Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

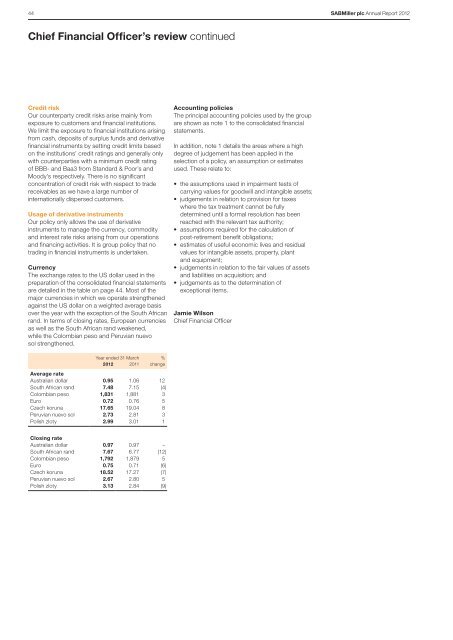

44 SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>Chief Financial Officer’s review continuedCredit riskOur counterparty credit risks arise mainly fromexposure to customers and financial institutions.We limit the exposure to financial institutions arisingfrom cash, deposits of surplus funds and derivativefinancial instruments by setting credit limits basedon the institutions’ credit ratings and generally onlywith counterparties with a minimum credit ratingof BBB- and Baa3 from Standard & Poor’s andMoody’s respectively. There is no significantconcentration of credit risk with respect to tradereceivables as we have a large number ofinternationally dispersed customers.Usage of derivative instrumentsOur policy only allows the use of derivativeinstruments to manage the currency, commodityand interest rate risks arising from our operationsand financing activities. It is group policy that notrading in financial instruments is undertaken.CurrencyThe exchange rates to the US dollar used in thepreparation of the consolidated financial statementsare detailed in the table on page 44. Most of themajor currencies in which we operate strengthenedagainst the US dollar on a weighted average basisover the year with the exception of the South Africanrand. In terms of closing rates, European currenciesas well as the South African rand weakened,while the Colombian peso and Peruvian nuevosol strengthened.Accounting policiesThe principal accounting policies used by the groupare shown as note 1 to the consolidated financialstatements.In addition, note 1 details the areas where a highdegree of judgement has been applied in theselection of a policy, an assumption or estimatesused. These relate to:• the assumptions used in impairment tests ofcarrying values for goodwill and intangible assets;• judgements in relation to provision for taxeswhere the tax treatment cannot be fullydetermined until a formal resolution has beenreached with the relevant tax authority;• assumptions required for the calculation ofpost-retirement benefit obligations;• estimates of useful economic lives and residualvalues for intangible assets, property, plantand equipment;• judgements in relation to the fair values of assetsand liabilities on acquisition; and• judgements as to the determination ofexceptional items.Jamie WilsonChief Financial OfficerYear ended 31 March %<strong>2012</strong> 2011 changeAverage rateAustralian dollar 0.95 1.06 12South African rand 7.48 7.15 (4)Colombian peso 1,831 1,881 3Euro 0.72 0.76 5Czech koruna 17.65 19.04 8Peruvian nuevo sol 2.73 2.81 3Polish zloty 2.99 3.01 1Closing rateAustralian dollar 0.97 0.97 –South African rand 7.67 6.77 (12)Colombian peso 1,792 1,879 5Euro 0.75 0.71 (6)Czech koruna 18.52 17.27 (7)Peruvian nuevo sol 2.67 2.80 5Polish zloty 3.13 2.84 (9)