Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

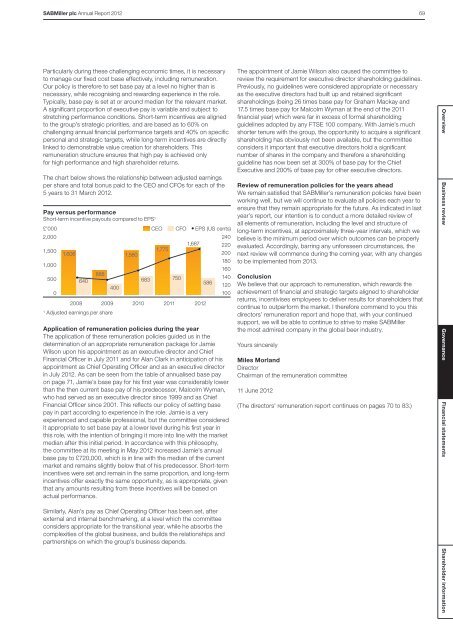

SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 69Particularly during these challenging economic times, it is necessaryto manage our fixed cost base effectively, including remuneration.Our policy is therefore to set base pay at a level no higher than isnecessary, while recognising and rewarding experience in the role.Typically, base pay is set at or around median for the relevant market.A significant proportion of executive pay is variable and subject tostretching performance conditions. Short-term incentives are alignedto the group’s strategic priorities, and are based as to 60% onchallenging annual financial performance targets and 40% on specificpersonal and strategic targets, while long-term incentives are directlylinked to demonstrable value creation for shareholders. Thisremuneration structure ensures that high pay is achieved onlyfor high performance and high shareholder returns.The chart below shows the relationship between adjusted earningsper share and total bonus paid to the CEO and CFOs for each of the5 years to 31 March <strong>2012</strong>.Pay versus performanceShort-term incentive payouts compared to EPS 1£’000 CEO CFO EPS (US cents)2,0002401,5001,687 2201,7751,6061,5802001,000180160500 640888683 75014058612040001002008 2009 2010 2011 <strong>2012</strong>1 Adjusted earnings per shareApplication of remuneration policies during the yearThe application of these remuneration policies guided us in thedetermination of an appropriate remuneration package for JamieWilson upon his appointment as an executive director and ChiefFinancial Officer in July 2011 and for Alan Clark in anticipation of hisappointment as Chief Operating Officer and as an executive directorin July <strong>2012</strong>. As can be seen from the table of annualised base payon page 71, Jamie’s base pay for his first year was considerably lowerthan the then current base pay of his predecessor, Malcolm Wyman,who had served as an executive director since 1999 and as ChiefFinancial Officer since 2001. This reflects our policy of setting basepay in part according to experience in the role. Jamie is a veryexperienced and capable professional, but the committee consideredit appropriate to set base pay at a lower level during his first year inthis role, with the intention of bringing it more into line with the marketmedian after this initial period. In accordance with this philosophy,the committee at its meeting in May <strong>2012</strong> increased Jamie’s annualbase pay to £720,000, which is in line with the median of the currentmarket and remains slightly below that of his predecessor. Short-termincentives were set and remain in the same proportion, and long-termincentives offer exactly the same opportunity, as is appropriate, giventhat any amounts resulting from these incentives will be based onactual performance.Similarly, Alan’s pay as Chief Operating Officer has been set, afterexternal and internal benchmarking, at a level which the committeeconsiders appropriate for the transitional year, while he absorbs thecomplexities of the global business, and builds the relationships andpartnerships on which the group’s business depends.The appointment of Jamie Wilson also caused the committee toreview the requirement for executive director shareholding guidelines.Previously, no guidelines were considered appropriate or necessaryas the executive directors had built up and retained significantshareholdings (being 26 times base pay for Graham Mackay and17.5 times base pay for Malcolm Wyman at the end of the 2011financial year) which were far in excess of formal shareholdingguidelines adopted by any FTSE 100 company. With Jamie’s muchshorter tenure with the group, the opportunity to acquire a significantshareholding has obviously not been available, but the committeeconsiders it important that executive directors hold a significantnumber of shares in the company and therefore a shareholdingguideline has now been set at 300% of base pay for the ChiefExecutive and 200% of base pay for other executive directors.Review of remuneration policies for the years aheadWe remain satisfied that SABMiller’s remuneration policies have beenworking well, but we will continue to evaluate all policies each year toensure that they remain appropriate for the future. As indicated in lastyear’s report, our intention is to conduct a more detailed review ofall elements of remuneration, including the level and structure oflong-term incentives, at approximately three-year intervals, which webelieve is the minimum period over which outcomes can be properlyevaluated. Accordingly, barring any unforeseen circumstances, thenext review will commence during the coming year, with any changesto be implemented from 2013.ConclusionWe believe that our approach to remuneration, which rewards theachievement of financial and strategic targets aligned to shareholderreturns, incentivises employees to deliver results for shareholders thatcontinue to outperform the market. I therefore commend to you thisdirectors’ remuneration report and hope that, with your continuedsupport, we will be able to continue to strive to make SABMillerthe most admired company in the global beer industry.Yours sincerelyMiles MorlandDirectorChairman of the remuneration committee11 June <strong>2012</strong>(The directors’ remuneration report continues on pages 70 to 83.)Overview Business review Governance Financial statements Shareholder information