Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

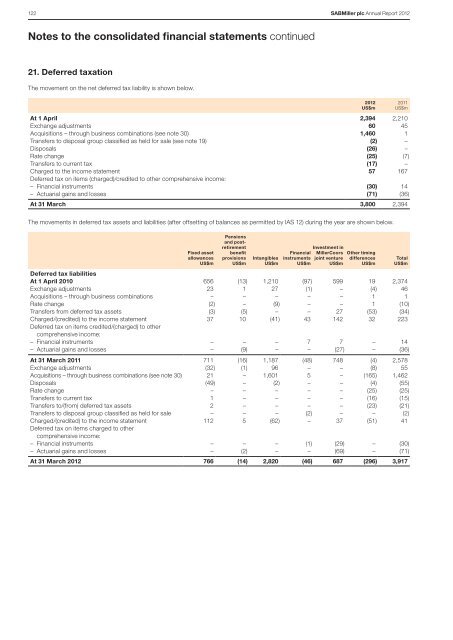

122 SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>Notes to the consolidated financial statements continued21. Deferred taxationThe movement on the net deferred tax liability is shown below.At 1 April 2,394 2,210Exchange adjustments 60 45Acquisitions – through business combinations (see note 30) 1,460 1Transfers to disposal group classified as held for sale (see note 19) (2) –Disposals (26) –Rate change (25) (7)Transfers to current tax (17) –Charged to the income statement 57 167Deferred tax on items (charged)/credited to other comprehensive income:– Financial instruments (30) 14– Actuarial gains and losses (71) (36)At 31 March 3,800 2,394<strong>2012</strong>US$m2011US$mThe movements in deferred tax assets and liabilities (after offsetting of balances as permitted by IAS 12) during the year are shown below.Fixed assetallowancesUS$mPensionsand postretirementbenefitprovisionsUS$mIntangiblesUS$mFinancialinstrumentsUS$mInvestment inMillerCoorsjoint ventureUS$mOther timingdifferencesUS$mDeferred tax liabilitiesAt 1 April 2010 656 (13) 1,210 (97) 599 19 2,374Exchange adjustments 23 1 27 (1) – (4) 46Acquisitions – through business combinations – – – – – 1 1Rate change (2) – (9) – – 1 (10)Transfers from deferred tax assets (3) (5) – – 27 (53) (34)Charged/(credited) to the income statement 37 10 (41) 43 142 32 223Deferred tax on items credited/(charged) to othercomprehensive income:– Financial instruments – – – 7 7 – 14– Actuarial gains and losses – (9) – – (27) – (36)At 31 March 2011 711 (16) 1,187 (48) 748 (4) 2,578Exchange adjustments (32) (1) 96 – – (8) 55Acquisitions – through business combinations (see note 30) 21 – 1,601 5 – (165) 1,462Disposals (49) – (2) – – (4) (55)Rate change – – – – – (25) (25)Transfers to current tax 1 – – – – (16) (15)Transfers to/(from) deferred tax assets 2 – – – – (23) (21)Transfers to disposal group classified as held for sale – – – (2) – – (2)Charged/(credited) to the income statement 112 5 (62) – 37 (51) 41Deferred tax on items charged to othercomprehensive income:– Financial instruments – – – (1) (29) – (30)– Actuarial gains and losses – (2) – – (69) – (71)At 31 March <strong>2012</strong> 766 (14) 2,820 (46) 687 (296) 3,917TotalUS$m