Old school New England 92 - Scanorama

Old school New England 92 - Scanorama

Old school New England 92 - Scanorama

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Illustration: Per Dybvig<br />

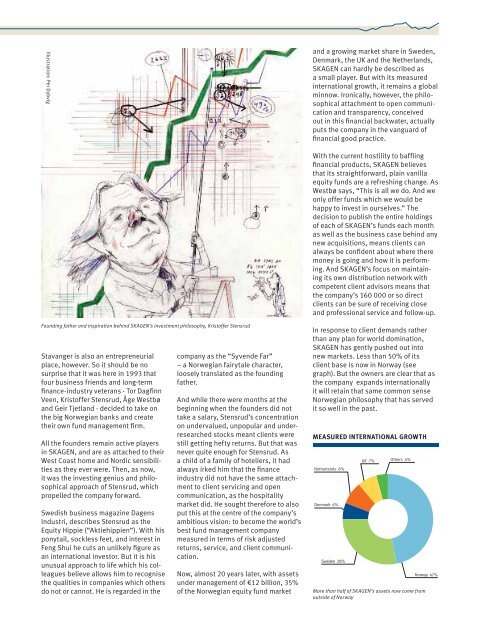

Founding father and inspiration behind SKAGEN’s investment philosophy, Kristoffer Stensrud<br />

Stavanger is also an entrepreneurial<br />

place, however. So it should be no<br />

surprise that it was here in 1993 that<br />

four business friends and long-term<br />

finance-industry veterans - Tor Dagfinn<br />

Veen, Kristoffer Stensrud, Åge Westbø<br />

and Geir Tjetland - decided to take on<br />

the big Norwegian banks and create<br />

their own fund management firm.<br />

All the founders remain active players<br />

in SKAGEN, and are as attached to their<br />

West Coast home and Nordic sensibilities<br />

as they ever were. Then, as now,<br />

it was the investing genius and philosophical<br />

approach of Stensrud, which<br />

propelled the company forward.<br />

Swedish business magazine Dagens<br />

Industri, describes Stensrud as the<br />

Equity Hippie (“Aktiehippien”). With his<br />

ponytail, sockless feet, and interest in<br />

Feng Shui he cuts an unlikely figure as<br />

an international investor. But it is his<br />

unusual approach to life which his colleagues<br />

believe allows him to recognise<br />

the qualities in companies which others<br />

do not or cannot. He is regarded in the<br />

company as the “Syvende Far”<br />

– a Norwegian fairytale character,<br />

loosely translated as the founding<br />

father.<br />

And while there were months at the<br />

beginning when the founders did not<br />

take a salary, Stensrud’s concentration<br />

on undervalued, unpopular and under-<br />

researched stocks meant clients were<br />

still getting hefty returns. But that was<br />

never quite enough for Stensrud. As<br />

a child of a family of hoteliers, it had<br />

always irked him that the finance<br />

industry did not have the same attachment<br />

to client servicing and open<br />

communication, as the hospitality<br />

market did. He sought therefore to also<br />

put this at the centre of the company’s<br />

ambitious vision: to become the world’s<br />

best fund management company<br />

measured in terms of risk adjusted<br />

returns, service, and client communication.<br />

Now, almost 20 years later, with assets<br />

under management of €12 billion, 35%<br />

of the Norwegian equity fund market<br />

and a growing market share in Sweden,<br />

Denmark, the UK and the Netherlands,<br />

SKAGEN can hardly be described as<br />

a small player. But with its measured<br />

international growth, it remains a global<br />

minnow. Ironically, however, the philosophical<br />

attachment to open communication<br />

and transparency, conceived<br />

out in this financial backwater, actually<br />

puts the company in the vanguard of<br />

financial good practice.<br />

With the current hostility to baffling<br />

financial products, SKAGEN believes<br />

that its straightforward, plain vanilla<br />

equity funds are a refreshing change. As<br />

Westbø says, “This is all we do. And we<br />

only offer funds which we would be<br />

happy to invest in ourselves.” The<br />

decision to publish the entire holdings<br />

of each of SKAGEN’s funds each month<br />

as well as the business case behind any<br />

new acquisitions, means clients can<br />

always be confident about where there<br />

money is going and how it is performing.<br />

And SKAGEN’s focus on maintaining<br />

its own distribution network with<br />

competent client advisors means that<br />

the company’s 160 000 or so direct<br />

clients can be sure of receiving close<br />

and professional service and follow-up.<br />

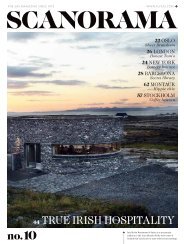

In response to client demands rather<br />

than any plan for world domination,<br />

SKAGEN has gently pushed out into<br />

new markets. Less than 50% of its<br />

client base is now in Norway (see<br />

graph). But the owners are clear that as<br />

the company expands internationally<br />

it will retain that same common sense<br />

Norwegian philosophy that has served<br />

it so well in the past.<br />

MEASURED INTERNATIONAL GROWTH<br />

Netherlands 8%<br />

Denmark 6%<br />

Sweden 28%<br />

UK 7%<br />

Others 4%<br />

More than half of SKAGEN’s assets now come from<br />

outside of Norway<br />

Norway 47%