Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

Download Sabmiller Plc Annual Report 2012 PDF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

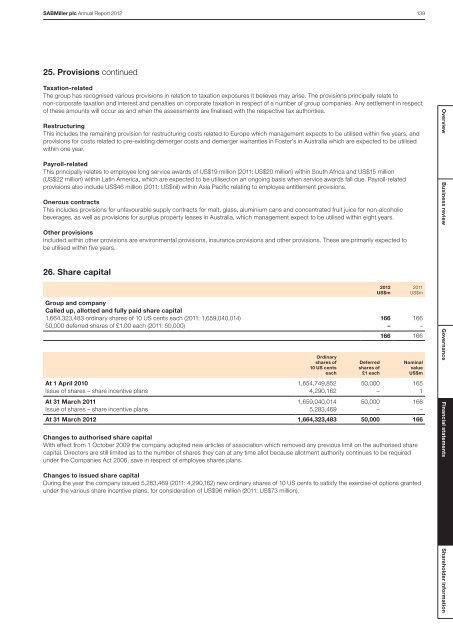

SABMiller plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 13925. Provisions continuedTaxation-relatedThe group has recognised various provisions in relation to taxation exposures it believes may arise. The provisions principally relate tonon-corporate taxation and interest and penalties on corporate taxation in respect of a number of group companies. Any settlement in respectof these amounts will occur as and when the assessments are finalised with the respective tax authorities.RestructuringThis includes the remaining provision for restructuring costs related to Europe which management expects to be utilised within five years, andprovisions for costs related to pre-existing demerger costs and demerger warranties in Foster’s in Australia which are expected to be utilisedwithin one year.Payroll-relatedThis principally relates to employee long service awards of US$19 million (2011: US$20 million) within South Africa and US$15 million(US$22 million) within Latin America, which are expected to be utilised on an ongoing basis when service awards fall due. Payroll-relatedprovisions also include US$46 million (2011: US$nil) within Asia Pacific relating to employee entitlement provisions.Onerous contractsThis includes provisions for unfavourable supply contracts for malt, glass, aluminium cans and concentrated fruit juice for non-alcoholicbeverages, as well as provisions for surplus property leases in Australia, which management expect to be utilised within eight years.Other provisionsIncluded within other provisions are environmental provisions, insurance provisions and other provisions. These are primarily expected tobe utilised within five years.26. Share capitalGroup and companyCalled up, allotted and fully paid share capital1,664,323,483 ordinary shares of 10 US cents each (2011: 1,659,040,014) 166 16650,000 deferred shares of £1.00 each (2011: 50,000) – –166 166Ordinaryshares of10 US centseachDeferredshares of£1 each<strong>2012</strong>US$m2011US$mNominalvalueUS$mAt 1 April 2010 1,654,749,852 50,000 165Issue of shares – share incentive plans 4,290,162 – 1At 31 March 2011 1,659,040,014 50,000 166Issue of shares – share incentive plans 5,283,469 – –At 31 March <strong>2012</strong> 1,664,323,483 50,000 166Changes to authorised share capitalWith effect from 1 October 2009 the company adopted new articles of association which removed any previous limit on the authorised sharecapital. Directors are still limited as to the number of shares they can at any time allot because allotment authority continues to be requiredunder the Companies Act 2006, save in respect of employee shares plans.Changes to issued share capitalDuring the year the company issued 5,283,469 (2011: 4,290,162) new ordinary shares of 10 US cents to satisfy the exercise of options grantedunder the various share incentive plans, for consideration of US$96 million (2011: US$73 million).Overview Business review Governance Financial statements Shareholder information