Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

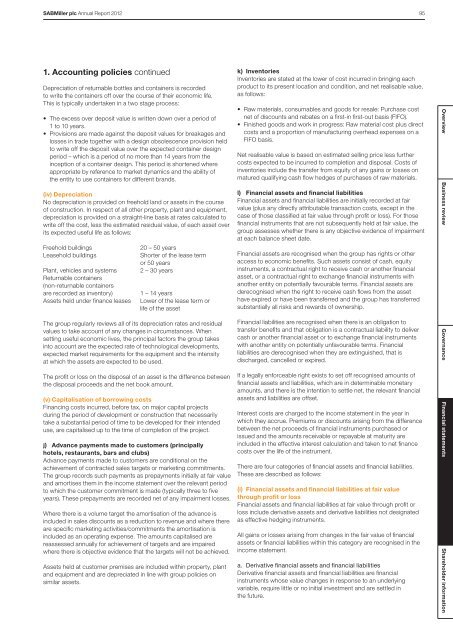

SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 951. Accounting policies continuedDepreciation of returnable bottles and containers is recordedto write the containers off over the course of their economic life.This is typically undertaken in a two stage process:• The excess over deposit value is written down over a period of1 to 10 years.• Provisions are made against the deposit values for breakages andlosses in trade together with a design obsolescence provision heldto write off the deposit value over the expected container designperiod – which is a period of no more than 14 years from theinception of a container design. This period is shortened whereappropriate by reference to market dynamics and the ability ofthe entity to use containers for different brands.(iv) DepreciationNo depreciation is provided on freehold land or assets in the courseof construction. In respect of all other property, plant and equipment,depreciation is provided on a straight-line basis at rates calculated towrite off the cost, less the estimated residual value, of each asset overits expected useful life as follows:Freehold buildingsLeasehold buildingsPlant, vehicles and systemsReturnable containers(non‐returnable containersare recorded as inventory)Assets held under finance leases20 – 50 yearsShorter of the lease termor 50 years2 – 30 years1 – 14 yearsLower of the lease term orlife of the assetThe group regularly reviews all of its depreciation rates and residualvalues to take account of any changes in circumstances. Whensetting useful economic lives, the principal factors the group takesinto account are the expected rate of technological developments,expected market requirements for the equipment and the intensityat which the assets are expected to be used.The profit or loss on the disposal of an asset is the difference betweenthe disposal proceeds and the net book amount.(v) Capitalisation of borrowing costsFinancing costs incurred, before tax, on major capital projectsduring the period of development or construction that necessarilytake a substantial period of time to be developed for their intendeduse, are capitalised up to the time of completion of the project.j) Advance payments made to customers (principallyhotels, restaurants, bars and clubs)Advance payments made to customers are conditional on theachievement of contracted sales targets or marketing commitments.The group records such payments as prepayments initially at fair valueand amortises them in the income statement over the relevant periodto which the customer commitment is made (typically three to fiveyears). These prepayments are recorded net of any impairment losses.Where there is a volume target the amortisation of the advance isincluded in sales discounts as a reduction to revenue and where thereare specific marketing activities/commitments the amortisation isincluded as an operating expense. The amounts capitalised arereassessed annually for achievement of targets and are impairedwhere there is objective evidence that the targets will not be achieved.Assets held at customer premises are included within property, plantand equipment and are depreciated in line with group policies onsimilar assets.k) InventoriesInventories are stated at the lower of cost incurred in bringing eachproduct to its present location and condition, and net realisable value,as follows:• Raw materials, consumables and goods for resale: Purchase costnet of discounts and rebates on a first-in first-out basis (FIFO).• Finished goods and work in progress: Raw material cost plus directcosts and a proportion of manufacturing overhead expenses on aFIFO basis.Net realisable value is based on estimated selling price less furthercosts expected to be incurred to completion and disposal. Costs ofinventories include the transfer from equity of any gains or losses onmatured qualifying cash flow hedges of purchases of raw materials.l) Financial assets and financial liabilitiesFinancial assets and financial liabilities are initially recorded at fairvalue (plus any directly attributable transaction costs, except in thecase of those classified at fair value through profit or loss). For thosefinancial instruments that are not subsequently held at fair value, thegroup assesses whether there is any objective evidence of impairmentat each balance sheet date.Financial assets are recognised when the group has rights or otheraccess to economic benefits. Such assets consist of cash, equityinstruments, a contractual right to receive cash or another financialasset, or a contractual right to exchange financial instruments withanother entity on potentially favourable terms. Financial assets arederecognised when the right to receive cash flows from the assethave expired or have been transferred and the group has transferredsubstantially all risks and rewards of ownership.Financial liabilities are recognised when there is an obligation totransfer benefits and that obligation is a contractual liability to delivercash or another financial asset or to exchange financial instrumentswith another entity on potentially unfavourable terms. Financialliabilities are derecognised when they are extinguished, that isdischarged, cancelled or expired.If a legally enforceable right exists to set off recognised amounts offinancial assets and liabilities, which are in determinable monetaryamounts, and there is the intention to settle net, the relevant financialassets and liabilities are offset.Interest costs are charged to the income statement in the year inwhich they accrue. Premiums or discounts arising from the differencebetween the net proceeds of financial instruments purchased orissued and the amounts receivable or repayable at maturity areincluded in the effective interest calculation and taken to net financecosts over the life of the instrument.There are four categories of financial assets and financial liabilities.These are described as follows:(i) Financial assets and financial liabilities at fair valuethrough profit or lossFinancial assets and financial liabilities at fair value through profit orloss include derivative assets and derivative liabilities not designatedas effective hedging instruments.All gains or losses arising from changes in the fair value of financialassets or financial liabilities within this category are recognised in theincome statement.a. Derivative financial assets and financial liabilitiesDerivative financial assets and financial liabilities are financialinstruments whose value changes in response to an underlyingvariable, require little or no initial investment and are settled inthe future.Overview Business review Governance Financial statements Shareholder information