Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

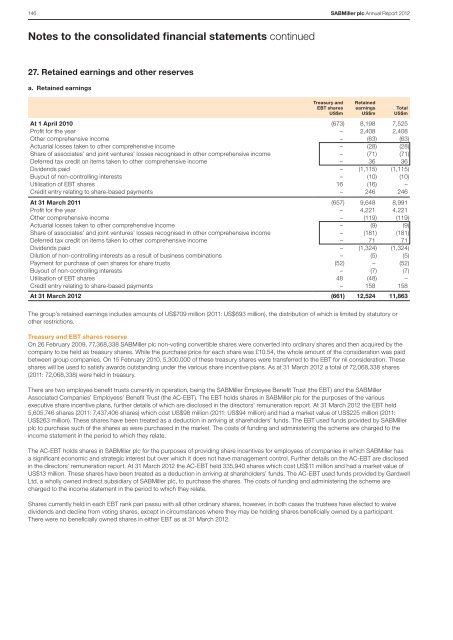

146 SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>Notes to the consolidated financial statements continued27. Retained earnings and other reservesa. Retained earningsTreasury andEBT sharesUS$mRetainedearningsUS$mAt 1 April 2010 (673) 8,198 7,525Profit for the year – 2,408 2,408Other comprehensive income – (63) (63)Actuarial losses taken to other comprehensive income – (28) (28)Share of associates’ and joint ventures’ losses recognised in other comprehensive income – (71) (71)Deferred tax credit on items taken to other comprehensive income – 36 36Dividends paid – (1,115) (1,115)Buyout of non-controlling interests – (10) (10)Utilisation of EBT shares 16 (16) –Credit entry relating to share-based payments – 246 246At 31 March 2011 (657) 9,648 8,991Profit for the year – 4,221 4,221Other comprehensive income – (119) (119)Actuarial losses taken to other comprehensive income – (9) (9)Share of associates’ and joint ventures’ losses recognised in other comprehensive income – (181) (181)Deferred tax credit on items taken to other comprehensive income – 71 71Dividends paid – (1,324) (1,324)Dilution of non-controlling interests as a result of business combinations – (5) (5)Payment for purchase of own shares for share trusts (52) – (52)Buyout of non-controlling interests – (7) (7)Utilisation of EBT shares 48 (48) –Credit entry relating to share-based payments – 158 158At 31 March <strong>2012</strong> (661) 12,524 11,863TotalUS$mThe group’s retained earnings includes amounts of US$709 million (2011: US$693 million), the distribution of which is limited by statutory orother restrictions.Treasury and EBT shares reserveOn 26 February 2009, 77,368,338 SABMiller plc non-voting convertible shares were converted into ordinary shares and then acquired by thecompany to be held as treasury shares. While the purchase price for each share was £10.54, the whole amount of the consideration was paidbetween group companies. On 15 February 2010, 5,300,000 of these treasury shares were transferred to the EBT for nil consideration. Theseshares will be used to satisfy awards outstanding under the various share incentive plans. As at 31 March <strong>2012</strong> a total of 72,068,338 shares(2011: 72,068,338) were held in treasury.There are two employee benefit trusts currently in operation, being the SABMiller Employee Benefit Trust (the EBT) and the SABMillerAssociated Companies’ Employees’ Benefit Trust (the AC-EBT). The EBT holds shares in SABMiller plc for the purposes of the variousexecutive share incentive plans, further details of which are disclosed in the directors’ remuneration report. At 31 March <strong>2012</strong> the EBT held5,605,746 shares (2011: 7,437,406 shares) which cost US$98 million (2011: US$94 million) and had a market value of US$225 million (2011:US$263 million). These shares have been treated as a deduction in arriving at shareholders’ funds. The EBT used funds provided by SABMillerplc to purchase such of the shares as were purchased in the market. The costs of funding and administering the scheme are charged to theincome statement in the period to which they relate.The AC-EBT holds shares in SABMiller plc for the purposes of providing share incentives for employees of companies in which SABMiller hasa significant economic and strategic interest but over which it does not have management control. Further details on the AC-EBT are disclosedin the directors’ remuneration report. At 31 March <strong>2012</strong> the AC-EBT held 335,940 shares which cost US$11 million and had a market value ofUS$13 million. These shares have been treated as a deduction in arriving at shareholders’ funds. The AC-EBT used funds provided by GardwellLtd, a wholly owned indirect subsidiary of SABMiller plc, to purchase the shares. The costs of funding and administering the scheme arecharged to the income statement in the period to which they relate.Shares currently held in each EBT rank pari passu with all other ordinary shares, however, in both cases the trustees have elected to waivedividends and decline from voting shares, except in circumstances where they may be holding shares beneficially owned by a participant.There were no beneficially owned shares in either EBT as at 31 March <strong>2012</strong>.