Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

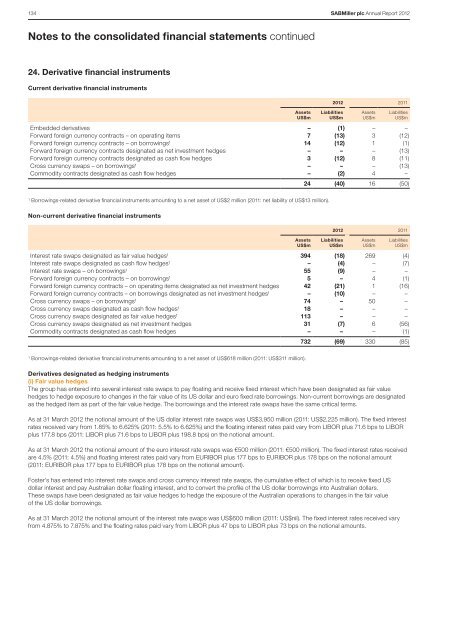

134 SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>Notes to the consolidated financial statements continued24. Derivative financial instrumentsCurrent derivative financial instrumentsAssetsUS$m<strong>2012</strong> 2011LiabilitiesUS$mAssetsUS$mLiabilitiesUS$mEmbedded derivatives – (1) – –Forward foreign currency contracts – on operating items 7 (13) 3 (12)Forward foreign currency contracts – on borrowings 1 14 (12) 1 (1)Forward foreign currency contracts designated as net investment hedges – – – (13)Forward foreign currency contracts designated as cash flow hedges 3 (12) 8 (11)Cross currency swaps – on borrowings¹ – – – (13)Commodity contracts designated as cash flow hedges – (2) 4 –24 (40) 16 (50)1 Borrowings-related derivative financial instruments amounting to a net asset of US$2 million (2011: net liability of US$13 million).Non-current derivative financial instrumentsAssetsUS$m<strong>2012</strong> 2011LiabilitiesUS$mAssetsUS$mLiabilitiesUS$mInterest rate swaps designated as fair value hedges 1 394 (18) 269 (4)Interest rate swaps designated as cash flow hedges 1 – (4) – (7)Interest rate swaps – on borrowings 1 55 (9) – –Forward foreign currency contracts – on borrowings 1 5 – 4 (1)Forward foreign currency contracts – on operating items designated as net investment hedges 42 (21) 1 (16)Forward foreign currency contracts – on borrowings designated as net investment hedges 1 – (10) – –Cross currency swaps – on borrowings 1 74 – 50 –Cross currency swaps designated as cash flow hedges 1 18 – – –Cross currency swaps designated as fair value hedges 1 113 – – –Cross currency swaps designated as net investment hedges 31 (7) 6 (56)Commodity contracts designated as cash flow hedges – – – (1)732 (69) 330 (85)1 Borrowings-related derivative financial instruments amounting to a net asset of US$618 million (2011: US$311 million).Derivatives designated as hedging instruments(i) Fair value hedgesThe group has entered into several interest rate swaps to pay floating and receive fixed interest which have been designated as fair valuehedges to hedge exposure to changes in the fair value of its US dollar and euro fixed rate borrowings. Non-current borrowings are designatedas the hedged item as part of the fair value hedge. The borrowings and the interest rate swaps have the same critical terms.As at 31 March <strong>2012</strong> the notional amount of the US dollar interest rate swaps was US$3,950 million (2011: US$2,225 million). The fixed interestrates received vary from 1.85% to 6.625% (2011: 5.5% to 6.625%) and the floating interest rates paid vary from LIBOR plus 71.6 bps to LIBORplus 177.8 bps (2011: LIBOR plus 71.6 bps to LIBOR plus 198.8 bps) on the notional amount.As at 31 March <strong>2012</strong> the notional amount of the euro interest rate swaps was €500 million (2011: €500 million). The fixed interest rates receivedare 4.5% (2011: 4.5%) and floating interest rates paid vary from EURIBOR plus 177 bps to EURIBOR plus 178 bps on the notional amount(2011: EURIBOR plus 177 bps to EURIBOR plus 178 bps on the notional amount).Foster’s has entered into interest rate swaps and cross currency interest rate swaps, the cumulative effect of which is to receive fixed USdollar interest and pay Australian dollar floating interest, and to convert the profile of the US dollar borrowings into Australian dollars.These swaps have been designated as fair value hedges to hedge the exposure of the Australian operations to changes in the fair valueof the US dollar borrowings.As at 31 March <strong>2012</strong> the notional amount of the interest rate swaps was US$600 million (2011: US$nil). The fixed interest rates received varyfrom 4.875% to 7.875% and the floating rates paid vary from LIBOR plus 47 bps to LIBOR plus 73 bps on the notional amounts.