Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

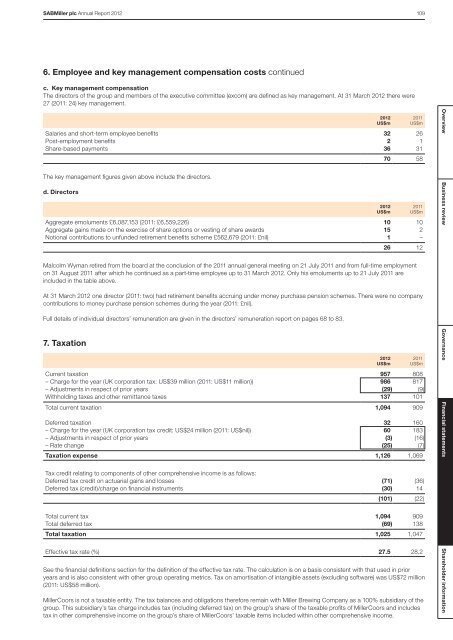

SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 1096. Employee and key management compensation costs continuedc. Key management compensationThe directors of the group and members of the executive committee (excom) are defined as key management. At 31 March <strong>2012</strong> there were27 (2011: 24) key management.Salaries and short-term employee benefits 32 26Post-employment benefits 2 1Share-based payments 36 31The key management figures given above include the directors.d. Directors<strong>2012</strong>US$m<strong>2012</strong>US$m2011US$m70 58Aggregate emoluments £6,087,153 (2011: £6,559,226) 10 10Aggregate gains made on the exercise of share options or vesting of share awards 15 2Notional contributions to unfunded retirement benefits scheme £562,679 (2011: £nil) 1 –26 12Malcolm Wyman retired from the board at the conclusion of the 2011 annual general meeting on 21 July 2011 and from full-time employmenton 31 August 2011 after which he continued as a part-time employee up to 31 March <strong>2012</strong>. Only his emoluments up to 21 July 2011 areincluded in the table above.At 31 March <strong>2012</strong> one director (2011: two) had retirement benefits accruing under money purchase pension schemes. There were no companycontributions to money purchase pension schemes during the year (2011: £nil).Full details of individual directors’ remuneration are given in the directors’ remuneration report on pages 68 to 83.7. TaxationCurrent taxation 957 808– Charge for the year (UK corporation tax: US$39 million (2011: US$11 million)) 986 817– Adjustments in respect of prior years (29) (9)Withholding taxes and other remittance taxes 137 101Total current taxation 1,094 909Deferred taxation 32 160– Charge for the year (UK corporation tax credit: US$24 million (2011: US$nil)) 60 183– Adjustments in respect of prior years (3) (16)– Rate change (25) (7)Taxation expense 1,126 1,069Tax credit relating to components of other comprehensive income is as follows:Deferred tax credit on actuarial gains and losses (71) (36)Deferred tax (credit)/charge on financial instruments (30) 14(101) (22)Total current tax 1,094 909Total deferred tax (69) 138Total taxation 1,025 1,047Effective tax rate (%) 27.5 28.2See the financial definitions section for the definition of the effective tax rate. The calculation is on a basis consistent with that used in prioryears and is also consistent with other group operating metrics. Tax on amortisation of intangible assets (excluding software) was US$72 million(2011: US$58 million).MillerCoors is not a taxable entity. The tax balances and obligations therefore remain with Miller Brewing Company as a 100% subsidiary of thegroup. This subsidiary’s tax charge includes tax (including deferred tax) on the group’s share of the taxable profits of MillerCoors and includestax in other comprehensive income on the group’s share of MillerCoors’ taxable items included within other comprehensive income.<strong>2012</strong>US$m2011US$m2011US$mOverview Business review Governance Financial statements Shareholder information