank</strong> <strong>Limited</strong>Rm2009 2008 2009 2008Tier 1 capital (primary) 36 627 33 458 28 600 27 031Core Tier 1 capital 31 389 28 427 23 365 22 156Ordinary share capital 436 410 27 27Ordinary share premium 13 728 11 370 14 434 14 434Reserves 25 485 23 133 15 610 14 298Minority interest: ordinary shareholders 1 849 1 881Deductions (10 109) (8 367) (6 706) (6 602)Impairments (8) (6) (3 430) (3 608)Goodwill (4 981) (3 894) (1 126) (1 126)Excess of expected loss over eligible provisions (50%) (780) (588) (861) (588)Unappropriated profits (1 312) (658) (798) (300)Foreign currency translation reserves (223) (545) (9) (9)Share-based payment reserves (875) (949) 206 (281)Property revaluation reserves (1002) (951) (666) (668)Surplus capital held in insurance entities (50%) (489) (387)Other regulatory differences (439) (389) (22) (22)Non-core Tier 1 capital 5 238 5 031 5 235 4 874Preference share capital and premium 3 486 3 279 3 483 3 122Hybrid debt capital instruments 1 752 1 752 1 752 1 752Tier 2 capital (secondary) 10 911 10 153 9 807 9 395Long-term debt instruments 11 500 10 464 10 848 9 812Revaluation reserves (50%) 501 476 333 334Deductions (1 090) (787) (1 374) (751)Surplus capital held in insurance and financial entities (50%) (489) (387)Excess of expected loss over eligible provisions (50%) (780) (588) (861) (588)General allowance for credit impairment 212 212Other regulatory differences (33) (24) (513) (163)Tier 3 capital (tertiary) – – – –Total 47 538 43 611 38 407 36 426Including unappropriated profits<strong>Nedbank</strong> <strong>Group</strong> <strong>Nedbank</strong> <strong>Limited</strong>Rm2009 2008 2009 2008Core Tier 1 capital 32 435 28 935 23 897 22 307Tier 1 capital 37 673 33 966 29 132 27 182Total capital 48 584 44 119 38 939 36 577178<strong>NEDBANK</strong> GROUP ANNUAL REPORT 2009