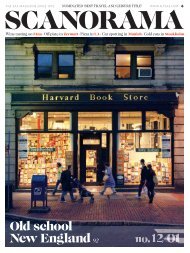

Old school New England 92 - Scanorama

Old school New England 92 - Scanorama

Old school New England 92 - Scanorama

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Contrarian with a purpose<br />

Doing it differently for the right reasons<br />

“Just because the stocks in Hong Kong<br />

fell by 5% this morning, doesn’t mean<br />

that the companies are 5% worse,” says<br />

Åge Westbø, SKAGEN Funds deputy<br />

managing director and co-founder.<br />

The observation goes to the heart of<br />

Westbø’s contrarian outlook.<br />

He is a contrarian character. Possessed<br />

of an agile mind, which bounces from<br />

subject to subject, he first rages at rival<br />

fund managers who buy stocks just to<br />

prove they are doing something, then<br />

takes a philosophical detour, as he<br />

discusses Marx and Kant. Each time, he<br />

challenges orthodox interpretations,<br />

and comes up with his own considered<br />

alternative.<br />

“If you say black, he will say white,”<br />

says one SKAGEN insider.<br />

As one of the four founders and five<br />

major shareholders of the company,<br />

Westbø can be as contrarian as he likes.<br />

(“My greatest fear is that we become<br />

part of the establishment,” he says).<br />

But you quickly realise that this type of<br />

outlook runs throughout the company.<br />

“It certainly applies to SKAGEN,” says<br />

Harald Espedal, chief executive, investment<br />

director and another of the five<br />

major owners. “The business ideal of<br />

providing great returns is founded in a<br />

contrarian approach.”<br />

“If you think like most other participants<br />

in the market then you won’t be able<br />

to achieve a return which is in any way<br />

better than the market. So if you want to<br />

make money for your clients, then you<br />

need to have a view which is different<br />

from other investors.”<br />

Investment decisions are made from<br />

the bottom up. The firm does not invest<br />

in markets or indices. It invests in<br />

companies from all corners of the globe.<br />

In addition to making their own investment<br />

decisions, portfolio managers do<br />

all of their own analysis – a relative rarity<br />

– and they have to pitch and justify<br />

their ideas to all of their investment<br />

colleagues. And, because the owners of<br />

the company are the same sage heads<br />

who believe in long-term investment,<br />

there is no incentive for disruptive stock<br />

churn or panic selling in a downturn.<br />

Says Espedal, “being independent<br />

means that we don’t have to meet quarterly<br />

performance targets, so we can<br />

take the long-term view and do the right<br />

things for our clients.” Funds tend on<br />

*<br />

average to hold stocks for just six<br />

months. But once picked, SKAGEN<br />

stocks remain in the funds for an<br />

average of between three and five<br />

years, regardless of what the rest<br />

of the market is doing.<br />

Indeed, true to contrarian form, SKAGEN<br />

managers regard a falling market as<br />

the ideal time to pick up unloved gems.<br />

“In this industry, people seem to sell<br />

when the stocks get cheap, and buy<br />

when they are expensive again. They<br />

don’t want to do it but that is the kind of<br />

behaviour you exhibit when you don’t<br />

understand risk properly,” says Westbø.<br />

Kristian Falnes, SKAGEN Global portfolio<br />

manager, and another of the five<br />

major owners of the company, has his<br />

own interpretation.<br />

“The efficient market is a myth,” he<br />

says. “The market is irrational. So when<br />

everyone says a stock is bad, that is the<br />

first place we look.” (See case study box<br />

on previous page). Sometimes, stocks<br />

are just bad and undervalued for a good<br />

reason. Bad management or poor corporate<br />

governance can destroy value,<br />

no matter how attractive some of the<br />

numbers appear. But often the unloved<br />

apples are the ones which turn out to<br />

be the<br />

“The market is irrational. So when everyone<br />

says a stock is bad, that is the first place we look.”<br />

sweetest.<br />

“Each<br />

of our<br />

equity<br />

funds comprises about 100 companies.<br />

But where we do invest, it needs to<br />

be from a different viewpoint,” says<br />

Espedal. “Since we tend to invest in<br />

companies which are unloved we need<br />

to have a more optimistic view of the<br />

companies than the rest of the market<br />

and a good idea about the triggers<br />

which will release the value.”<br />

Out in sleepy Stavanger, on the West<br />

Coast of Norway, SKAGEN fund managers<br />

are thousands of miles from the rumours<br />

and bar-talk of London and <strong>New</strong><br />

York. The isolation helps them maintain<br />

their contrarian outlook and prevents<br />

them from getting swept up in investment<br />

groupthink. It also contributes to<br />

what is a very Nordic success story.